Press release

Cases and fines for violation of the General Data Protection Regulation

In three weeks, a year will have passed since the General Data Protection Regulation of the EU came into force. Sorainen Latvia collected some experiences.

Simplified voluntary liquidation

From 1 July 2018, any company exempt from the obligation to be audited can opt for a simplified voluntary liquidation if the procedure is completed within 150 days.

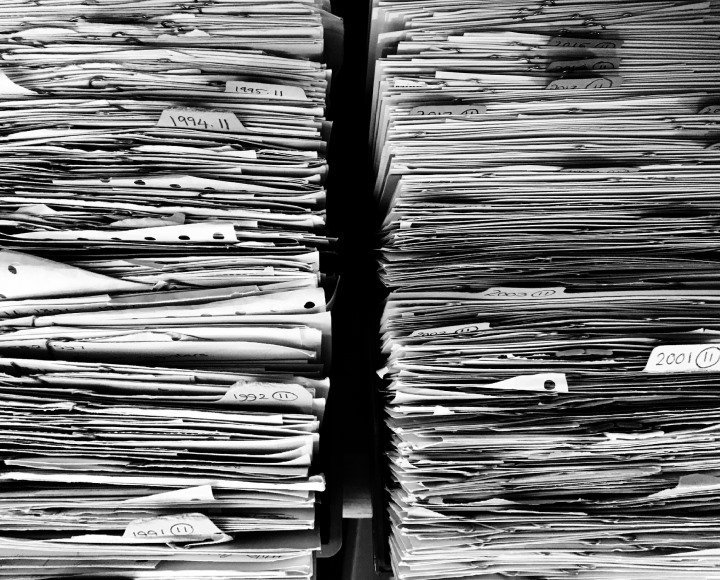

Keeping records of personal data breaches

Failure to comply with the obligation to keep records of personal data breaches may result in an administrative fine.

Tax allowance for foreign scientists and researchers in Austria

Foreign scientists and researchers in Austria are entitled to claim an additional tax allowance of 30% of taxable income for a period of up to five years.

New interest deduction limitation rules in Hungarian corporate taxation

On 1 January 2019, new interest deduction limitation rules entered into force in Hungary following the adoption of the provisions of the ATAD I Directive.

European Tax Awards 2019: WTS Klient Hungary on the shortlist

WTS Klient Hungary is in the finals for Hungary Tax Firm of the Year and Hungary Transfer Pricing Firm of the Year titles at the European Tax Awards 2019.

Final version of the Czech tax package 2019 approved

The final Czech tax package 2019 was signed by the President and published end of March 2019. Most amendments came into effect on 1 April 2019.

Equity components in Hungary

Equity finances the operations of businesses. Its size and composition provide important information on the financial position of a company.

Quick fixes to the new EU VAT system

On 4 December 2018, the Council of the European Union adopted three so-called quick fixes related to the new European value added tax system.

Comprehensive package could further boost employment in Hungary

Employment in Hungary could be boosted further by retraining, supporting mobility as well as flexible and part-time forms of employment.

New withholding tax regulations in Poland

The new withholding tax regulations in Poland will come into effect on 1 July 2019, and will complicate the withholding tax refund process.

Brexit effects on social security

Hungarian Parliament approved Bill No. T/4821 on 19 March 2019 that mitigates the uncertainties related to Brexit effects on social security.

Reverse charge mechanism in Romania extended until 30 June 2022

To combat value added tax fraud, the country requested an extension of the reverse charge mechanism in Romania from the European Union until 30 June 2022.

Changes to tax-exempt status of export freight

From 1 January 2019, services related to exported products, such as export freight, will be tax exempt if they are invoiced to the exporter of the products.

Tax reform in Slovenia 2019-2022

At the end of February the Slovene Ministry of Finance presented a tax package. The tax reform in Slovenia should relieve the tax burden on labour.