Amendments to the Slovenian Personal Income Tax Act and amendments to the Slovenian Tax Procedure Act (effective from 28 December 2022), as well as the Regulation on the tax treatment of expense reimbursements and other employment income for 2023 were adopted and published at the end of 2022. Below, we summarise the most important changes affecting income tax.

Personal allowances in 2023

Basic personal tax allowance

The amount of the total basic personal tax allowance is determined by total income in 2023. In the case of total annual income up to EUR 16,000, the annual basic tax allowance is EUR 5,000 plus 18,761.40 – 1.17259 x total income. If the total annual income exceeds EUR 16,000, the annual basic tax allowance is EUR 5,000.

If the employee presents a written request to the employer that the increased tax base should not be taken into account when calculating the income tax from the employment relationship, the monthly allowance amounts to EUR 416.67.

Personal tax allowances

According to the amendments to the Slovenian Personal Income Tax Act, a special tax allowance for young people up to the age of 29 has been introduced for 2023 and later. The tax allowance for people under 29 amounts to EUR 1,300 per year.

The special tax allowance for people with a valid student or scholar status amounts to EUR 3,500 annually.

The tax allowance for voluntary additional pension insurance is capped at EUR 2,903.66 annually, or up to 5.844% of an employee’s annual gross salary.

In 2023, the annual tax allowance in Slovenia for a disabled taxpayer with a 100% physical disability is EUR 18,188.61, while the monthly allowance amounts to EUR 1,515.72. Taxpayers over the age of 70 years are entitled to a EUR 1,500 annual or a EUR 125 monthly senior allowance. Taxpayers involved in civil defence or rescue tasks on a voluntary and non-professional basis for at least ten years without interruption are entitled to the same amount of tax allowance.

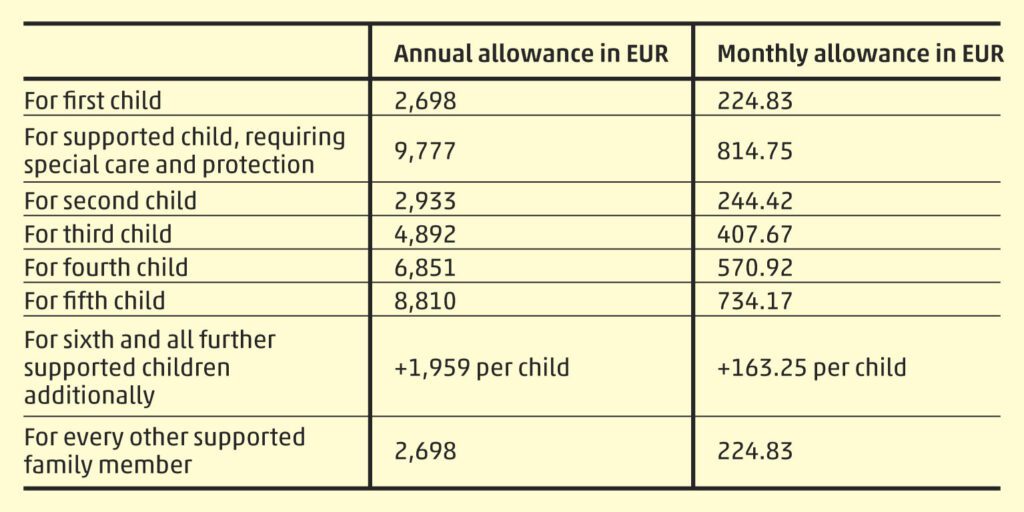

Special tax allowance for supported family members

In accordance with the amendments to the Slovenian Personal Income Tax Act, the tax allowance for 2023 only increased for supported family members, as follows:

Minimum wages 2023

The gross minimum monthly salary for work performed after 1 January 2023 amounts to EUR 1,203.36.

