The digital transition is also affecting the finance sector. In fact, to increase work efficiency, data usability, to ensure better traceability of documentation and to reduce time-consuming administration, it is essential for every company and business to become more and more aware of this area.

We know from own experience that the digital transition is a long journey with a lot of forks in the road. Drawing on our practical experience, in this article we delve into the challenges of the digital transition. Off we go!

Destination

First, let’s determine what the destination is. After all, once the destination is set, we only have to choose the route and the means of transport, taking the available budget into consideration of course. It’s up to everyone to decide whether to pay for a trip organised by an agency, with tried and tested programmes and ready-made solutions, or to put the backpack on and let your own ideas and inspirations lead you into discovering the unknown.

Digitalisation, as a target, has become inevitable in the world of finance and business, but also in taxation. The digital transition has become an essential part of strategic decisions. Paper-based invoices and payrolls have been replaced by electronic invoices, applications recognising invoice images, and electronic payrolls. The electronic filing of invoices, the automation of approval processes and electronic signatures greatly simplify business processes, and thus lead to cost efficiency. Only having the right IT infrastructure, streamlining and connecting databases, automating processes and digitalising documents enable businesses to stay competitive in this new information society.

IT infrastructure: what to travel with?

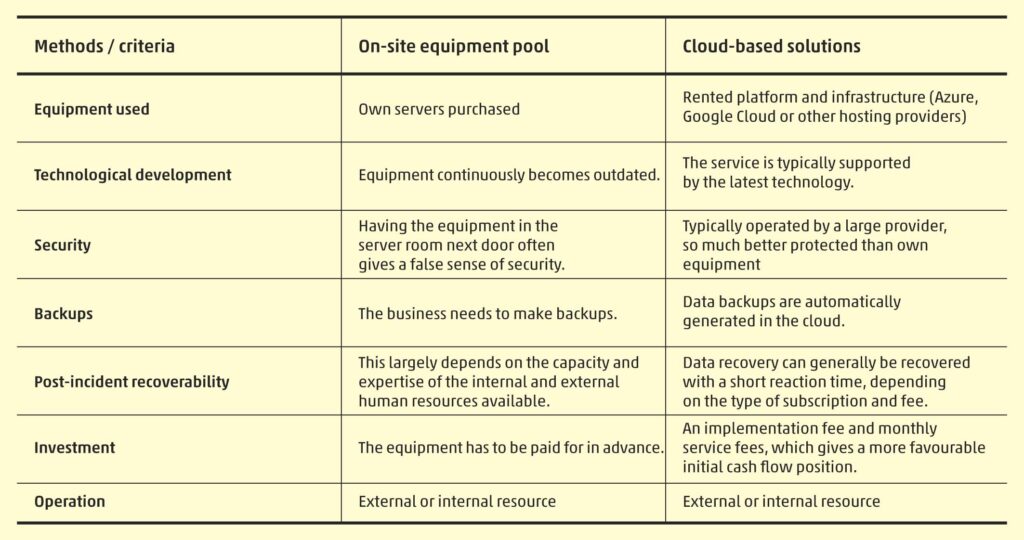

Comparing the optimal IT infrastructure for the digital transition with the IT equipment pool currently available can help identify what investments are needed. Before initiating a major investment, there is still a huge dilemma about whether to use a cloud-based solution or on-site equipment. When assessing this, the following aspects are worth considering:

There is no one-size-fits-all solution, it is up to the business leaders and IT managers to figure out what best fits the level of digital transition they intend to achieve and the means of the company, based on the criteria above. Mixed solutions are often viable too.

Internal or external developments – backpacking or organised trip?

Today, there are ready-made software solutions for almost any need, so-called out-of-the-box solutions. You can also choose to have your own solutions developed by external developers or by your own development team. It can cause serious headaches to decide when the right time is to start an internal development.

Given the client-support solutions, the automation of our processes and the digitalisation of internal administration, we, at WTS Klient opted for a combined solution. On the one hand, we set up our own development team, so development expertise is always available for us, and we are able to react to client or internal needs in a tailored fashion. However, as the capacity of our development team is limited, and the digital transition is fast-paced, we use ready-made, market solutions for our HR software and CRM system.

Travel guides and brochures, or booking.com and Tripadvisor?

The digital transition involves connecting databases and existing systems. Companies generally have data in different formats in isolated systems, just like travellers may gather information from a variety of brochures, guidebooks or by using one of today’s modern internet platforms offering tailored solutions based on the data entered. To turn the accumulated sea of data into useable, valuable information, it is important to synchronise databases, matching and linking the data they contain. Nowadays, these integrated databases are essential for measuring employee performance, evaluating engagements, providing offers and reaching informed managerial decisions. There are integrated corporate information systems which fully meet these needs, but software and databases connected via interfaces are also becoming more and more common.

The current expectation is the individual systems (like the invoicing software, the CRM and the performance recording programme) should be interconnected, and for them to be able to communicate with each other they need to use the same terms. For instance, turnover figures, outstanding invoices, time consumption and other client-specific information related to the same client need to be recorded under the same client code in the various systems, because when connecting the programmes, this is the only way to turn the pool of data into useful information.

The isolation generated by the pandemic brought collaborative platforms into everyone’s life. Quick Teams, Skype or Zoom meetings have become daily occurrences. Communication no longer takes place by email and in telephone conferences; instead, collaborative platforms connect colleagues and clients to share data, information and files.

No adventure without dangers: the issue of cybersecurity

The digital transition is not a walk in the park. In addition to the undisputable advantages, there are many dangers. By integrating external supporters, opening up our systems and connecting to a wider cyber community, we inevitably make ourselves vulnerable to attacks. Information is power, and the digitalisation of financial systems is all about that, so we need to focus on prevention.

However, it is no longer enough to defend ourselves with firewalls and virus scans. Training and keeping our staff vigilant is in our fundamental interest. There is a lot of training material as well as phishing simulations to help businesses actively and responsibly engage their employees in prevention activities, so the internal systems of the company can block out ransomware as a closed system.

Based on our experience, we can tell you that having policies helps, and our ISO 27001 information security certification also keeps our employees constantly alert. Our years of ISO audit experience help us keep information security issues constantly on the agenda, both in our internal workflows and during communication with clients.

No return ticket

Digitalisation is not a reversible process. The sooner you start consciously planning the journey, the better position you will be in compared to your competitors. Sometimes you reach a dead end when travelling, but an organisation open to learning and development also tries to build on failures. Fasten your seatbelts! Have a safe journey!

2022 marked the beginning of a new chapter in the life of WTS Klient, which brought with it some significant changes. Parallel to revamping our organisation, we also embarked on large-scale technological developments. In this article, we primarily draw your attention to the importance, or the inevitability, of the digital transition, while also sharing our own experiences with technology developments. Feel free to contact the WTS Klient Business Automation division if your company is facing similar challenges and problems, and you need an experienced professional to develop digital solutions for your business or tax matters.