On 3 June the permanent members of the European Council accepted the proposal of the European Commission that DAC6 data reporting deadlines pertaining to cross-border arrangements introduced by Council Directive (EU) 2018/822 would be extended by six months.

DAC6 data reporting deadlines at EU level

As we already reported earlier, the DAC6 regulation is designed to identify and map profit-shifting practices as well as aggressive and potentially aggressive tax planning arrangements associated with transactions and structures that span across more than one jurisdiction and are based on the differences between tax regulations in the affected states. Under this regulation, cross-border arrangements which display certain potentially aggressive tax planning “hallmarks” must be reported.

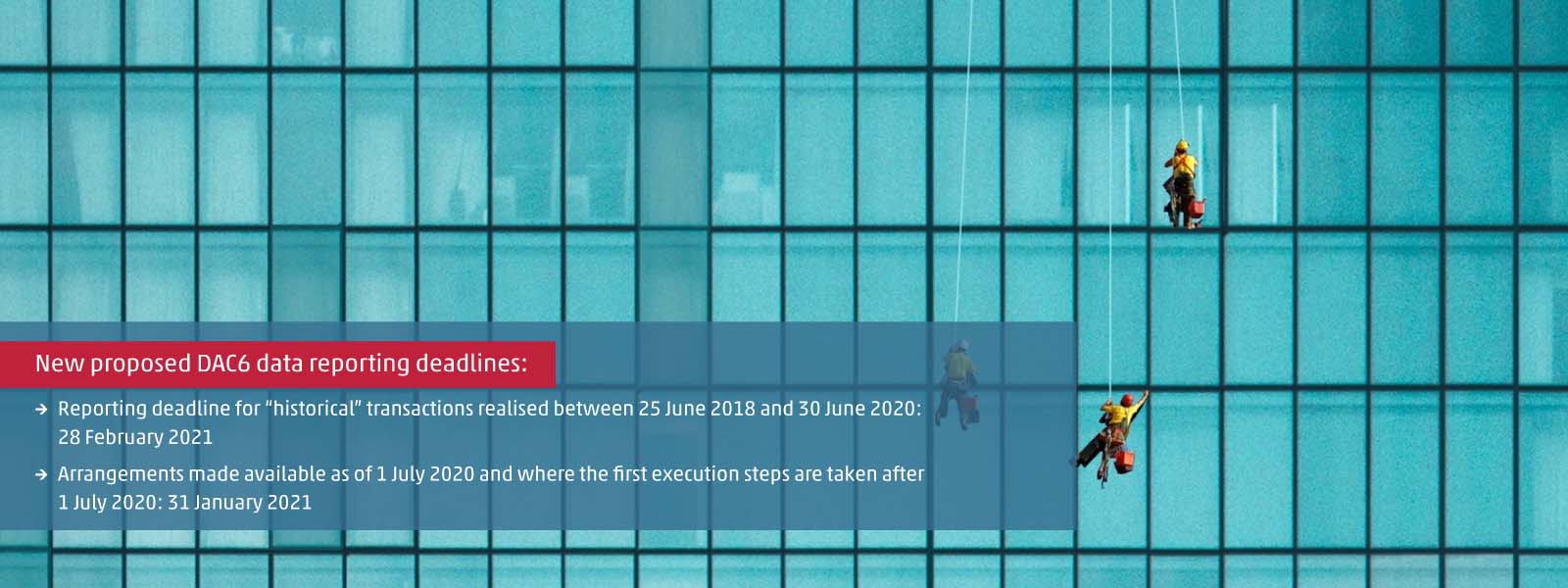

In accordance with the EU proposal accepted on 3 June, the DAC6 data reporting deadlines would be modified as follows:

- The reporting deadline for “historical” transactions realised between 25 June 2018 and 30 June 2020 would be shifted from 31 August 2020 to 28 February 2021; while

- for arrangements made available as of 1 July 2020 and for transactions where the first execution steps are taken after 1 July 2020, the (first) data reporting deadline would change from 31 July 2020 to 31 January 2021.

For the new DAC6 data reporting deadlines above to take effect, the European Council must approve the modification of the DAC6 directive, which the European Parliament must express an opinion on. All this is expected by the end of June; EU Member States may only transpose the appropriate modifications into their legislation thereafter.

Hungary has already submitted the bill

In Hungary the legislation transposing the DAC6 Directive into Hungarian law was approved in June 2019, with an effective date of 1 July 2020. Now, somewhat ahead of EU legislative procedures, Hungary has already submitted a proposal on the six-month extension of the DAC6 data reporting deadlines as part of the bill laying down the grounds for the 2021 Hungarian central budget on 2 June 2020, the approval of which is still expected in June.

Despite the fact that businesses are expected to receive a six-month extension on the reporting of their DAC6 transactions due to the economic situation as a result of the coronavirus pandemic, it is crucial that transactions potentially subject to the reporting obligation are assessed as soon as possible and the necessary internal procedures are developed. This is especially true for companies operating as part of a multinational group where, among other things, intra-group financing transactions and services among group members may be affected from DAC6.

Establishing and maintaining procedures in line with DAC6 has to be one of the main goals going forward for all companies that are part of a multinational group. In all cases, the relevant arrangements and transactions need to be comprehensively examined from both legal and taxation perspectives to identify transactions with a potential reporting obligation. Should you wish to entrust such a review to an expert, please do not hesitate to contact the tax consultancy team at WTS Klient Hungary. We will be happy to assist you.