The Ukrainian Tax Code has contained special rules for advance pricing agreements (APA) since September 2013, when the first transfer pricing (TP) rules were implemented in Ukrainian legislation. Since then the APA procedure has been revised several times. The current rules establishing the details of the new APA procedure were finalised and approved by Resolution #518 of the Cabinet of Ministers of Ukraine as of 4 July 2018.

It is worth mentioning that Ukraine is yet to see the signature of the first APA. The absence of “agiotage” in respect of this instrument was caused largely by the extremely cumbersome procedure, which could barely be offset by corresponding benefits for the taxpayers. This may change due to the new APA procedure.

Legal certainty for large taxpayers

The essence behind an APA is to ensure legal certainty for Ukrainian taxpayers, who fall into the category of “large” with respect to the application of Ukrainian TP rules.

According to the Ukrainian Tax Code, a taxpayer (legal entity or permanent establishment) shall be recognised as “large” if its overall revenue from all types of activity in the 4 most recent tax (reporting) quarters exceeds the equivalent of EUR 50 million; or if the total amount of taxes, fees and payments to Ukraine’s state budget for the same period exceeds the equivalent of EUR 1 million determined based on the average official exchange rate of the National Bank of Ukraine for the same period, provided that the sum of such taxes, fees and charges less customs payments exceeds the equivalent of EUR 500,000.

An APA is concluded for a limited period between the taxpayer and the State Fiscal Service of Ukraine (with the possible participation of fiscal authorities from other states), setting forth special pricing criteria and selecting the most appropriate tools in transfer pricing methodology that will be used to determine if future controlled transactions of the taxpayer are at arm’s length. Such arrangements may be either unilateral (between the taxpayer and the State Fiscal Service of Ukraine), bilateral (between the taxpayer, the State Fiscal Service of Ukraine and the fiscal authority of the country of the non-resident party in the controlled transaction) or multilateral (with the participation of several fiscal authorities in the countries of the non-resident parties of controlled transactions). It is important to note that an effective double taxation treaty with the countries of residence of the parties to the transaction is a prerequisite for engaging the fiscal authorities of the respective countries in an APA procedure.

Steps of new APA procedure in Ukraine

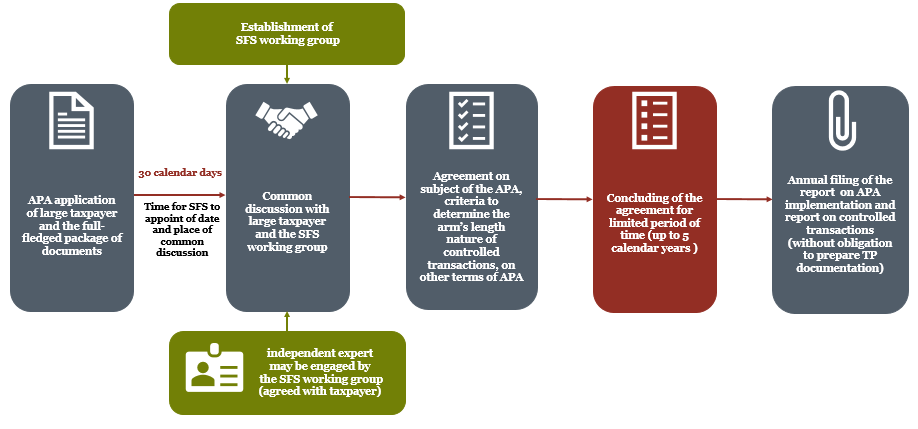

Entering into an APA is a multi-step process and it is usually difficult to predict how long such steps will last, and if an agreement will ultimately be reached. To test the ground the new APA procedure establishes a special preliminary procedure. Namely, before filing a fully-fledged APA request the companies may make a preliminary request, which is a sort of light option designed to check whether it is worth making a fully-fledged application for an APA and preparing the whole set of documents.

The new wording of the procedure also establishes time limits by when the State Fiscal Service of Ukraine has to take action in response to the taxpayer’s application.

The following procedure must be followed in the case of preliminary procedures:

The second option for the taxpayer is to file a fully-fledged APA application without preliminary consultations. In such a case the procedure is as follows:

The new APA procedure at least ensures predictability regarding the timing for the start of the procedure. It would obviously not be excessive to set some general deadlines for the overall procedure too, which is likely to take time.

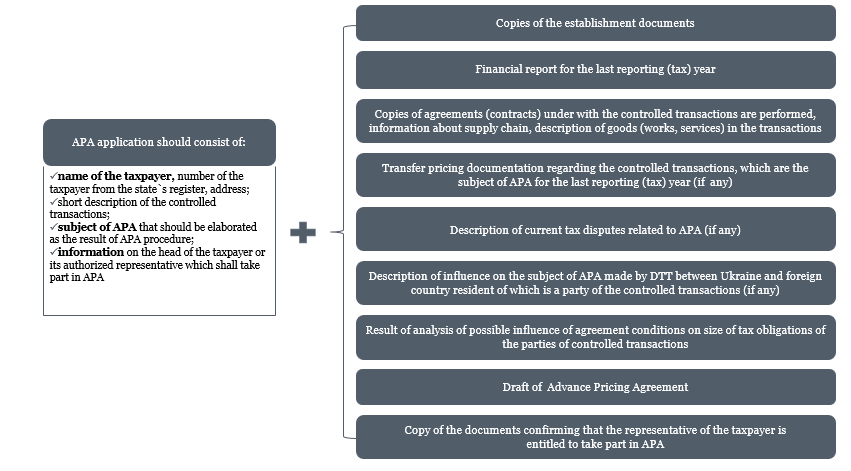

Documents required

The documents required for filing, alongside the APA, are as follows:

The procedure stipulates that any information, documents or materials received by the State Fiscal Service of Ukaine from the taxpayer during an APA (including any preliminary request discussion) may not be disclosed without the prior consent of the taxpayer and/or such information may not be used as the grounds for a tax or transfer pricing audit. All this information is confidential. It is hard to predict whether the provisions regarding the ban for launching a tax / TP audit will actually work in practice.

Upon agreement with the State Fiscal Service, an APA may be extended to previous tax periods. This is an advantage of the new APA procedure because if the APA is successfully concluded, the large taxpayer could theoretically also mitigate TP risks for previous periods, on condition of compliance with the APA of course.

A taxpayer signing an APA is required to report annually on its implementation, in the form and by the deadlines to be agreed in the APA. One clear advantage of the new APA procedure is that the taxpayer will not be required to prepare separate TP documentation. Previously, even if an APA was concluded, the taxpayer not only had to fill out the report on controlled transactions but also prepare TP documentation like other taxpayers. Now we understand that all the required TP analysis information will be presented in an annual report on APA implementation.

Protection against additional tax liabilities

If a taxpayer complies with the APA, it protects the taxpayer against additional tax liabilities, fines and penalties for breaching Ukrainian TP legislation.

Yet this protection is limited by the possibility of the State Fiscal Service of Ukraine terminating the APA early, with effect from the date the APA entered into force. Such early termination is possible in the following cases:

- the fiscal authority finds that the taxpayer has provided misleading information (if such information was mentioned in documents and materials, filed together with the APA application and/or was in the annual report on APA implementation);

- the taxpayer violates the APA.

To conclude, the new Ukrainian APA procedure seems to be more operational in comparison with previous procedures. Although it is not ideal, it may be considered an option for establishing legal certainty in relation to Ukrainian TP rules.

If you would like to know more about the new APA procedure or other issues in Ukraine, please visit the homepage of WTS Tax Legal Consulting, LLC, the exclusive representative of WTS Global in Ukraine.