An issue affecting the NAV’s (Hungarian tax authority) inspection and penalty practice was brought to the European Court of Justice in the form of a request for a preliminary ruling. Member States normally use this opportunity if a question arises in respect of interpreting EU law. In this case, the issue is related to the provisions of the EU’s VAT Directive, and the response will provide guidance for the application of reverse charge as per the Hungarian VAT Act as well.

So what is the issue?

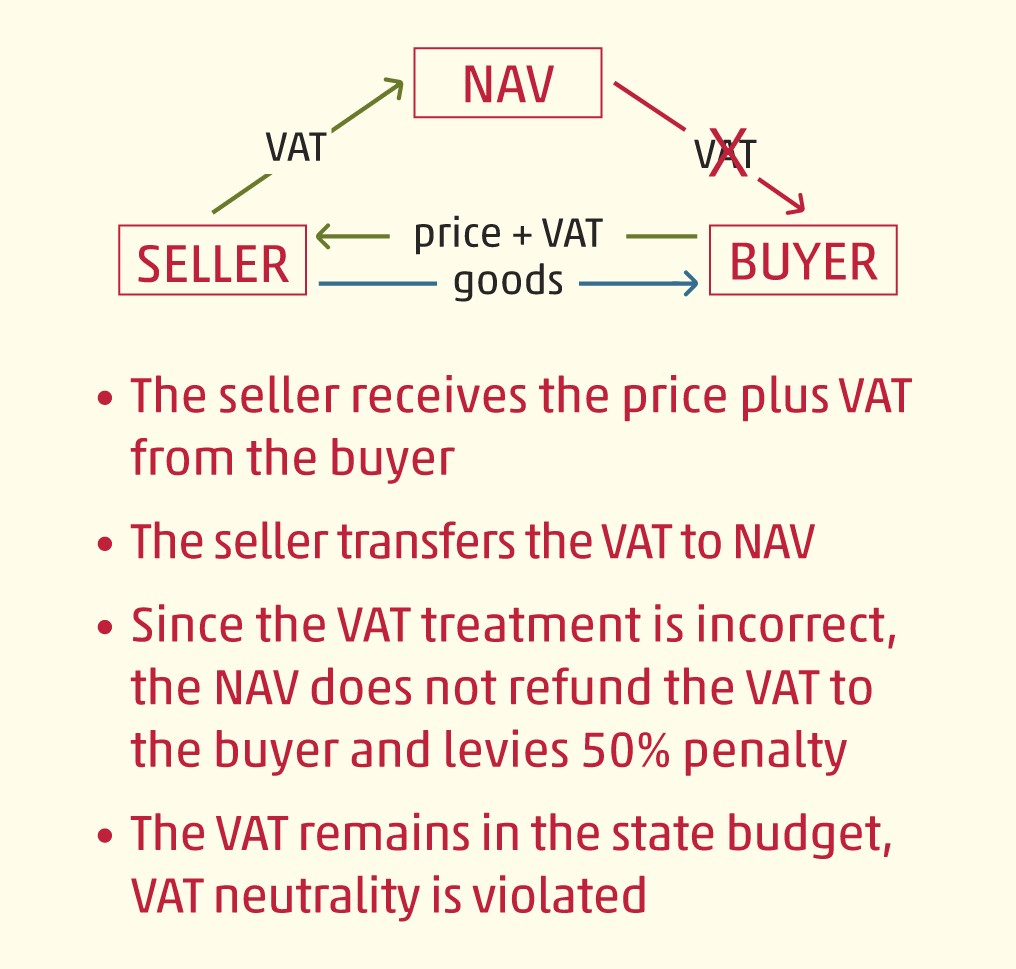

The request for a preliminary ruling was submitted by the Kecskemét Public Administration and Labour Court. The defendant is the NAV Tax Directorate in Bács-Kiskun County, while the applicant is Tibor Farkas, who purchased a mobile hangar from an insolvent company in an auction. The applicant paid the purchase price along with the VAT charged on the transaction by the seller, and then deducted this VAT.

However, the Hungarian tax authority indicated that the rules on reverse charge should have been applied for the transaction, so they challenged the deduction of the VAT. The tax authority demanded payment of the VAT amount and levied a penalty worth 50% of the VAT.

This is not a one-off, isolated case; the NAV has previously qualified the deduction of VAT on invoices as unlawful where the invoices were incorrectly issued according to the rules of direct taxation instead of reverse charge rules.

The main question of the Hungarian court presiding in this instance was whether the tax authority’s practice was EU-compatible when the tax authority declares that a purchaser is liable for a tax difference in a situation in which the seller issues an invoice in accordance with the ordinary tax system for a transaction to which the reverse charge procedure applies and declares and pays to the Treasury the tax relating to that invoice, and the purchaser deducts the VAT paid to the issuer of the invoice, even though purchaser may not exercise his right to deduct the VAT declared? The other question is related to the practice of levying fines, i.e. whether the 50% tax penalty is a proportionate sanction for selecting the incorrect taxation method when the Treasury did not lose any taxes and there is no evidence of abuse?

Where are we now?

As part of the procedure, the Advocate General’s opinion was published not long ago, where the Advocate General investigates the case in detail and makes a proposal for the Court on interpreting the law. Based on the Advocate General’s opinion, the NAV’s procedure is against EU law when it levies a penalty even if there is no suspicion of tax fraud, while the NAV’s procedure also violates VAT neutrality.

When forming its opinion, the Court largely relies on the Advocate General’s opinion, a ruling contrary to this is very rare. In light of this, the Court is expected to form a similar opinion when making its decision.

So what happens now?

The question is how the NAV will proceed in the future if the European Court of Justice’s legal interpretation for the Hungarian court is in favour of the applicant. Under the current legal environment, in cases like this the most suitable procedure would be if the NAV draws the affected parties’ attention to their incorrect interpretation of the tax law regarding the reviewed transactions (reverse charge instead of normal taxation) and calls for the issuer of the invoice to correct it. After issuing the corrected invoice, the VAT balance would be restored and in this case neither the parties nor the budget would suffer any damage. Naturally, for this the NAV cannot consider the VAT originally deducted incorrectly as an unlawful reclaim.

Although this procedure would be desirable, it would not provide an appropriate solution in all cases. For example, it is difficult to remedy the VAT treatment of a transaction if the invoice issuer has ceased to exist in the meantime, or the purchaser can even incur financial losses if the seller is unable to repay the VAT after the invoice correction.

You can read about the judgement of the Court of Justice of the European Union here.