On 23 October 2019 the country’s National Assembly adopted the Slovenian tax package for 2020. As we wrote in an earlier article, the changes were mainly aimed at reducing the tax burden on labour, however, the rate of corporate income tax and capital tax will not increase in all points, as proposed by the Ministry of Finance at the end of February 2019. Below we highlight the main changes to the new Slovenian tax package 2020.

The Slovenian tax package adopted in October 2019 includes amendments to the Personal Income Tax Act (ZDoh-2V), the Corporate Income Tax Act (ZDDPO-2R), the Act on Tax on Profit from the Disposal of Financial Derivatives (ZDDOIFI-A) and the Tax Procedure Act (ZDavP-2M). The amended and new provisions will apply from 1 January 2020, with the exception of the provisions on the depreciation of assets from operating leases, which have been in force since 1 January 2019.

Taxation of companies according to new Slovenian tax package

Although Slovenia had proposed to increase the general corporate tax rate (DDPO) from 19% to 20% in February, according to the adopted Slovenian tax package this tax rate will remain at 19%, as in 2019, and will not change in 2020.

While the rate remains unchanged, all companies in Slovenia will have to pay corporate income tax from 2020. If a legal entity generates taxable income, any tax exemptions and tax losses from previous tax periods can be used up to a maximum of 63% of the taxable base. This means that companies generating profits for tax purposes and who previously reduced their tax base to zero due to high research and development (R&D) investments, investments in fixed and intangible assets, for employing certain categories of worker (disabled people), as well as for investing in voluntary supplementary pension insurance and for donations, will from now on always have to pay corporate income tax.

The tax allowances for R&D and equipment, as well as in fixed and tangible assets may be carried forward for a limited period of five tax years, while other allowances reduce the tax base only in the year they originated, which further limits the actual application of tax allowances. The same provisions also apply to sole entrepreneurs who determine income tax on the basis of actual expenses.

Example:

A company generates a profit before corporate tax of EUR 1,000,000 and has invested EUR 1,500,000 in R&D in 2020. In 2020 the company can only consider a tax exemption for the R&D investment amounting to EUR 630,000, and then the difference over the next five years.

Corporate income tax base: EUR 1 Mio x (1 – 0.63) = EUR 370,000

Corporate income tax calculation: EUR 370,000 x 19% = EUR 70,300

Irrespective of the high level of investment or previous tax losses, the company will have to pay corporate income tax of EUR 70,300, which represents 7.03% of the profit.

The changes to depreciation of assets in operating leases are the most important amendments that apply retroactively, i.e. from 1 January 2019. This means that by incorporating the operating lease into fixed and intangible assets in accordance with international and also Slovenian accounting standards, the legislator set the depreciation at the highest annual rate possible, which corresponds to the actual depreciation period of the asset, i.e. the asset’s useful life in operating leases. This provision already applies to the preparation of the corporate income tax self-assessment for 2019 and the determination of income tax for sole entrepreneurs for 2019.

Taxation of capital owners

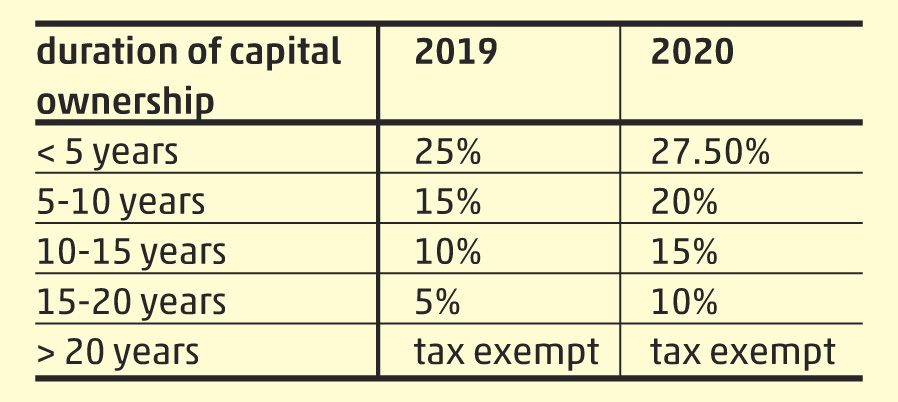

In 2019, taxpayers still have to pay 25% of the final tax on investment income (interest, dividends, capital gains and gains on the sale of derivative financial instruments). From 2020, capital gains will be taxed at the rate of 27.5%.

For capital gains realised in 2019, we present the comparable tax rates that will apply from 2020:

To close the legal discrepancy and avoid abuse, income of a shareholder from the sale of shares to the company (purchase of own shares) or company shares from non-regulated market are taxed as a dividend at the total amount paid.For income from real estate leasing, taxpayers can take into account standardised costs of 15% (only 10% in 2019), but the income tax rate for income from real estate leasing increases to 27.5% as well (in 2019 the tax rate is 25%).

The transferor may inform the taxpayer in writing about the acquisition value of the shares or units sold prior to the tax settlement.

