On 29 October the Hungarian government submitted the draft 2024 autumn tax law amendments to the Parliament. By amending the tax laws the legislators are aiming, among other things, to improve the situation of families with children, continue whitening the economy and reduce administration. They also seek to meet EU harmonisation obligations. To varying extents, the 2024 autumn tax law amendments would change the main tax laws, but the changes would also affect the functioning of the Hungarian tax administration (NAV), accounting and auditing rules, and the products that can be imported in personal luggage, among other things. In this article, we summarise the key plans affecting tax rules.

Tax indexing

According to the recently submitted bill, legislators are set to introduce tax rates for several taxes as of July of the year preceding the given year, and adjusted by the consumer price index published by the Central Statistical Office.

From 2025, the excise duties on alcohol and fuel – among energy products – as well as the rates of motor vehicle tax, registration tax, and the duty payable on acquiring ownership of a vehicle or trailer would increase every year in line with inflation.

From 2026, such indexed tax increases will also apply to excise duties on heating fuels, excise duties on tobacco products, and to company car tax. These amendments will only take effect from 2026 because the HUF tax rates for 2025 will be updated in the relevant law.

Based on the proposals of the 2024 autumn tax law amendments, the Hungarian tax authority will publish the prevailing tax rates on its website by 31 October of the year preceding the fiscal year in question. For the first time, the deadline for publishing the indexed taxes concerned for the 2025 fiscal year will be 15 December 2024.

Company car tax from 2025

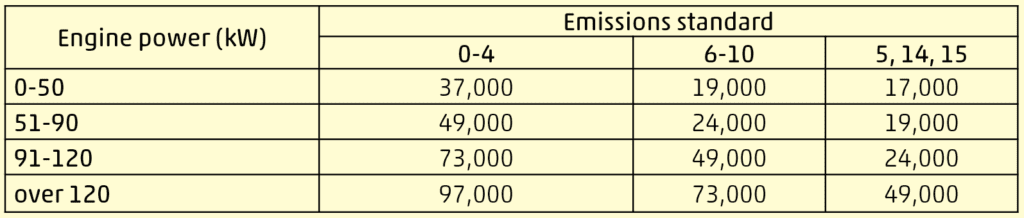

The 2024 autumn tax law amendments set the monthly rate of company car tax in Hungary from 1 January 2025 as follows in the table below (in HUF), and would introduce an indexing mechanism for these rates for the years after 2025.

5% VAT on new housing

The proposal would extend the reduced rate of 5% VAT on the sale of new residential property in certain cases for two years. This would mean that the reduced VAT rate for the sale of new residential property would continue to apply after 31 December 2024, until 31 December 2026.

Personal income tax

The 2024 autumn tax law amendments clarify the place where income is earned in terms of interest, and the time income is earned in terms of services received. However, the most important change affecting personal income tax is the increase in the rate of the family allowance. The Hungarian government intends to implement this raise in two stages, from 1 July 2025 and 1 January 2026:

- monthly HUF 100,000 for one dependent from July 2025, and HUF 133,340 from 2026,

- monthly HUF 200,000 per dependent for two dependents from July 2025, and HUF 266,660 from 2026,

- monthly HUF 330,000 per dependent for three or more dependents from July 2025, and HUF 440,000 from 2026.

Individuals engaged in the private accommodation business in Hungary may opt for flat-rate taxation on up to three properties, provided they are deemed private accommodation (not used by accommodation providers) according to the Act on Trade.

Under the submitted bill, the annual tax per room would increase to HUF 150,000 in Hungarian municipalities where the number of overnight stays spent in the second year preceding the given year exceeded 2 million (the annual tax would remain at HUF 38,400 in other municipalities). By 31 January of each year, the tax authority will publish on its website a list of the municipalities where the number of overnight stays exceeded 2 million in the second year preceding the given year according to data published by the Central Statistical Office. Under a transitional provision, this must be done for the first time by 15 January 2025.

The draft legislation classifies as other benefits the part of the holiday benefit provided in a trade union holiday resort that exceeds the minimum wage.

If the bill is adopted, the scope of the SZÉP card benefits would be extended, meaning that SZÉP card funds could also be used for home renovations in 2025.

To increase the number of visitors to zoos in Hungary, zoo admission tickets will be included among the range of tax-free benefits, up to the value of the minimum wage.

Services given by the payer through providing free or reduced-rate use of a sports facility (e.g. a fitness gym in an office building) and the sports equipment therein will also become tax-exempt.

