As previously mentioned in our Challenges during transformation of companies article, managing the transformation process of companies is a long and complex process. Given that transformations can take between six months and one year, and many deadlines have to be observed in the process, such tasks require very thorough planning. In this article we go into more detail about the process.

What are the most important milestones for a transformation?

- Ownership decision on the transformation

- Preparation of the draft transformation balance sheet and publication of transformation plan

- Application to the Court of Registration, and registration of transformation

- Preparation of the final transformation balance sheet

The transformation process of companies is governed by the Hungarian Civil Code (Act V of 2013), Act CLXXVI of 2013 on the Reorganisation, Merger and Demerger of Legal Persons, Act C of 2000 on Accounting, and Act V of 2006 on Public Company Information, Company Registration and Winding-up Proceedings.

What is the first step of the transformation process?

The first and the most important step is deciding on the transformation, a decision that is contained in the transformation plan. The transformation plan includes the draft transformation balance sheet and the draft inventory of asset and liabilities as well as the merger or the demerger agreement.

The owners use the transformation plan to determine the transformation process. As part of the transformation plan, decisions are reached, among other things, on the transformation method, date, company form, the exiting and joining members, settling up with those leaving, the senior executives of the new company, the capital structure of the new and the surviving companies, the measurement of assets and liabilities (at carrying value or market value), and the auditor of the transformation.

Company transformations are triggered with one or two decisions by the owners. In the first decision, the owners decide based on a management proposal whether they agree with the intention of the transformation, and what form this transformation should take.

The audit of the transformation must be conducted by an independent auditor of the audit firm appointed by the company.

Publication of transformation, application to Court of Registration and draft transformation balance sheet

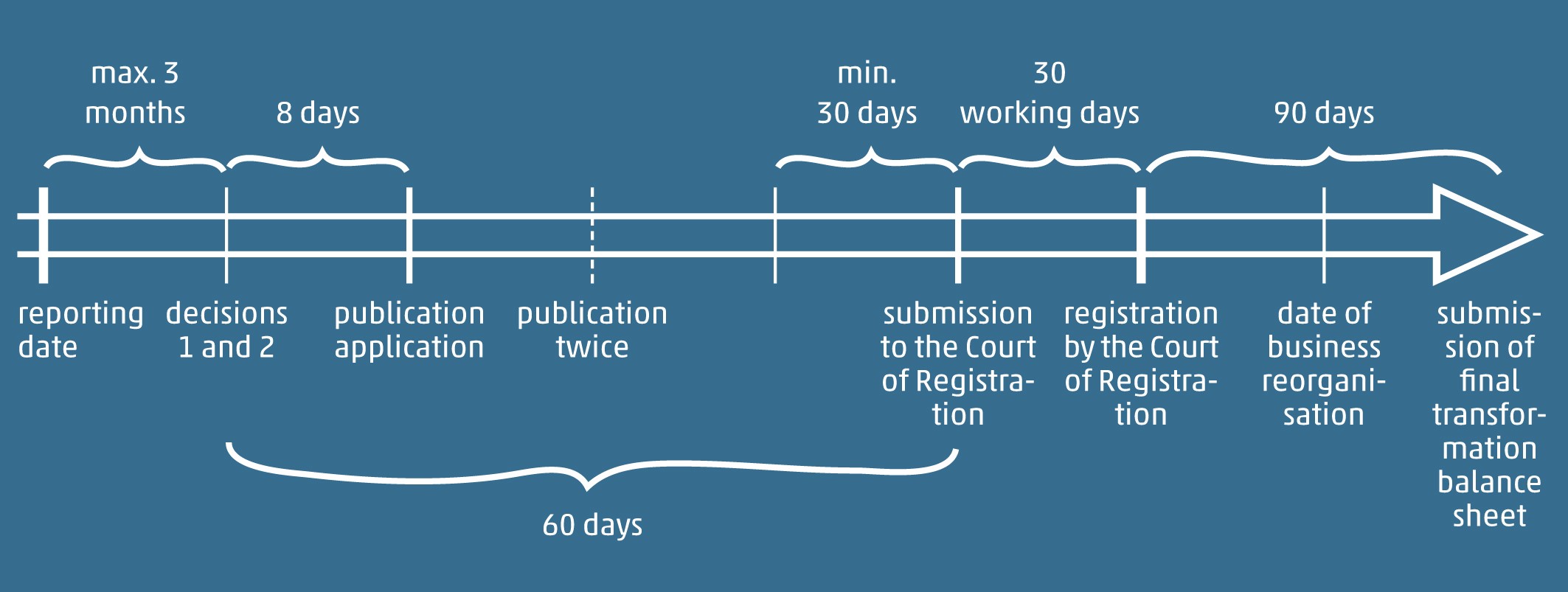

In the second decision the owners finally resolve to carry out the transformation based on the audited draft transformation balance sheet. If the audited draft transformation balance sheet is available at the time of the first decision, the two decisions can be combined. Action must be taken within eight days to have the decision on the transformation published in the Company Gazette. The decision must appear in two consecutive gazettes.

The draft transformation balance sheet is designed to present how they wish to distribute the assets and liabilities of the surviving company after the transformation, while the draft inventory of asset and liabilities details the draft transformation balance sheet to support it.

The transformation application must be submitted to the Court of Registration within 60 days of the transformation plan being accepted. Thirty days from the second publication of the decision, creditors may request security for their outstanding claims that arose prior to the publication. In this respect it is worthwhile waiting until the 30-day deadline for creditors has elapsed before submitting to the Court of Registration.

Registration by Court of Registration and final transformation balance sheet

The Court of Registration makes its decision on the transformation based on the submitted transformation plan and the draft transformation balance sheet, among other things. The Court of Registration has 30 working days to rule on the application. It is possible to request that the transformation be registered on a given date, which is advisable because it is better to prepare an accounting closure as of the end of a month. From 15 March 2014 one new feature in relation to the registration at the court is that the tax authority (NAV) has to notify the Court of Registration that there are no pending tax authority procedures.

After the registration by the Court of Registration, the transformation process of companies is completed upon preparing the audited final transformation balance sheet and the final inventory of assets and liabilities as of the date of the transformation, which must be filed within 90 days. Thereafter, the final transformation balance sheet and the final inventory of assets and liabilities are used to open the accounting records at the companies starting as of when the transformation is registered.

The company terminated during the transformation has to prepare, publish and file the financial statements with a reporting date that tallies with the date of registration at the Court of Registration.