Reducing the tax burden on labour and increasing the rate of corporate income tax and capital tax – this is the simplified formula of the current tax reform in Slovenia. The Ministry of Finance which presented the tax package at the end of February hopes to generate economic growth and higher consumption by means of the tax reform in Slovenia.

On 26 February 2019, the Slovene Ministry of Finance presented a tax package for the period 2019 to 2022, which has not yet been adopted. As stated by the country’s finance minister, the main goal of the tax reform in Slovenia is “to increase the net income of employees to make the Slovenian labour market more competitive internationally”. The provisions for the relief of taxation on employment income follow the latest suggestions of the OECD, and are warmly welcome, but the changes in taxation on capital income and capital gains should be considered carefully before implementation.

Tax reform in Slovenia for companies: increase in CIT rate

The current corporate income tax (CIT) rate in 2019 is 19%, which will increase in the coming years as follows:

- in 2020 the CIT rate will be 20%,

- in 2021 the CIT rate will be 21%,

- from 2022 onwards the CIT rate will be 22%.

Taxation of individuals: heavier tax on capital income and capital gains

So far, the taxation on interest, dividends, rental income and capital gains has been 25% and final. At present, the following tax rates apply to capital gains realised in 2019:

- ownership of capital < 5 years => tax rate of 25%,

- ownership of capital from 5 to 10 years => tax rate of 15%,

- ownership of capital from 10 to 15 years => tax rate of 10%,

- ownership of capital from 15 to 20 years => tax rate of 5%,

- ownership of capital > 20 years => tax free.

With the 2019-2022 tax reform, the taxation of interest, dividends and rental income will increase from the current 25% to 30%.

Taxation of capital gains from the disposal of shareholdings, real estate and other property will be taxed as follows from 2020 onwards:

- ownership of capital up to 10 years => tax rate of 30%,

- ownership of capital > 10 years => tax rate of 15%.

It is clear from the tax reform in Slovenia that capital gains will not be tax free anymore from 2020 onwards. The government’s proposal does not provide for a transition period for old rights acquired under the existing Income Tax Act.

Taxation of employees: holiday remuneration

The payment of holiday remuneration is currently subject to an advance payment of personal income tax up to 70% of the average gross salary in Slovenia at the time of payment, which is EUR 1,247.49 in March 2019.

After the tax reform in Slovenia, the holiday remuneration should be free of tax and free of any social contributions. Simply put, this means the employer’s cost would equal the net payment to the worker at the maximum amount of an average gross salary in Slovenia, which for March 2019 is EUR 1,782.

It is expected that holiday remuneration already paid in 2019, for which the advance payment of income tax has been charged and withheld, will be refunded to the employee in the course of the 2019 annual income tax assessment.

Example:

Following the tax reform proposal, a company who pays out holiday remuneration amounting to a gross EUR 1,500 should incur a labour cost of EUR 1,500, and the employees should receive a net amount of EUR 1,500 of holiday remuneration to their bank account.

More favourable income tax brackets and tax-free amount

The income tax brackets are designed to relieve employment income from heavy taxation, as evaluated by the OECD.

