At the beginning of September 2021, the amendment to the Anti-Wage and Social Dumping Act came into force and applies to all postings that started after 31 August 2021 in Austria.

Central elements of the amendment are the adaption of the Anti-Wage and Social Dumping Act to the EU Posted Worker Directive, the revision of the administrative penalties, the extension of the catalogue of exceptions, as well as the restructuring of the security performance.

Through the amendment, Austria implemented the changed regulations of the EU Posted Worker Directive and the regulations of the European Court of Justice concerning the posting of workers.

Amendment of the concept of posting to the Anti-Wage and Social Dumping Act

The Austrian Anti-Wage and Social Dumping Act previously provided for a very far-reaching concept of posting, whereby the EU Posted Worker Directive only includes postings carried out based on a service agreement, cross-border hiring outs (personnel leasing), postings within the concern.

The law now reflects the same regulations as the EU Directive, thus posting in the employer´s interest without any service agreement no longer fall under the scope of the Anti-Wage and Social Dumping Act.

Extension of the exception catalogue

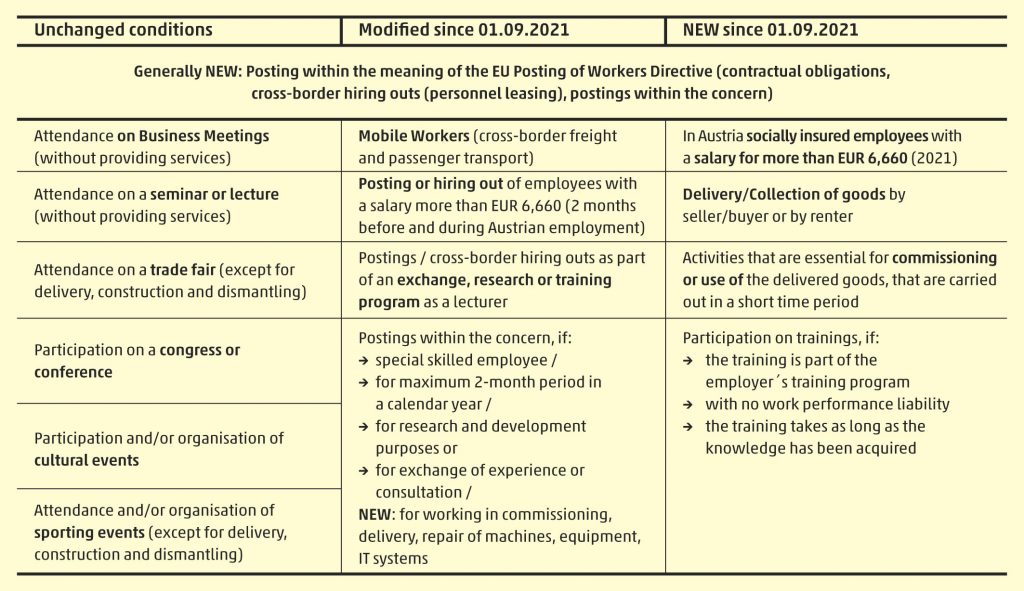

For some short-term activities such as attending on a business meeting, a seminar, a lecture or participating on a congress, on a cultural event or on a trade fair, (except for delivery, construction, and dismantling) the Anti-Wage and Social Dumping Act is, as before, not applicable, if no services are provided during these activities.

Newly added significant exceptions to the Anti-Wage and Social Dumping Act are in Austria insured high earners as well as seconded employees who provably receive (at least two months before and during posting) a monthly salary of at least EUR 6,660 gross (for 2021), regardless of the duration of the posting.

Activities that are essential for the commissioning of the delivered goods or the delivery and collection of products are also exempt from the regulations of the amended law.

A further exception clause was added in § 7, whereby employees who are posted for training purposes are excluded from the scope of the law, provided that the training is part of a training program of the employer or the Austrian company, the employee does not owe any work performance and the employees are only trained as long as it is necessary to acquire the knowledge.

Differentiation between short-term and long-term assignments

With a very few exceptions there has been no differentiation in term of how long a posting takes in Austria according to the Anti-Wage and Social Dumping Act so far.

The amending directive also contains separate regulations for long-term postings, which have now been transposed into national law. It now stipulates, that in the case of postings and assignments for a longer period than 12 months (or 18 months) the Austrian terms and conditions of employment applies (both law, ordinance and collective agreement), insofar as these standards are more favourable than the corresponding standards of the posting country.

Changes in the penalty system

Another key point of the amendment to the Anti-Wage and Social Dumping Act was the adaption of the penalty range, since according to the European Court of Justice the previous regulations were disproportionate and illegal. In its decision the European Court of Justice called for a penalty limit without a minimum level penalty, as well as the omission of penalty accumulation. The new regulation led to the abolishment of the accumulated (per employee) penalties, whereby it applies for any offense with minimum wage and notification requirements.

The following penalty fees are applicable regardless of how many employees are affected:

- Violation in connection with the reporting and maintenance obligation when posting or cross- border hiring out: fine up to EUR 20,000.

- Fraudulent activity during authority control (documents delayed submission, denied access to documents or information): fine up to EUR 40,000.

- Failing to provide wage related documents: fine up to EUR 20,000, in the event of second offence: fine up to EUR 40,000.

- Underpayment based on Austrian law and collective agreements: depend on the amount of withheld remuneration: fine up to EUR 400,000. The number of employees affected is irrelevant. A full cooperation of the employer is penalty-reducing.

Posting documents simplification

Important simplification is the use of English language in all wage-related documents, as well as social security insurance evidence, because previously only the employment contract in English language were accepted.

The following list of documents must be kept available in Austria, where the posted worker is employed:

- A1 social security document (or comparable documents if the A1 form is still not available)

- Copy of the notification document (ZKO3 or ZKO4)

- Employment contract

- Payslip / Wage records

- Proof of the monthly payment

- Working time records

- Documents relating to pay categorisation (if this information cannot be found in the employment contract)

In addition, there are simplifications in the reporting obligations. Now it is possible to make a single notification for a period of six months (before the maximum period was three months called “Rahmenmeldung”) if there are repeated cases of posting of workers to the same client / the same project. In the case of service contracts of the same type concluded with several clients, the notifications may be combined within one collective report in the case of continuous performance within one week in Austria (“Sammelmeldung”).

Overview of the amendment in the catalogue of exceptions

If you would like to know more about the details of the changes to the Austrian Anti-Wage and Social Dumping Act, please visit the homepage of ICON Wirtschaftstreuhand GmbH, partner firm of WTS Global in Austria!