In view of the armed conflict and humanitarian disaster in Ukraine, the Hungarian Government amended Act CL of 2017 on Rules of Taxation for the period of the declared state of emergency, which has doubled default penalties compared to the previous rates.

Which default penalties are affected in Hungary?

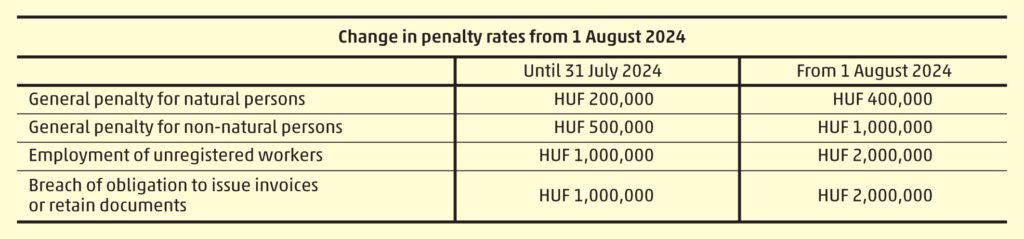

The increase in default penalties affects general penalties and two special types of default penalty:

- The upper threshold for general default penalties in the case of natural persons has risen from HUF 200,000 to HUF 400,000, while for non-natural persons it is now HUF 1 million instead of HUF 500,000.

- Violations of the rules to register employees can now lead to default penalties for taxpayers of HUF 2 million instead of the previous HUF 1 million.

- Violations of the rules on issuing invoices and receipts as well as the obligation to retain documents now also can be penalised up to HUF 2 million instead of HUF 1 million.

The decree, published in issue 74 of the Hungarian Gazette on 8 July 2024, enters into force on 1 August 2024, and the rules must be applied by the Hungarian Tax and Customs Administration for violations of such obligations due from the following day.

How does the NAV impose the penalties?

The following legal means are at the disposal of the National Tax and Customs Administration in Hungary to enforce the norms formulated by the legislators:

- late payment interest

- tax penalty

- default penalty

- measures

As an administrative sanction, default penalties can be imposed if a taxpayer fails to meet a tax liability, or does so late or incorrectly.

When levying default penalties, the willingness of the taxpayer to adhere to the law must be taken into account, along with the gravity, frequency and duration of the illegal conduct, and whether they acted with the due care expected in the given situation. After weighing up these circumstances, the NAV must levy a penalty commensurate with the presumed damage, even repeatedly and at higher amounts. This is dealt with in more detail by the NAV Guideline 3002/2021 on exercising powers of leniency (available in Hungarian here).

In this context, taxpayers can also ask for circumstances substantiating a request for leniency to be considered, thereby achieving a payment reduction or relief.

When imposing default penalties, another important aspect is whether the taxpayer in question is classified as reliable or risky. If deemed a reliable taxpayer, this is looked upon favourably when the penalties are imposed. For default penalties the maximum punishment is 50% of the upper threshold. Risky taxpayers accordingly find themselves in a worse situation; in their case the smallest amount of any default penalty is 30% of the upper threshold for the penalty.

Who may be most affected by the increase in default penalties?

The quick answer to this question is everyone, since as mentioned above, one of the increased NAV default penalties is the general penalty, which essentially affects all taxpayers in Hungary who fulfil their tax obligations incorrectly, incompletely, with false data, late, or not at all. Consequently, if you fail to submit your local business tax return, the tax authority can impose a default penalty of up to HUF 1 million.

Those who breach the rules on registering employees find themselves in a special group, as the NAV keeps them in a separate database. The list containing roughly 5,500 taxpayers can be viewed on their website (available in Hungarian here). Most of these employers are self-employed businesses, or work in the commercial, construction and hospitality sectors. These taxpayers can be penalised with default penalties of up to HUF 2 million, if they employ or have employed unregistered staff.

The increase in penalties for taxpayers who breach invoice, simplified invoice or invoice-issuing obligations, or issue invoices, simplified invoices or receipts with the wrong amount or who fail to retain documents for the requisite period will also mainly affect those working in the commercial and hospitality sectors.

Such drastic increases in default penalties in Hungary mean it is even more important to pay close attention to the deadlines set by the tax authority and to fulfilling the prescribed obligations. Should you require any assistance with compliance, please contact the tax consulting team of WTS Klient Hungary who are always happy to help.