What is the potential impact of artificial intelligence on taxation, and how can we possibly use it in tax consulting? What are the first steps and experiments that have already been carried out in this field? These are the questions we seek answers to in our article.

For now we are still far from submitting our tax returns to the tax authority using artificial intelligence. In the short term this is not likely to happen, even in the most developed countries of the world. In the medium term though, it is not inconceivable.

Artificial intelligence in taxation could create new area of expertise

Solutions provided by artificial intelligence will sooner or later create a new business area in tax consulting. Yet in order for artificial intelligence in taxation to be feasible, according to Fritz Esterer, Chairman of the Board of WTS Global and acknowledged expert in this field, large-scale and high quality databases along with clear rules and definitions are required. This is because intelligent algorithms need clear instructions and large-scale databases to ensure learning and continuous development.

Within the field of taxation, VAT, customs, transfer pricing and personal income tax are the areas where we find large-scale databases so it is worth considering the use of artificial intelligence primarily in these areas. According to Fritz Esterer, there are three questions to answer if we want to make artificial intelligence capable of evaluating databases automatically.

- Where is the tax rate?

- Which data do we need to capture and in which areas?

- Which areas do we need to assign these data to?

The German Research Centre for Artificial Intelligence (DFKI) and the centre of WTS in Munich set up the research institution Centre of Competence Tax and Technology at the beginning of this year. The centre aims to explore innovative application possibilities of artificial intelligence in taxation and develop tools based on the research that makes taxation easier, more precise and optimal with the help of artificial intelligence. The first intelligent algorithms have been created during the past few months and are being tested by multinational companies like Audi, Bosch, E.on or Henkel.

Software prototypes for application of artificial intelligence

The jointly established research centre is currently developing five different types of software:

- Examination of content of tax-related issues

- Texts related to taxation, speech recognition and interpretation

- Identification of argumentative structures

- Translation of texts related to taxation (NeuMU)

- Detection of errors not previously identified in extensive databases

The artificial intelligence algorithms built into extensive databases learn automatically from large volumes of data. This allows the detection of errors and anomalies that no one noticed before. This software is especially useful in customs operations.

The speech recognition system helps users access relevant taxation information or give orders quickly and easily via voice input. This question-answer system also sets an example for a trend in taxation, i.e. the possibility to reduce the complexity of tax legislation by using artificial intelligence. The system helps users make decisions in certain taxation issues.

The automatic translation system is similar to Google Translate, but there is a significant difference between the two. Google practically “eats everything”, while NeuMU, the prototype developed by the research centre of WTS and DFKI, deals only with one field of expertise, the translation of taxation documents with a high level of specialisation. As a result, the translated document is free of errors, understandable, and above all correct.

Compliance, network building and real-time solutions

Artificial intelligence in taxation can accelerate procedures, taxation processes and creates a significantly higher level of compliance. In addition, cognitive systems can also be used to build horizontal networks with other sectors, and this aspect is becoming more and more important for experts and departments dealing with taxation. Last but not least, these developments enable us to access all, globally accessible, taxation-related data and processes in real time.

You can read the interview by DATEV magazine with Fritz Esterer here in German. The study of the research centre is available here.

An IT-based tax solution, thus the use of artificial intelligence in taxation will achieve the most and be the most efficient if it is adapted to the company’s individual situation. That is why we at WTS Klient Hungary place high value on tailored implementation. Feel free to contact us if you want to simplify the taxation of your company with automated and digitalised solutions!

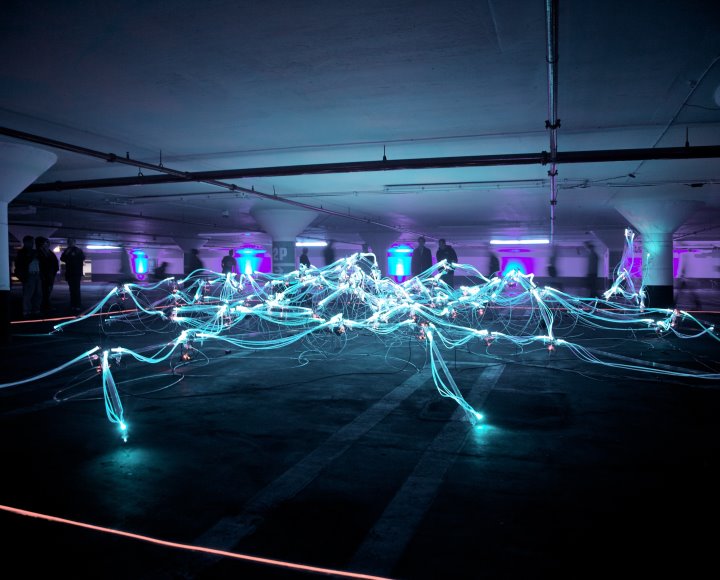

RELATED VIDEO: