31 March, the final deadline for submitting annual financial statements and corporate income tax returns for 2022 for non-audited companies in Slovenia is fast approaching. Below we summarise the amendments to the Slovenian CITA (Corporate Income Tax Act) that must be applied for tax periods from 1 January 2022 onwards, and give you some tips for the 2022 CIT return. Corporate taxpayers with a financial year other than the calendar year will only have to comply with the new provisions for part of the financial year.

Reverse hybrid discharges

Hybrid inconsistencies were already part of the previous CITA in Slovenia. A hybrid discrepancy arises in the case of a double deduction of the same income, or a deduction without being included in two different countries, which means the income is not included in the tax base in any country. Hybrid mismatches occur often between related persons.

According to the Anti-Tax Avoidance EU Directive II (ATAD II), the amendments to the Slovenian CITA also include reverse hybrid inconsistencies, which now cover a larger circle of participants. The new provisions are a must-read for international groups of cross-border operating companies.

Extension of national list of low-tax-countries

Companies from countries classified on the so called “blacklist” are treated less favourably from a tax point of view. These companies are not eligible for the exemption of dividends and dividend-like income, as well as up to 50% of the exemption from profit from share sales, donation allowances and other tax benefits.

There are two blacklists in Slovenia:

- Slovenian national list, includes countries in which the general or average nominal corporate income tax rate is lower than 12.5%, and

- EU list, countries on the list of non-cooperative tax jurisdictions, published in the Official Journal of the European Union.

Tax base assessment from January 2022

The amendment to the Slovenian CITA stipulates several changes that affect the assessment of the tax base. The changes that apply in 2022 for the first time cover the following areas:

Accruals

In determining the tax base or in recognising the taxpayer’s income, accruals are recognised as an expense in the total amount charged. However, for the following groups of accruals, only a 50% expense is recognised for tax purposes in the amount charged:

- guarantees given when selling products or providing services,

- accruals for expected losses from dubious contracts,

- pension accruals and

- accruals for anniversary awards and retirement severance payments (exception 2022-2026).

It is important to know that the latest amendments to the Slovenian CITA introduce a transition period for the accruals of pensions, anniversary awards and retirement severance payments from 1 January 2022 to 31 December 2026. In this period these accruals are recognised in the total 100% amount for tax purposes too.

Writing off of receivables

According to the amendments to the Slovenian CITA, writing off receivables is now recognised as a tax expense for all reported and confirmed receivables that were reported by the taxpayer in a timely manner in the compulsory settlement procedure or bankruptcy proceedings. The receivables must be confirmed by the liquidator. This means that the taxpayer will no longer have to wait for the issuance of a final court decision on the completed bankruptcy proceedings or a decision on confirmation of the compulsory settlement to write these off.

Expenses for hospitability and payments to Supervisory Board members

Expenses for business hospitability costs and payments to members of the Supervisory Board are deductible for tax purposes in the 2022 calendar year up to 60%, but from 2023 onwards the deductibility will again be only 50%.

Depreciation of leased assets

For the right to use a leased fixed asset, the highest annual depreciation rate corresponding to the term of the contractual lease of the fixed asset is used for tax purposes.

Employment allowance

In accordance with the latest amendments to the Slovenian CITA, in addition to tax-deductible salary costs, an additional employment allowance of 55% of the employee’s salary in the first 24 months of employment is possible if the employee is under 25 years of age and employed for the first time.

An employment allowance of 45% of the salary is possible for an employee in the first 24 months of employment, who:

- is under 29 years of age, or

- over 55 years of age, or

- performs a job for which there is a shortage of job applicants on the labour market (list from Slovenian Labour Ministry).

The main condition for the employment allowance is an increase in the number of employees in a year.

Please note that to claim the benefit, future employees no longer have to be registered with the Employment Service before employment.

Facilitating investment in digital and green transition

Taxpayers in Slovenia can claim a tax base reduction of 40% of digital transformation and green transition investments in the tax period, in particular for:

- cloud computing, artificial intelligence and big data,

- environmentally friendly technologies,

- cleaner, cheaper and healthier public and private transport,

- decarbonisation of the energy sector, energy efficiency of buildings and

- introduction of other standards for climate neutrality.