Taxation of employees

From 4 May 2019 the annual holiday payment is completely exempt from social security contributions as well as income tax. This means that the employer’s costs are equal to the employee’s net payment, which corresponds to the average gross salary in Slovenia, amounting to EUR 1,726 in August 2019.

Example:

A company pays out the holiday payment at a gross amount of EUR 1,700. It actually has personnel costs of EUR 1,700 and the employee receives a net amount of EUR 1,700 to his or her bank account.

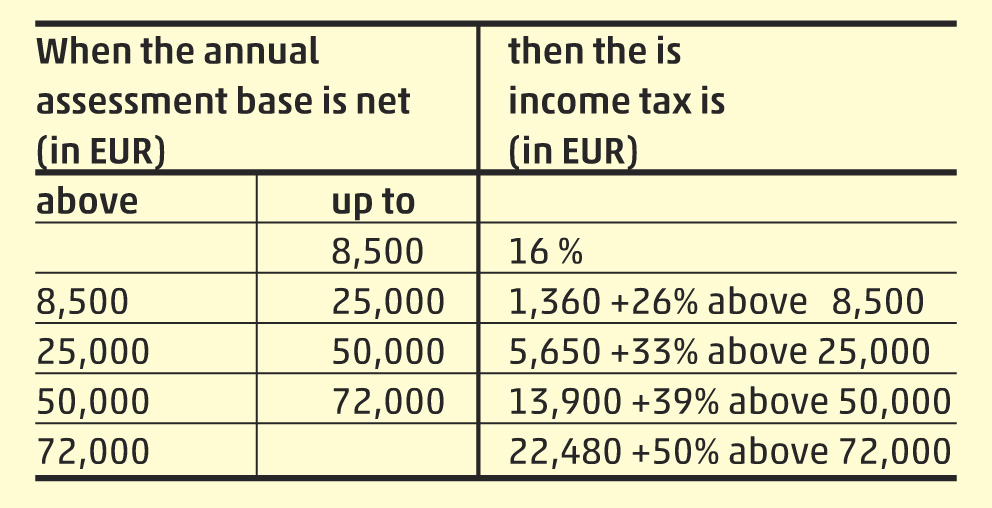

The Slovenian tax package for 2020 is also intended to change the income tax categories in terms of reducing income from employment of the middle tax brackets.

From 2020 the following income tax categories apply:

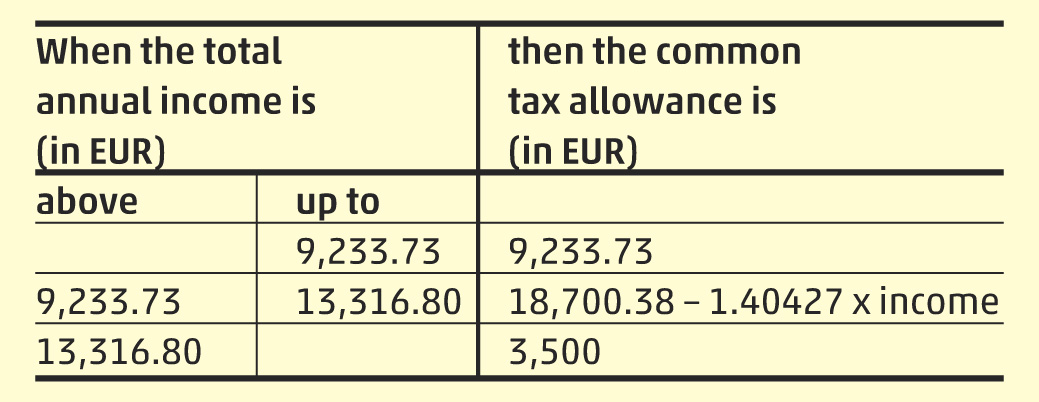

Also, the common tax allowance will increase and from 2020 should be the following:

This means that the common tax allowance for all taxpayers will rise at least from the current EUR 3,302 to EUR 3,500.

To apply and recognise a special allowance for supported family members (adult and unemployed children, parents or adoptive parents), the significant change is that such a person must have the same permanent residence as the taxpayer who declares that family member as a supported family member. This does not apply to children under 18 years.

To promote the purchase and use of electric vehicles, the Slovenian tax package reduces the benefit in kind when purchasing company vehicles used by employees for private purposes. The monthly benefit in kind for the private use of a small electric vehicle will only amount to 0.3% of the purchase price of the vehicle, if the purchase cost of the vehicle including VAT does not exceed EUR 60,000. The benefit in kind for private use of company vehicles for conventional petrol and diesel vehicles, as well as for larger electric vehicles (only for a surplus over EUR 60,000), remains at 1.5% of the initial cost in the first year.

According to the new Slovenian tax package the taxation of part of the salary for business success (so-called 14th salary or Christmas bonus) currently remains unchanged for the coming years. The 14th salary can be paid without income tax, and only bears the obligatory social security contribution deduction of 38.2%. In 2019, the tax-exempt part of the Christmas bonus can be paid out up to approximately EUR 1,700.

If you would like to find out more detailed information about the adopted Slovenian tax package, please visit the website of WTS Slovenia and contact the local experts of WTS Global for Slovenia.