Press release

Online invoicing in Hungary: you can register in the live system from 18 June

The final text of the decree on online invoicing has been published. From 18 June you can register in the live system, which will start from 1 July.

New rules regarding mergers, fusions and demergers in Slovakia

From 1 January 2018, amendments to the Slovak Commercial Code entered into force in order to improve the business environment, and among other things, to stop fraudulent practices related to reorganisations. The amendments introduced new obligations and...

WTS Global and LATAXNET entered into an exclusive cooperation agreement

WTS Global and LATAXNET started an exclusive cooperation which was recently signed in an official ceremony held in Munich, Germany.

Product fee warehouse

Using a product fee warehouse the product fee payment liability can either be avoided or postponed. Read our article and find out how!

Accounting of a spin-off in Austria

The accounting treatment and the presentation of a spin-off can be challenging in practice. In this article we would like to highlight the accounting consequences of a spin-off in Austria from the transferring entity’s point of view. Our examination is...

Right to deduct VAT and right for a refund of VAT

In our article we take a close look at the ruling of the Court of Justice of the European Union in case no. C-533/16 published on 21 March 2018, which looks into when the right to deduct VAT and the right for a refund of VAT arise.

WTS Klient Hungary awarded title of Reliable Employer

The German-Hungarian Chamber of Industry and Commerce has awarded WTS Klient Hungary the title of “Reliable Employer 2018-2019” based on the company’s HR management practices.

Polish monitoring system will be extended to rail transport

Rail transport will be shortly a part of the monitoring system in Poland as a result of latest amendments to the Carriage of Goods by Road Act that have been approved by signature of President of Poland on 28 May 2018. Work on the amendments to the...

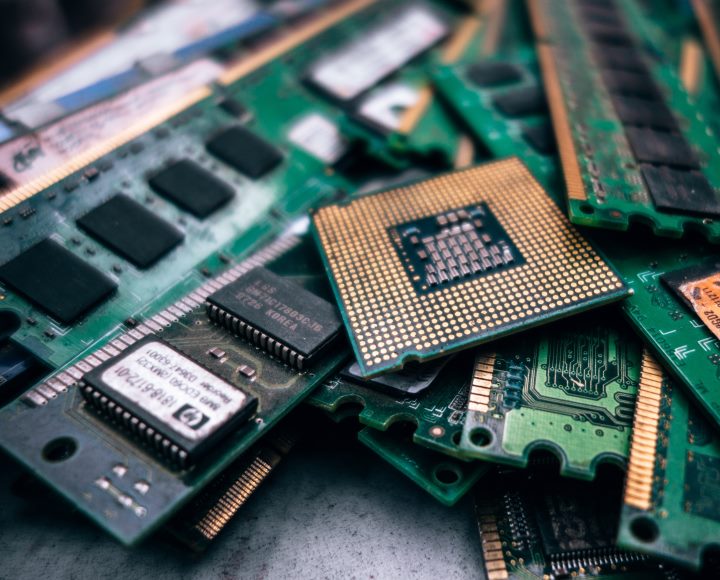

IFRS 16: integrating off-balance-sheet financing into the balance sheet

From a Hungarian point of view, recent years have seen extensive harmonisation in the accounting practice of lease contracts. Although the detailed regulations and conditions may contain some differences, the International Financial Reporting Standards...

WTS Global is again the European Indirect Tax Firm of the Year

For the second year in a row, WTS Global has been rewarded with the “European Indirect Tax Firm of the Year” by International Tax Review at European Tax Awards Ceremony 2018. Its high ranking could be credited to its practice orientated solutions among others.

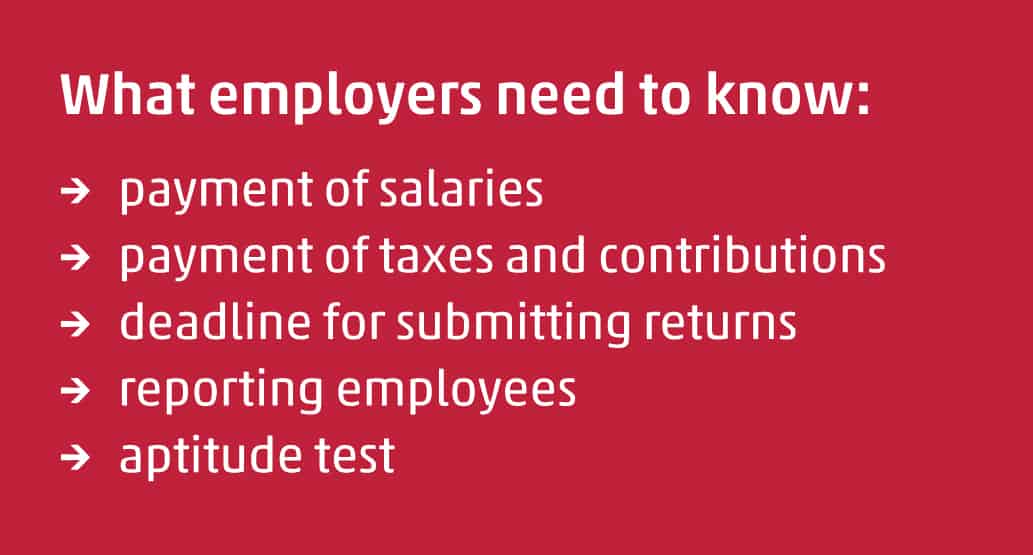

Basic payroll principles: what employers in Hungary definitely need to know

What are the key deadlines employers have to observe and what tasks do they have to perform to comply with relevant laws and regulations? These are some of the questions we seek answers to in this article, along with providing some useful...

Draft law on BEPS implementation is still on the agenda in Ukraine

Although Ukraine updated transfer pricing rules for 2018 in January, these changes were rather technical character. Hence, the draft law on BEPS implementation from September last year is still on the agenda in Ukraine without any changes. Due to the...

Challenges faced by international companies in Hungary in 2018

After labour shortages, online invoicing from 1 July is the second major challenge for international companies operating in Hungary in 2018 – as revealed by a survey conducted by WTS Klient Hungary among more than 100 finance managers at the beginning of this year.

Guidelines on business valuations: what to evaluate, how and for whom?

Commerce is one of the most ancient business activities of humanity, with price always playing a central role. The establishment of companies created a market for them too, together with the need for determining the value of companies. In our previous...

Permanent establishments in Central and Eastern Europe

The 2018 spring issue of WTS CEE Tax Bridge has been published. It summarizes the latest developments in permanent establishments in 10 countries of the Central and Eastern Europe Region. We are happy to introduce our first Tax Bridge this year. In order...