As we approach the end of May, businesses are already well underway with preparations for their 2023 annual financial statements and tax returns. However, accountants who include deferred tax effects in their accounts could run into practical problems when it comes to the final steps of publishing financial statements and completing corporate tax returns.

Previously we reported on the fact that the introduction of the global minimum tax triggered an amendment to the Act on Accounting, allowing the recognition of deferred tax in Hungarian financial statements. This can be done for the first time for the 2023 financial year.

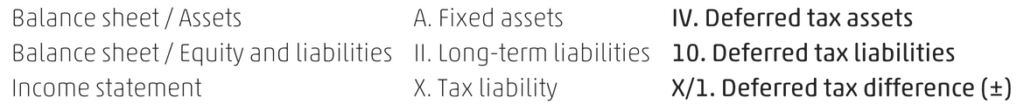

For companies making use of this option, the profit after tax is calculated from the profit before tax, tax payable and the reporting-year change in the deferred tax difference. Accordingly, the balance sheet and income statement under the Act on Accounting have been amended as follows:

Recognition of deferred tax in reports published electronically

Companies can easily reflect these changes in their own financial statements and reports. But how is this handled by the Electronic Reporting Portal?

The information is now available on the Online Reporting and Form Completion System (OBR), which provides guidance on the above changes as well as practical information. Accordingly, you can select the reporting format with the new rows at point 17 of the Cover Page. So anyone who wants to publish a report that includes deferred tax can now do so. However, please note that in this case, due to changes in the balance sheet and income statement rows, the data for the previous year will not be included automatically, it must be filled in manually.

The situation is different for tax returns though.

Recognition of deferred tax in 2023 corporate tax returns

It is always important to stress that in Hungary, deferred tax can only be interpreted in relation to corporate tax, since only this tax has a carry-over effect through items reconciling the tax base.

Consequently, only with corporate tax returns (2329) may you run into problems with the recognition of deferred tax when completing annual tax returns. Form A-01 of the return contains the balance sheet data, which must be completed based on the financial statements. At the minute, form 2329 cannot yet fully handle the recognition of deferred tax in the balance sheet.

According to information obtained from the tax authority by telephone, if a company has a deferred tax liability it should be reported on form 2329-A-01, row 31, under Long-term liabilities.

However, in the case of a deferred tax asset, there is currently no appropriate row under Fixed assets, since only Intangible assets, Tangible assets and Investments can be classified here.

UPDATE! The above issue regarding the completion of the corporate tax return has been resolved. According to the written information from the tax authority, new lines have been added to the A-01 sheet of the 2329 return, where the balance sheet data must be shown:

2329-A-01, line 44: amount of deferred tax asset (under fixed assets)

2329-A-01, line 45: total amount of deferred tax liability (under long-term liabilities, deducted from the amount on line 31)

The above lines are now included in the updated ÁNYK form, so there is no obstacle to submit in the correctly completed corporate tax return by the deadline (31 May).

The accounting specialists and tax advisers at WTS Klient Hungary are in regular contact with the tax authority to seek answers to clients’ questions as soon as possible, and to draw the tax authority’s attention to any shortcomings with the system of tax returns or with publishing reports and financial statements. We believe it is important to share with our clients the latest accounting and tax law changes, professional knowledge, and practical advice on the problems they face. If you have any other questions about deferred tax, please contact us.