On 26 March 2021 the Ministry of Finance in Ukraine hosted a ceremony marking the beginning of the new customs authorisation procedures in Ukraine. At the ceremony, the first Ukrainian Authorised Economic Operator (AEO) Certificate obtained by tobacco company JT International Ukraine was presented. The certificate confirms the right to use simplified customs procedures following European practices and standards.

First steps for new customs authorisation

Law No 141-IX of 2 October 2019 introduced comprehensive changes to the Customs Code of Ukraine, aimed at making the rules on AEO operational and bringing them into line with similar European regulations. According to these rules, there are two types of customs authorisation:

- AEO-S: on the entitlement to special simplifications

- AEO-B: on the confirmation of security and reliability

Companies may choose one of the customs authorisation types, or apply for both. They are different in terms of the available advantages and criteria which should be met as conditions for obtaining the status.

Advantages and special simplifications

The advantages of both AEO-S and AEO-B status are as follows:

- Customs formalities in the first order;

- Lower level of risk in the Automated System of Customs Control for defining the list of customs formalities;

- Use of designated traffic lane at customs posts;

- Use of national AEO logo

The list of special simplifications, however, is wider in the case of obtained AEO-S status. While the AEO-S status implies a general financial guarantee, the right to use customs seals of a special type, a simplified declaration procedure and customs clearance procedures on-site, special simplification for AEO-B only includes the right to use customs seals of a special type.

The customs clearance procedure is the most useful amongst the special simplifications as it offers material time and cost savings due to the peculiarities of customs clearance practices in Ukraine.

Essentially, similar cost savings are currently achieved by applying the customs clearance procedure under the “EA” preliminary import customs declaration. However, from 7 November 2022, this procedure will no longer be available. Hence, if no changes are implemented into the Customs Code by this date, cost savings will be available only for companies with AEO-S authorisation.

Conditions of the new customs authorisation in Ukraine

According to the Ukrainian Customs Code, the AEO status is available for any resident enterprise that performs any role in the international supply chain (producer, exporter, importer, customs representative, forwarder, warehouse keeper).

At the same time, during the transition period (first three years), the customs service will consider applications for AEO-S only from companies that are simultaneously producers and exporters (importers). There are no such limitations for AEO-B authorisation.

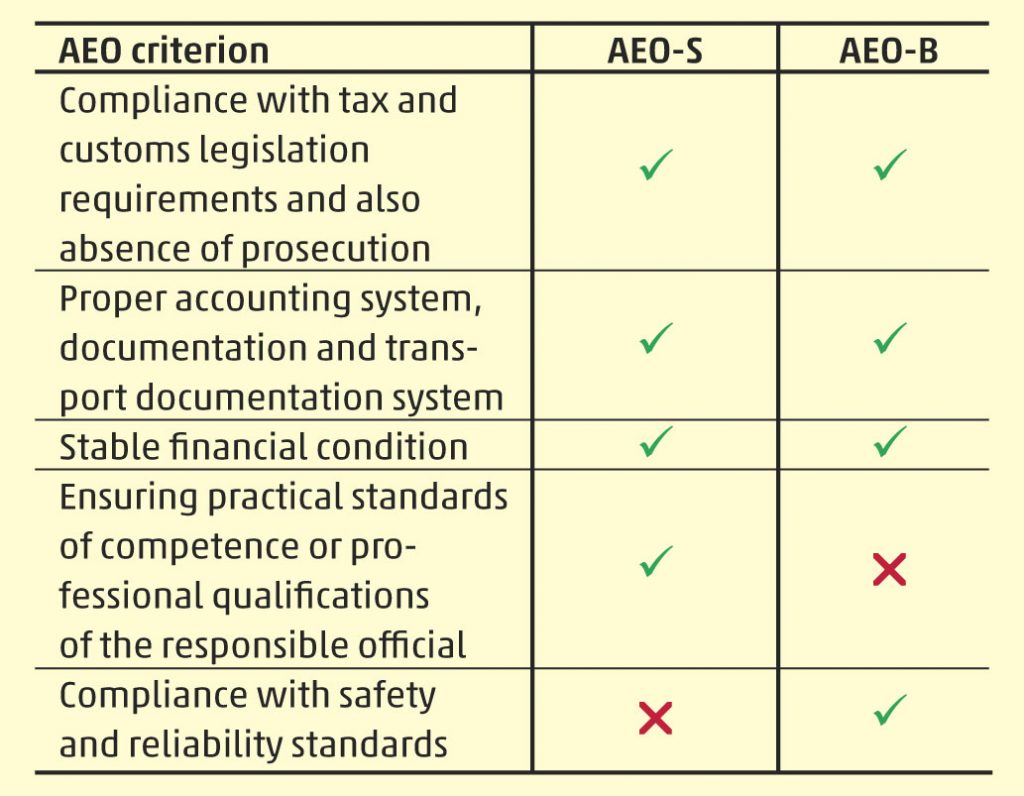

To be eligible for obtaining the status, companies should comply with the criteria established by the Customs Code. The criteria differ slightly depending on the type of AEO, and are as follows:

In July 2020, the Cabinet of Ministers of Ukraine adopted the procedural regulations which gave the “green light” to launch the new customs authorisation. In March 2021, the Ministry of Finance reported on the first AEO status obtained by JT International Ukraine. Thus the procedure for obtaining AEO status is now fully operational.

This customs authorisation may offer material advantages and simplify customs clearance in Ukraine. Hence, we encourage businesses to consider this opportunity.

If you would like to know more about the new customs authorisation types and need help to access the simplified customs procedures in Ukraine, please contact the experts of WTS Tax Legal Consulting, LLC, the exclusive representative of WTS Global in Ukraine.