After labour shortages, online invoicing is the second major challenge for international companies operating in Hungary in 2018 – as revealed by our survey conducted among more than 100 finance managers at the beginning of this year.

At the beginning of 2018, WTS Klient Hungary asked the financial experts of more than 100 international companies cooperating with the group and operating in Hungary about the most challenging tax, legal and accounting issues for them in 2018. The results clearly show that the lack of the right workers is the biggest challenge for international companies in 2018, but the introduction of online invoicing from 1 July is also a major challenge for managers.

Focus on increasing revenues

Increasing revenues was set as the priority business goal for 2018 by most companies operating in the field of manufacturing, services and commerce, representing roughly equal proportions from each sector. This was mentioned by more than one third (36%) of the respondents, but increasing staff numbers (21%) as well as growing capacity on the fourth place (13%) are also closely related to the priority issue.

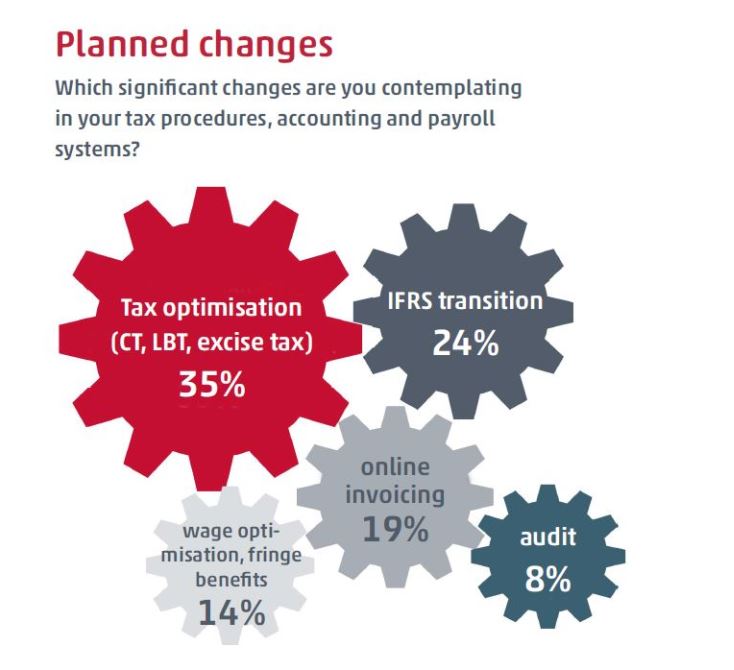

To achieve their goals, nearly two-thirds of the surveyed companies are planning to make modifications in their taxation processes, accounting and payroll systems in 2018. Tax optimisation – for example deducting research and development costs from the tax base – dominates here among the changes, mentioned by over one-third (35%) of the participants, along with transitioning to IFRS, which is a key issue for a quarter (24%) of the companies. For many businesses (19%) the online data reporting obligation applicable from 1 July is one of their planned changes, with optimising salaries and restructuring fringe benefit systems representing a significant proportion as well (14%).

To achieve their goals, nearly two-thirds of the surveyed companies are planning to make modifications in their taxation processes, accounting and payroll systems in 2018. Tax optimisation – for example deducting research and development costs from the tax base – dominates here among the changes, mentioned by over one-third (35%) of the participants, along with transitioning to IFRS, which is a key issue for a quarter (24%) of the companies. For many businesses (19%) the online data reporting obligation applicable from 1 July is one of their planned changes, with optimising salaries and restructuring fringe benefit systems representing a significant proportion as well (14%).

Labour shortage main challenge for international companies

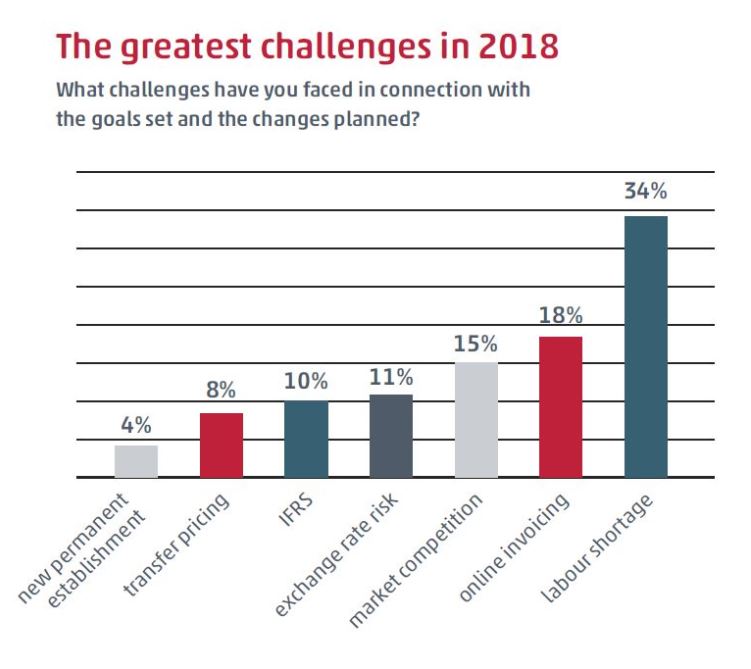

The lack of appropriate workers was mentioned by most respondents when asked about the challenges they faced in connection with the goals set and the changes planned. This issue was included in more than one-third (34%) of the answers, while online invoicing came second (18%) in the list. Competition in the market (15%), exchange rate risk (11%), IFRS (10%), transfer pricing (8%), and issues related to setting up a new permanent establishment (4%) were also mentioned by the respondents.

In line with this, the labour shortage (18%) and switching to IFRS (12%) are considered factors standing in their way of achieving the defined objectives. However, based on the research the greatest obstacle (34%) is that the already complex Hungarian taxation system is constantly modified, and it is very difficult to keep up and comply with the continuously changing tax and legal environment. Tax-related administrative burdens that are somehow connected to the above factors also pose challenges for a high number of companies (26%).

Consulting companies can mainly help with online invoicing

The fact that the two greatest obstacles are the continuously changing tax and legal environment and the administrative burdens correlates closely with the feedback received from companies working with WTS Klient Hungary, namely that consulting companies can mainly help and support clients in achieving their goals by providing up-to-date professional information.

When asked which challenge for international companies consulting companies can help overcome, nearly a quarter of them mentioned online invoicing. Almost the same number of responses were received for updating transfer pricing documentation (22%) and tax optimisation (19%).