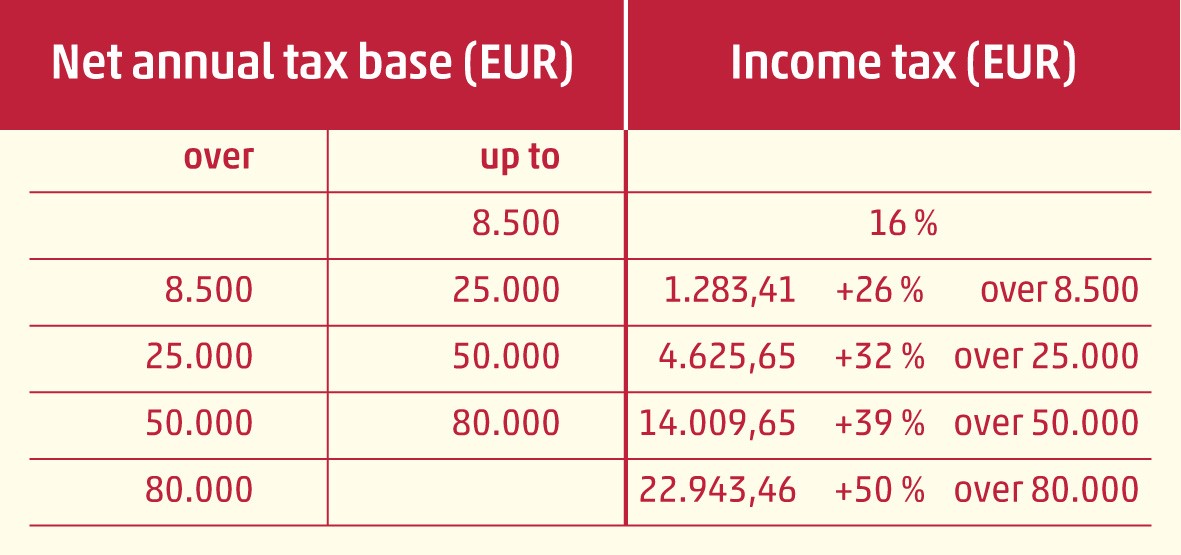

The following income tax brackets are proposed:

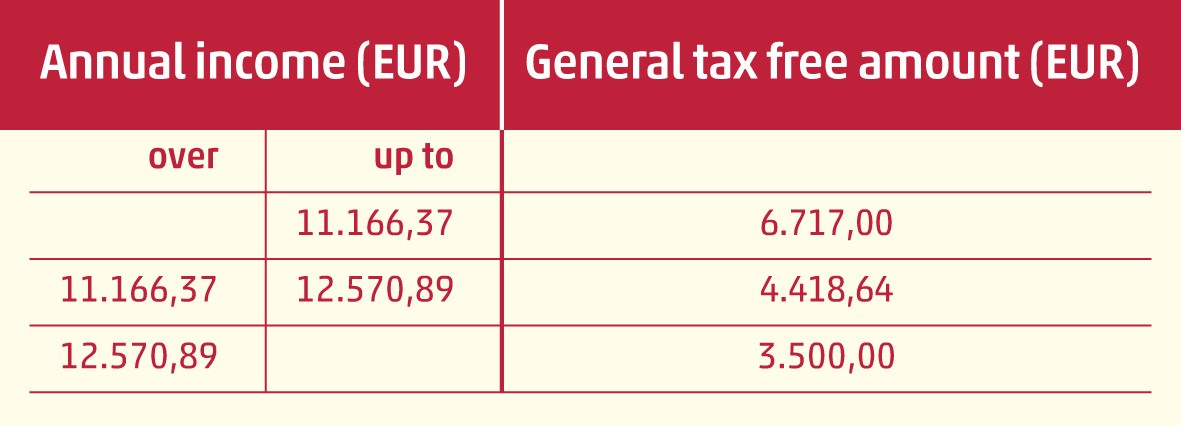

The general relief for taxable persons / residents is determined based on the total annual income of the individual and is expected to be the following:

This means a general tax deduction from the current EUR 3,302 would increase to EUR 3,500 for all taxpayers.

Bonus salary

Currently, a social contribution of 38.2% is levied without limitation on one-time bonus salaries, or on “part of remuneration for successful business” in translation from the Slovenian, but there is no advance tax payment for 100% of the average gross salary in Slovenia. The bonus salary may be paid out once a year only, and to all employees who fulfil the requirements, as specified in the decision of the Management Board.

The tax reform in Slovenia suggests that from 2020 onwards a bonus salary, which is exempt from personal income tax, will be based on the following:

- in 2020 it will increase to 150% of the average gross salary in Slovenia or about EUR 2,550,

- in 2021 it will increase to 175% of the average gross salary in Slovenia or about EUR 2,975,

- and from 2022 it will increase to 200% of the average gross salary in Slovenia, currently around EUR 3,400.

It is also important to note that the bonus salary is not taken into account in the calculation of annual income tax.

Example of calculation for payment in 2022:

Gross bonus salary: EUR 3,400

Employer’s cost: EUR 3,947.40

Net payment to employee: EUR 2,648.60

It is expected that the proposals will be adopted in the current form, but there might be some transitional provisions which would prevent sudden decisions of capital owners / residents in Slovenia to flee from the Slovene capital market.

If you would like to find out more detailed information about the current tax reform in Slovenia, please visit the website of WTS Slovenia and contact the local experts of WTS Global for Slovenia.