Income tax scale 2023

Due to amendments to the Slovenian Personal Income Tax Act, the tax rate in the 5th tax bracket has been increased from 45% to 50%. Accordingly, the income tax is:

- 16% if the annual tax base is EUR 8,755 or less;

- EUR 1,400.80 + 26% on the part of the tax base exceeding EUR 8,755, if the annual tax base is between EUR 8,755 and EUR 25,750;

- EUR 5,819.50 + 33% on the part of the tax base exceeding EUR 25,750, if the annual tax base is between EUR 25,750 and EUR 51,500;

- EUR 14,317 + 39% on the part of the tax base exceeding EUR 51,500, if the annual tax base is between EUR 51,500 and EUR 74,160;

- and EUR 23,154.40 + 50% on the part of the tax base exceeding EUR 74,160, if the annual tax base is over EUR 74,160.

Donations up to 1% of income tax

With a special note, taxpayers can request that 1% of their annual income tax is used as a donation to certain beneficiaries (non-governmental organisations, political parties, representative trade unions, registered churches and other religious communities, school- and child-care funds).

Taxation of capital gains

The amendments to the Slovenian Personal Income Tax Act left tax rates on capital gains from property sales or the sale of shares unchanged. The tax rates are:

- 25% if the ownership period is 5 years or less;

- 20% if the ownership period is between 5 and 10 years;

- 15% if the ownership period is between 10 and 15 years;

- and 0% if the ownership period is over 15 years.

Income from rentals

The tax rate for renting out property is 25% again, not 15% as in the year 2022.

Furthermore, in 2022 it was possible to choose between flat or progressive taxation of rental income. According to the amendments to the Slovenian Personal Income Tax Act, this option no longer exists in 2023. If we compare the tax assessment on rental income in accordance with the income tax scale for 2022, while taking into account a pension of EUR 800/month, the gap in taxation for 2023 is almost twice as high as in 2022.

Taxation on share sales to the company: acquisition of own shares

From this year onwards, acquiring own shares is not considered a disposal of capital anymore. The taxation is the same as the taxation for dividend payments, i.e. a rate of 25%. One exception is the acquisition of own shares listed on an organised stock market.

The tax base is the revenue reduced by the purchase value of the sold shares.

Income taxation of full-time self-employed entrepreneur

The lump-sum expenses in the case of a full-time insured self-employed entrepreneur (s.p.) or a full-time employee in 2023 are as follows:

- 80% of the total income, if the annual income is EUR 50,000 or less;

- 40% between EUR 50,000 and EUR 100,000;

- and 0% over EUR 100,000.

It means, for example, that in the case of annual income of EUR 95,000, the annual income tax will almost double: in 2022 the tax was EUR 3,800 and in 2023 the tax amounts to EUR 7,400.

Income taxation of part-time self-employed entrepreneur

The amendments to the Slovenian Personal Income Tax Act have also changed the income tax on business activities by sole entrepreneurs who determine their tax base based on lump-sum costs and are socially insured based on their employment relationship (i.e. “afternoon s.p.”). In their case, the lump-sum expenses amount to:

- 80% of the total income, if the annual income is EUR 12,500 or less;

- 40% between EUR 12,500 and EUR 50,000;

- and 0% over EUR 50,000.

This means, for example, that in the case of annual income of a part-time entrepreneur totalling EUR 20,000, the annual income tax increases by 75%: in 2022 the tax was EUR 800, and in 2023 the tax will amount to EUR 1,400.

Deadline of advance tax payments

According to the amendments to the Slovenian Personal Income Tax Act, from 2023, advance income tax payments for sole entrepreneurs must be paid by the 20th of the following month.

Legal entities, which have to make advance payments of corporate income tax must do so by the 20th of the following month as well, and no longer by the 10th of the following month.

If you need more information on amendments to the Slovenian Personal Income Tax Act or other tax news in Slovenia, please visit the website of WTS Slovenia and contact the local experts of WTS Global for Slovenia.