Facilitating obligatory internships

The tax allowance for practical work in the professional education of an apprentice or student is increased to 80% of the average monthly salary of employees in Slovenia, and can be claimed for each month of practical work in an obligatory internship.

Donation allowance

- Basis allowance 1%: From 2022, corporate taxpayers can claim the allowance for donations of 1% of taxable income (so far only 0.3%) as an allowance for donations for humanitarian, disability, social welfare, charitable, scientific, educational, health, sports, cultural, ecological, religious and generally useful purposes, which are performed not only by such organisations in Slovenia but also in the EU.

- Additional allowance of 0.2% and 3.8%: In addition, 0.2% of the corporate taxpayer’s taxable income in the tax period may be claimed for payments in cash and in kind for cultural and sports purposes and for payments to voluntary associations established to protect against natural and other disasters and acting for those purposes in the public interest. The donation of 8% of the taxpayer’s taxable income for payments in cash and in kind also goes to providers of top sports programmes for investments in top sports.

- Donation beneficiaries: All described donations can be given to an organisation based in Slovenia or in the EU.

Higher deduction for expense reimbursements for employees

The amendments to the Slovenian CITA introduce the following maximum daily allowances for business trips within Slovenia from 1 January 2023:

- over 12 and up to 24 hours: EUR 27.81

- over 8 and up to 12 hours: EUR 13.88

- over 6 and up to 8 hours: EUR 9.69

The mileage allowance for transport costs incurred on a business trip is EUR 0.43 per kilometre.

The business trip surcharge for an employee who works and spends the night away from his usual place of dwelling and the employer’s registered office for at least two consecutive days is set at EUR 5.84 per day.

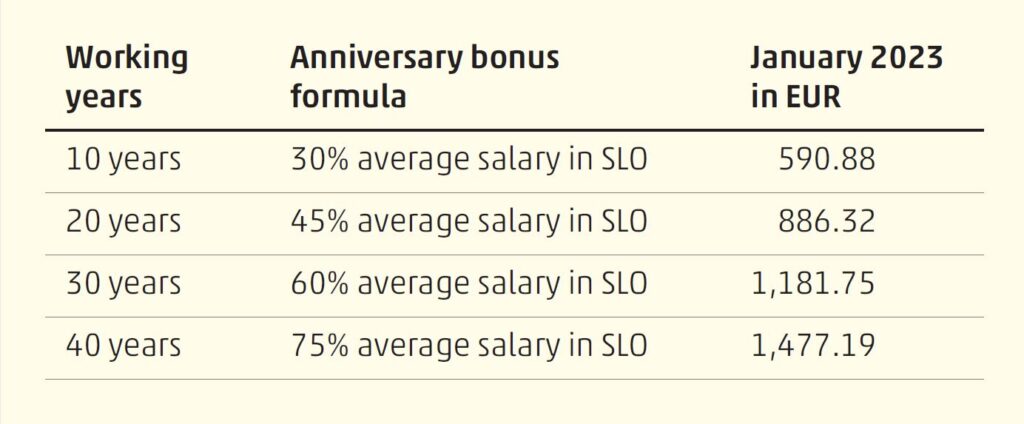

From 1 January 2023, the anniversary bonus will be determined as a percentage of the last known average annual salary of employees in Slovenia, broken down to one month, and for January 2023 will be as follows:

Compensation for retirement is 300% of the last known average annual salary in Slovenia, calculated per month (January 2023 set at EUR 5,908.77).

Solidarity assistance in the case of death of an employee or their family member is tax-exempt up to the amount of EUR 5,000.

Solidarity allowance in the case of a severe disability or long-term illness of the employee as well as natural disasters or fire incidents affecting the employee are tax-exempt up to the amount of EUR 2,000.

Remuneration for students for obligatory internships is not included in the tax base up to an amount of 15% of the last known average annual salary of employees in Slovenia, broken down into months (for January 2023 set at EUR 295.44).

The meal allowance for employees is tax-exempt in the amount of EUR 7.96/working day (valid from 1 September 2022).

The employee’s commuting costs to and from work are tax-exempt at the rate of EUR 0.21/kilometre (valid from 1 July 2022).

If you need more information on amendments to the Slovenian CITA or other tax news in Slovenia, please visit the website of WTS Slovenia and contact the local experts of WTS Global for Slovenia.