Corporate tax

The 2024 autumn tax law amendments add to the provisions in the Hungarian Corporate Income Tax (CIT) Act concerning tax evasion. Accordingly, if a taxpayer holds an interest in a given foreign legal entity, then for payments it is essentially not permitted to apply the provisions under the CIT Act for reducing pre-tax profit and deducting expenses and costs. However, if costs and expenses are accounted for under the corporate tax rules of states that apply different laws to the same set of facts, they become deductible.

The bill includes other amendments to the Corporate and Dividend Tax Act too: certain free benefits related to spectator team sports are recognised as eligible in the corporate tax base, if the conditions of the given provision are met.

Global minimum tax

The 2024 autumn tax law amendments would expand the Global Minimum Tax Act with formulas for calculating the top-up tax surplus payable in the given country and the UTPR percentage.

When determining both the simplified tax rate and the tax exemption, the country-by-country report will be used as the basis instead of the report that previously contained the corporate tax information.

According to the bill, companies liable to pay top-up tax would already have to pay a tax advance for fiscal years beginning in 2024. The top-up tax advance would be the amount of top-up tax expected for the fiscal year, and would have to be declared and paid by the 20th day of the 11th month of the year following the last day of the fiscal year (namely, where the fiscal year is the same as the calendar year, for the first time in November 2025).

Social contribution tax

With regard to the tax allowance available for individuals entering the labour market, up to 92 days of employment within 275 days preceding the month in which the beneficiary’s employment started was taken into account under the original rules. With the adoption of the 2024 autumn tax law amendments, this timeframe will rise to 365 days. The allowance is currently available for the first two years of employment, and then at a reduced rate in the third year, but after the amendment it will only be available in full for the first year, and at a reduced rate (50%) for six months thereafter.

The bill would also amend the rules on tax allowances for vocational training in Hungary: the same employer may claim a tax allowance for the same employee for up to 12 months if they complete the vocational training at their own employer and pass a vocational training examination no later than during the second exam period after the end of the vocational training.

Act on Rules of Taxation

Under the amendment, Hungarian branches of foreign companies will be obliged to open a bank account.

A data reconciliation procedure initiated by the tax authority has been included in the draft legislation as a possible option to eliminate the risk identified in the case of measures following a risk-analysis procedure. If the NAV detects a deficiency or discrepancy in data reported by a taxpayer, it will call upon the taxpayer to clarify these within the framework of the data reconciliation procedure. Taxpayers are required to complete the data reconciliation electronically within 15 days of receiving the notice. The National Tax and Customs Administration will provide taxpayers with the data necessary for such data reconciliation, including data provided by other taxpayers.

Act on Tax Administration Rules

Under the 2024 autumn tax law amendments, in the context of a compliance investigation, the Hungarian tax authority will be able to verify whether a taxpayer has complied with its record-keeping and reporting obligations in relation to determining arm’s length prices. In addition, it may examine the document archiving obligation with regard to records too. As part of this investigation, the tax authority must establish the credibility of the data, facts and circumstances in the taxpayer’s records, and their authenticity. The timeframe for a compliance investigation increases to 60 days if the tax authority carries it out with reference to the additional work outlined above.

Decree on extra-profit taxes

The amendments repeal the paragraph in the decree on extra-profit taxes, which contains the rules on derogating from the Act on the Financial Transaction Duty and the increased rate of retail tax for retail sales of vehicle fuel.

The proposed amendment to the financial transaction duty would raise the provisions of the state-of-emergency government decree introduced during the 2024 summer tax law amendments to the level of law (e.g. ceiling for duty payment increased to HUF 20,000; additional transaction duty on payment transactions involving a conversion between certain currencies).

Amendment to the Hungarian Act on Accounting

The 2024 autumn tax law amendments will raise the thresholds for simplified annual financial statements, so a wider range of companies may benefit from this option. By contrast, consolidated financial statements are to be tied to a higher threshold. The scope of companies subject to an audit is to narrow: the amendments require an audit from a net sales revenue figure of EUR 600 million instead of the previous thresholds of EUR 300 million and 50 employees.

Detailed rules surrounding sustainability reports have also been included in the draft legislation.

Retail tax

From 1 January 2025, the 2024 autumn tax law amendments would extend the scope of taxpayers to include non-resident or resident platform operators who provide a marketplace for sellers engaged in retail activities. The taxpayer for the retail activity conducted via the platform would be the platform operator, not the retailer. Platform operators would become “quasi-vendors” for sales made via the platform. However, if a platform operator defaults on its tax liabilities and the tax debt cannot be collected from it, the retailer will be liable to pay the tax instead of the platform operator.

In this article, we endeavoured to provide a thorough summary of the key elements of the 2024 autumn tax law amendments. If you have any questions about the rule changes detailed here, please contact the tax consulting team of WTS Klient Hungary, who are always willing to help.