The long-awaited draft law on top-up taxes in the Czech Republic for the purpose of ensuring a minimum level of taxation of large groups, has entered the phase of comment procedure this summer. The draft law on top-up taxes in the Czech Republic is the Czech implementation of the Council Directive (EU) 2022/2523, which follows the OECD initiative on global minimum tax (Pillar 2 of the OECD programme for the international reform of corporate taxation in the G20 countries). The proposed rules apply to large groups with consolidated revenues exceeding EUR 750 million are taxed at least at a minimum effective level of 15%.

Implementation of the Directive rules

The rules set out in the Directive are introduced into the legal system in the form of two new top-up taxes in the Czech Republic:

- allocation top-up tax and

- domestic top-up tax.

The allocation top-up tax replicates a system of taxation based on two interrelated rules (the “GloBE rules” from Global Anti-Base Erosion) applicable where the effective tax rate of the group subject to the top-up tax in the respective jurisdiction is less than 15%:

- Profit inclusion rule: assigns a top-up tax to the parent entity in the event of under-taxation of the subsidiary entity.

- Undertaxed profits rule: allocates the top-up tax to the low-taxed entities themselves where it has not been possible to collect the full amount of the top-up tax through the parent company under the income inclusion rule.

These two rules are thus intended to ensure that a minimum tax is paid for each jurisdiction in which the group is located, regardless of whether that country has adopted the Pillar 2 initiative.

In order to allow the proceeds of the top-up tax to flow directly to the countries in which the low-taxed entities operate, the Directive allows Member States to introduce an equivalent local (national) top-up tax, whereby if the minimum level of taxation is achieved through a local top-up tax, the top-up tax allocated according to the rules for the inclusion of income and undertaxed profits will be zero. The local top-up tax is represented in the proposed law by the domestic top-up tax.

Czech companies that are part of a group subject to the top-up tax will thus be subject to the domestic top-up tax. Czech parent entities that are part of a group subject to the top-up tax in respect of profits of their subsidiaries in other countries will be subject to the allocation top-up tax. The obligation to collect the allocation top-up tax will not arise for the Czech parent entity if the state of the subsidiaries imposes and collects a local (national) top-up tax. The local top-up tax thus has application priority over the allocation top-up tax.

How should Czech companies proceed?

First, it is necessary to determine whether the company is subject to the top-up tax provisions, i.e. whether it is part of a group with annual consolidated revenues exceeding EUR 750 million in two of the four preceding tax periods and whether it is not so a called excluded entity (e.g. pension funds, government and non-profit organisations).

If the Czech company is part of a group subject to a top-up tax, the next step is to calculate the effective tax rate as the share of included taxes included in the qualified profit. The effective tax rate is calculated for the given tax period for the entire group in the Czech Republic.

If the calculated effective tax rate of the group is less than 15%, it will be necessary to calculate the effective tax rate for the individual members of the Czech group and identify those with an effective tax rate lower than the minimum. Companies with an effective tax rate lower than 15% will be obliged to pay the domestic top-up tax. The domestic top-up tax will be calculated from the data for the entire Czech group and will be distributed among the under-taxed members based on their share of qualified profits.

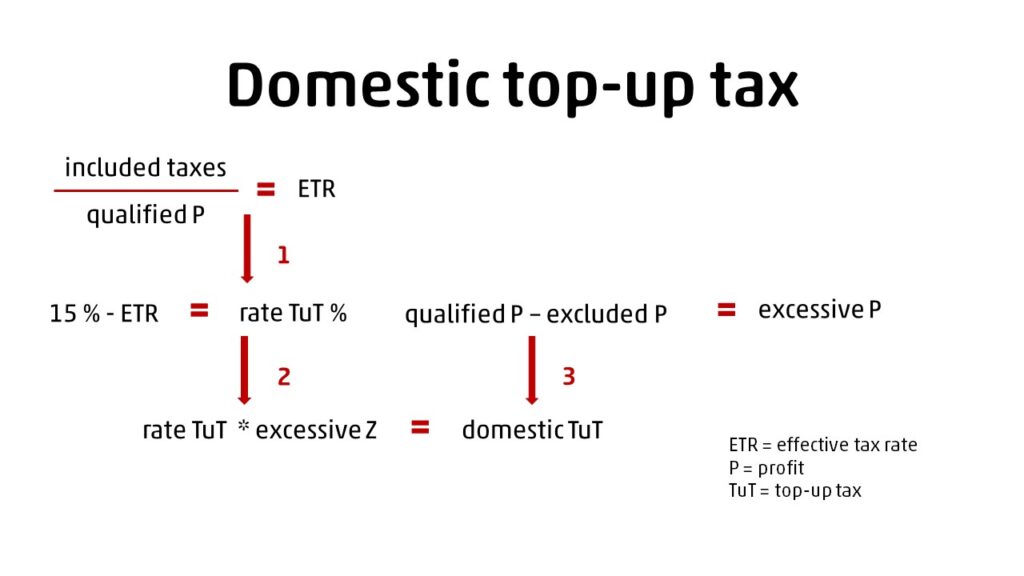

The procedure for determining the domestic top-up tax is described in a simplified way in the following diagram:

The proposed legislation contains relatively complex rules for determining the included taxes and calculating the qualified profit, while it is not be possible to simply take data from financial statements prepared in accordance with the Czech accounting standards. In many cases, it will be necessary to rely on the data provided to the parent company as part of the consolidation and to subsequently adjust them.

The proposed legislation contains relatively complex rules for determining the included taxes and calculating the qualified profit, while it is not be possible to simply take data from financial statements prepared in accordance with the Czech accounting standards. In many cases, it will be necessary to rely on the data provided to the parent company as part of the consolidation and to subsequently adjust them.

Administration of top-up taxes in the Czech Republic

The registration obligation of top-up tax taxpayers will have to be fulfilled within 15 days after the fulfilment of the group membership condition. With regard to the expected effectiveness of the law from the beginning of 2024, it will be necessary to register by 15 January 2024.

Another administrative obligation will be the submission of information reports. The information reports shall include information about the group, as well as the information necessary to calculate the effective tax rate, the top-up tax and its correct allocation. The deadline for submitting the information report on the domestic top-up tax is set at 10 months after the end of the tax period, and the tax return must be filed within the same period.

The deadline for filing the information report on the allocation top-up tax is set at 15 months after the end of the tax period (up to 18 months for the first filing) and the deadline for filing the tax return on this tax is 22 months after the end of the tax period.

The deadline for determining top-up taxes in the Czech Republic is set differently from the Tax Code as a four-year period.

The relevant tax office for the administration of top-up taxes will be the Specialised Tax Office.

If you have any queries about the top-up taxes in the Czech Republic or need to adapt to the new rules, the experts and advisors of WTS Alfery, the exclusive representative of WTS Global for the Czech Republic will be happy to provide you with professional support.