Over the past two years I have gained first-hand experience on the specificities of support for spectator team sports through corporate tax since, to realise my long-cherished dream, I took on a role at an association working with young sportspeople. In this article, I will look at the timing challenges the current legislation poses for the corporate sponsors and the associations that use the support, particularly in respect of the seemingly irresolvable difficulties that arose because of the deadline for Hungarian corporate tax returns and the lack of corporate tax top-ups, which were cancelled last year. I also attempt to propose a solution to the problem.

Forms of corporate tax support in Hungary

Hungarian companies can basically choose from two options if, in order to obtain some tax benefit, they want to support an association operating a youth team in one of the six spectator team sports (football, handball, basketball, water polo, volleyball and ice hockey). The direct support which seems simpler and can be given at any time of the year, and which is capped at 70% of the corporate tax amount, results in a corporate tax saving totalling 2.25% of the support. The other form is the corporate tax allocation available up to 80% of the corporate tax, which is transferred by the National Tax and Customs Administration from the company’s monthly tax advance paid according to the general rules, or from the annual tax specified in the annual tax return, and it results in a corporate tax saving of nearly 6.6% (in the case of monthly tax advances) or around 2.2% (in the case of an allocation made parallel to the annual tax return).

At first glance, the direct support seems a simpler solution with a similar tax benefit. Yet why do a significant number of companies still opt for the corporate tax allocation method in Hungary?

The answer is the difference in the accounting of the two methods. The direct support diminishes the company’s profit before tax as an other expense, so it results in lower EBIT, EBITA and EBITDA figures in a given year and only “recovers” the amount of the support at the level of profit after tax, “recognising” the higher value achieved through the corporate tax allowance.

By contrast, the fact of the corporate tax allocation does not even appear in the financial statements for a given year. The allocated amount “remains hidden” in the corporate tax and the achieved tax benefit even increases the company’s EBIT, EBITA and EBITDA figures in the following fiscal year. However, the aforementioned indices are used to measure profitability at most of the companies, they affect goodwill and senior staff are also rewarded on this basis. This is primarily why corporate tax allocation became almost the only method applied by large multinational and Hungarian companies.

Contradictions in deadlines for corporate tax and support for associations in Hungary

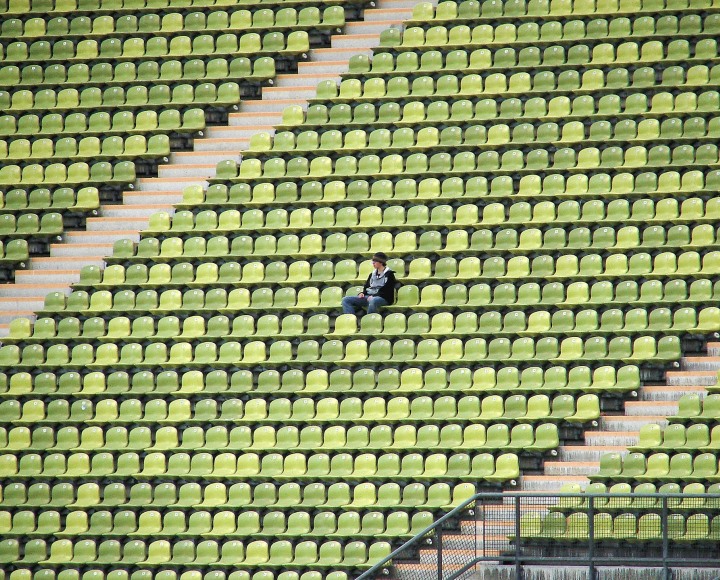

A significant proportion of companies close their accounts for a financial year that coincides with the calendar year, thus the deadline for their corporate tax return falls at the end of May. Although you can also make an allocation against your monthly tax advances, and indeed the tax benefit available is three times that of an allocation made at the same time as your annual tax return, the majority of large companies still only award the support once a year, in time for the end of May deadline, after the assessment of dozens of applications from associations. To this end, however, they ask associations to attach to their application the resolution of the relevant sports federation necessary for the disbursement of the support. But when are these resolutions issued, and for which period do the associations have to account for the permitted amount of support?

The resolutions of the sports federations are issued in April-May after the deadline for the submission of the support requests of the associations at the end of February, and the authorised costs can be accounted for in the season between 1 July of the given year and 30 June of the following year. Associations are therefore very unlikely to have a new resolution for the end of May tax allocation of the companies, and they can only submit applications for the amounts specified in the resolutions passed in the previous year. They only have a realistic chance of getting the support 9-10 months after receipt of the resolution. Additionally, they will only receive the money on the 15th day after the deadline for the end of May tax returns, i.e. 15 June, which means they have only 15 days left until the end of the season, i.e. 30 June, to account for it. There is no alternative, they must apply for a one-year extension of the accounting period, so only 16 months later can they finally start implementing their sports program submitted in February of the previous year.

Proposal for solving the problem arising in respect of the corporate tax allocation

This problem arose when the deadline of 20 December for the oft-criticised corporate tax top-ups was cancelled in Hungary. As a tax expert I fought long and hard for the cancellation of this pointless rule, and I am not about to take steps to reinstate it. I only propose that companies be given the chance to decide on the lump-sum allocation of 80% of their tax advances paid during the year either by the current deadline of 20 December or by an earlier date in the autumn, preferably ensuring a tax benefit that is identical to that available from the allocation from the monthly tax advances. Thus, companies could collect the applications of the associations, which are based on the resolutions already issued by the sports federations, until the end of summer/beginning of autumn, and with a year-end disbursement the associations would have enough time to spend the amount until the end of the season, i.e. by June of the following year. At the same time, the deadline for the corporate tax allocation still unused and calculated based on year-end data, and the deadline for allocations from companies not paying tax advances but realising a high profit in the given fiscal year, and thus paying significant corporate tax, would remain the end of May, as in former years.

Our tax advisers have been drafting proposals to streamline the Hungarian tax regime since our company was formed to facilitate and optimise the taxation of our clients. We have successfully pushed our proposals through the Hungarian tax administration systems and decision-makers several times. If, having seen our results, you think we could be of help for your company in tax matters, or if you have an opinion on taxation and would like to have your proposals regarding Hungarian taxation policy heard by the government, please do not hesitate to contact us.