When preparing annual personal income tax returns in Hungary, every year both taxpayers and tax consultants face the problem that it is very difficult to classify certain types of income under the (capital) gains specified by the Personal Income Tax Act. For example, investment opportunities available through financial service providers change every year, and based on a certificate issued by a foreign investment consultant it is difficult to decide when tax should be paid, on what grounds, and on how much income.

In the same way, Hungarian taxpayers found it difficult to pay their taxes on income from crypto assets. However, from 2022, these difficulties seem to be resolved. The bill submitted in May by the Hungarian Ministry of Finance strives to clarify the taxation of income from crypto asset transactions.

What are crypto assets and crypto asset transactions?

The European Parliament and the European Council jointly developed the so-called draft MiCA (Markets in Crypto Assets) regulation that defines crypto assets as digital representations of value or rights which may be transferred and stored electronically, using distributed ledger technology (DLT) or similar technology.

Based on the bill, the Hungarian Personal Income Tax Act will also use this definition. Crypto asset transactions are ones in which the private individual “acquires financial assets other than crypto assets through the transfer of crypto assets” in a transaction available to anybody.

Taxation of crypto assets so far in Hungary

Given that the Hungarian Personal Income Tax Act currently does not include special requirements in connection with crypto assets, the income realised through these has to be taxed as other income. Other income forms part of the aggregate tax base and, accordingly, it is also subject to a 15.5% social contribution tax besides the 15% personal income tax.

If private individuals are obliged to pay the social contribution tax themselves, e.g. if the crypto asset is not acquired from a Hungarian financial enterprise, the base of the personal income tax and the social contribution tax is 87% of the income obtained with the crypto asset. So the overall tax burden in Hungary is 26.5%.

Let’s see how this will change if the bill is accepted.

The new legislation

If the submitted bill is accepted by the Hungarian Parliament, the income realised through crypto asset transactions will qualify as separately taxed income. The taxation will be similar to that of controlled capital market transactions.

Generation of revenue

As mentioned above, taxation may arise if the crypto asset is exchanged for a non-crypto asset. So the cases when a crypto asset is exchanged for another crypto asset will not qualify as crypto asset transactions for personal income tax purposes, thus in these cases, no taxable income is generated. In the same way, no revenue is generated upon the production (mining) of the crypto asset.

Additionally, no tax has to be paid (no income assessed) if the revenue from the transaction does not exceed 10% of the minimum wage in Hungary. One additional condition is that no revenue should be generated from other identical transactions on the given date, and that the sum of these smaller revenues should not exceed the minimum wage in the fiscal year.

Defining income

When defining income, the revenue achieved from the transaction must be reduced by the amount used to acquire the asset.

What can qualify as an amount used for acquisition? When participating in mining a crypto asset or in the operation of a related system, the expense that arose in connection with such activity (e.g. IT devices, electricity) can be considered an amount used to acquire the asset. However, it is more common to acquire crypto assets through purchasing than mining. In this case, the amount spent to acquire the asset can be deducted from the revenue.

The transactional profits and losses established this way and realised in the fiscal year should be treated in aggregate. Taxable income is generated if the realised transactional profits exceed the sum of transactional losses as well as the fees and commissions related to the holding of the crypto assets, but not directly connected to the transactions of the fiscal year and the given transaction.

Tax equalisation in Hungary

We can apply the loss carryforwards known from controlled capital market transactions in the case of crypto asset transactions as well. If we incur losses in the given fiscal year during the transactions, in the next two years we can reduce the tax payable by the amount of tax pertaining to the loss within the framework of tax equalisation.

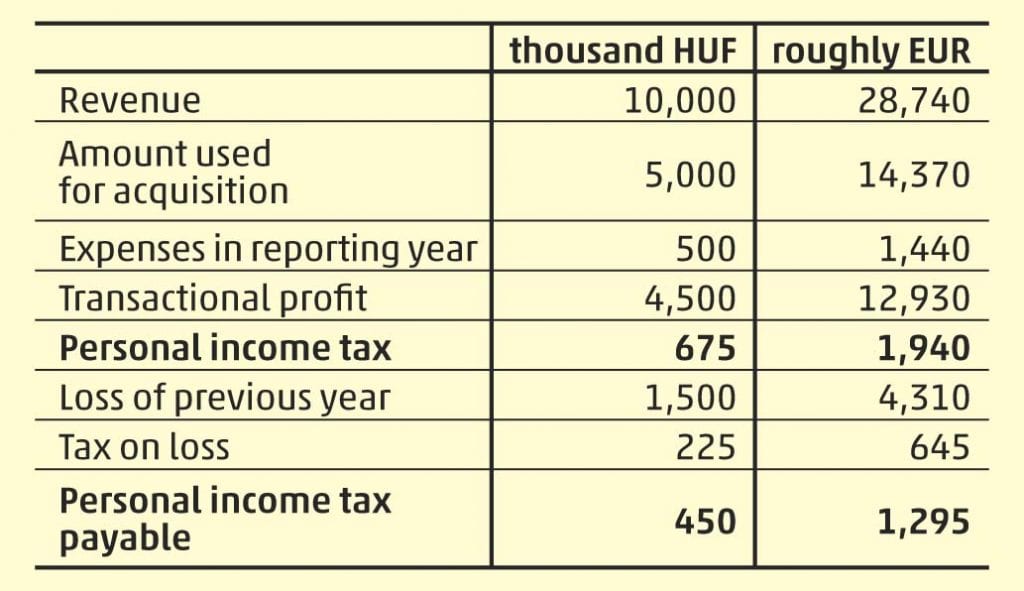

Let’s look at this with a specific example:

Social contribution tax

Considering that the income achieved with the crypto assets will not be part of the aggregate tax base if the bill is accepted, it will not be subject to social contribution tax. This means the previous overall tax burden of 26.5% will fall to 15% in Hungary.

Transitional rules

For those who previously did not declare their income from crypto assets, the bill has a very favourable option in store. Previously unreported income can be declared as a transactional result of 2022, at a more preferential tax rate.

The tax advisory team of WTS Klient Hungary has significant expertise in personal income tax, and has supported its clients regarding the taxes of their foreign employees for decades. Should you have any questions regarding the revenues of a foreign employee from crypto assets and the related taxation, you can certainly count on our colleagues! Please feel free to contact us.