The Hungarian real estate market has seen quite a strong upwards trend in prices recently, and therefore in value too. As a result, the duty liability on real estate transactions has become an increasingly important issue, and planning the transactional background to the onerous property transfer duty payable by the buyer is (and continues to be) of increasing importance. However, it is not only market players who are paying particular attention to the issues arising from the duty liability on real estate transactions, Hungarian legislation has also adjusted and refined the existing regulation several times.

Duty liability on real estate transactions when acquiring real estate or a company holding real estate

One of the most important rule changes regarding the duty liability on real estate transactions took place in January 2010: from this point onwards it was not only acquiring real estate (asset deal) that could result in an onerous property transfer duty liability, but also a share acquisition – directly or indirectly – of at least 75% in a company holding Hungarian real estate (share deal).

Calculating asset value when acquiring a company holding real estate

Subsequently, in July 2021, the legislator clarified the definition of a company holding Hungarian real estate with regard to the duty liability on real estate transactions, thereby closing a loophole that had hitherto been open to abuse in practice.

This is because according to the rules before July 2021, a company was deemed to hold Hungarian real estate if at least 75% of its assets as shown in its last available balance sheet (or opening balance sheet) consisted of real estate. So if the last available balance sheet (or opening balance sheet in the case of a start-up company) did not include any real estate (or if its value represented less than 75% of the adjusted asset value), but the company acquired property between two balance sheets, then the property value did not have to be taken into account when calculating the 75% ratio. This potentially gave rise to a situation where a company was not considered to be an entity holding Hungarian real estate in its last approved financial statements, but upon closing a share deal in the middle of the year, the company perhaps had significant real estate among its assets. If such a company was acquired by a buyer, as a general rule – under the previous legal provisions – it was not subject to paying duty on the real estate transaction.

The amendment adopted in 2021 eliminated the potential abuse arising from the above situation by effectively requiring the target company to prepare an interim balance sheet on the current value of the real estate and other assets at the time of selling the share. Based on this interim statement, it is necessary to determine whether a target company is a company holding Hungarian real estate, and thus whether the buyer is subject to the duty liability on real estate transactions if the company is acquired.

New proposal for sales revenue limit on real estate transfers

The tax law amendments to come into force at the end of 2022, with effect from 1 January 2023, include a proposed amendment now relevant for real estate sale transactions (asset deals). The proposal concerns the exemption from payment of the duty liability on real estate transactions, which exempts transfers of real estate between certain related companies from the payment of the onerous property transfer duty. According to the current legislation, the condition for the exemption is that the core activity of the buyer when the duty payment liability arises must be the rental or operation of own or rented real estate (TEÁOR 68.20) or the sale of own real estate (TEÁOR 68.10).

According to the reasoning behind the proposal submitted to the National Assembly, the fact the condition for duty exemption can be fulfilled by a simple change notification regarding the core business activity opens the system up to abuse. So while maintaining the condition on the scope of activity, the proposal also defines a new 50% sales revenue limit, which the acquirer must make a statement on to the tax authorities. In other words, the duty exemption only applies if the sales revenue of the acquirer from the preferential activities (TEÁOR 68.10 and 68.20) relating to the real estate represents at least 50% of the total sales revenue.

The proposal uses the net sales revenue of the acquirer in the previous fiscal year as the basis for determining the 50% limit. Of course, this exemption would also be available for businesses starting their activities in the given year, provided that the acquirer declares that at least 50% of its net sales revenue will be derived from the preferential activities in that fiscal year.

Amount of additional duty and penalty

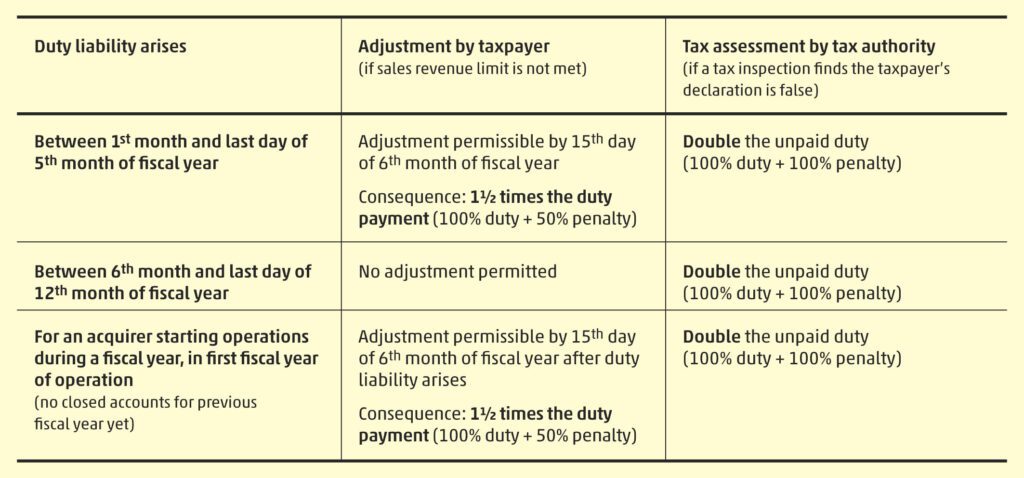

We might rightly ask what sanctions the proposal foresees if the sales revenue condition is not met for whatever reason. The following cases can be highlighted in this respect:

If this declaration or undertaking are not complied with, the acquiring party must report this to the state tax authority, which will compel the acquiring party to pay the unpaid duty plus an additional 50%. If they fail to comply with this obligation and the state tax authority finds in the course of a tax inspection that the declaration or undertaking were not complied with, the acquiring party will be charged twice the amount of the unpaid duty.

If the proposal is adopted, even given the level of the penalties, the duty liability on real estate transactions and the related financial and tax planning will be emphasised even more.

UPDATE (19 December 2022): In the meantime, the relevant bill was adopted by the Hungarian Parliament. The amendment will enter into force on 1 January 2023, as originally planned.

If you would like to entrust experienced experts with supporting your own individual transaction, please contact the tax consulting team of WTS Klient Hungary. We’re here to help.