Our clients often contact us with questions related to issuing invoices, such as how should invoices be issued correctly to clients, what content do invoices absolutely have to include, or what provisions need to be followed to comply with legislation. In a previous article we summarised the Hungarian rules on the content of invoices, now we are going to take a look at the rules regarding the performance date and exchange rates.

Determining the performance date

One of the most frequent questions that crops up when issuing invoices in Hungary concerns the performance date on the invoice. If the performance date differs from the invoice date, this must be indicated separately on the document. Defining the date correctly is important because (unless otherwise provided for by law) this determines when the tax payment liability is incurred. Under general rules, the performance date is the date when the transaction (supply of product or service) takes place. The procedure is different with advance invoices because then the supply of the product or service has not yet happened. In such cases, the performance date is the same as the date when the payment is received or credited.

Issuing invoices for transactions settled periodically

If business partners in Hungary agree to settle periodically, i.e. invoicing all completed transactions in a given month or quarter together, then according to the rules of issuing invoices the performance date by default is the last day of the settlement period. However, the Act on Value Added Tax contains different provisions that have to be taken into consideration. In these cases, the rules on issuing invoices are as follows:

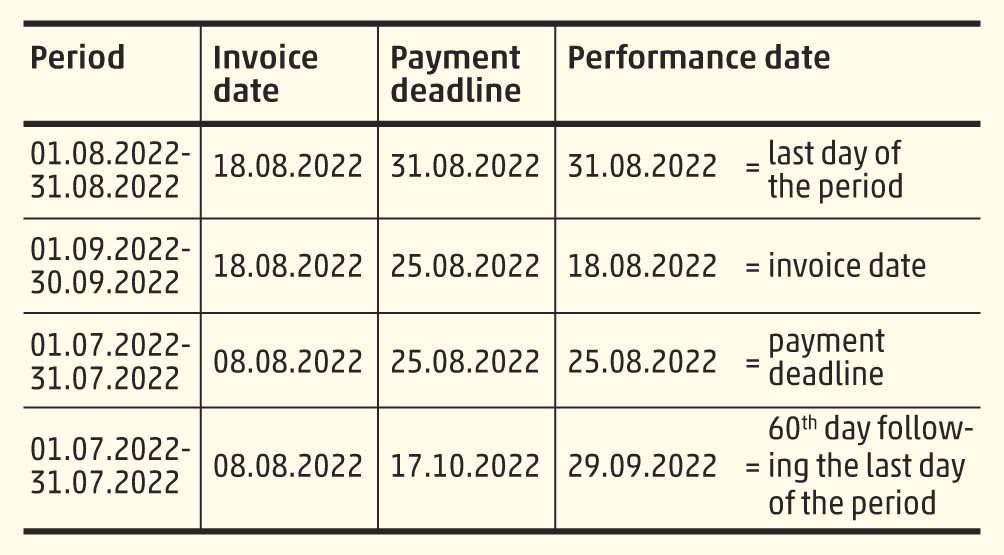

- If the payment deadline precedes the last day of the settlement period, the performance date is the same as the invoice date.

- If the payment deadline is after the last day of the settlement period, but still within 60 days, then the performance date is the same as the payment deadline.

- If the payment deadline is more than 60 days after the last day of the settlement period, then the performance date is on the 60th day following the last day of the settlement period.

Let’s take a look at some specific examples to see what this all means, and how we can determine the performance date in different cases:

Exchange rate for foreign-currency invoices

Another common question when issuing invoices concerns foreign-currency invoices. For foreign-currency invoices the amount of VAT must be indicated in Hungarian forints, but it is important which exchange rate is used. Similarly to determining the performance date, here too we must distinguish between transactions settled for a given period and one-off transactions. If the supply of the product or service falls under a periodical settlement procedure, the exchange rate is set based on the invoice date; in all other cases it is set based on the performance date.

Once the date has been established, the applicable exchange rate is the FX selling rate of the chosen Hungarian bank, or if the company has decided to use the exchange rate published by the National Bank of Hungary – and has notified this to the tax authority – then this rate is applied. It can happen that there is no official exchange rate for the given day (for example on public holidays or weekends, or the daily rate has not yet been released), and in these cases, under the rules for issuing invoices, the last applicable exchange rate must be used.

The accountants at WTS Klient Hungary have more than 20 years’ experience in accounting invoices on the most varied of transactions, and are as prepared as they can be to answer questions from our clients with regard to issuing invoices. We look forward to hearing from you should you need a reliable team of accountants to provide solutions specifically tailored to your and your company’s needs, but also if you are already a client of ours, and need help with issuing invoices.