At the end of 2023, the Hungarian National Assembly adopted the legislation referred to in the industry as the ESG law, i.e. Act CVIII of 2023 on the rules of corporate social responsibility to promote sustainable financing and unified corporate responsibility with due consideration of environmental, societal and social aspects, and amending other related acts. Although the ESG law has been in force since 1 January 2024, its provisions will only gradually enter into force in Hungary.

What is ESG?

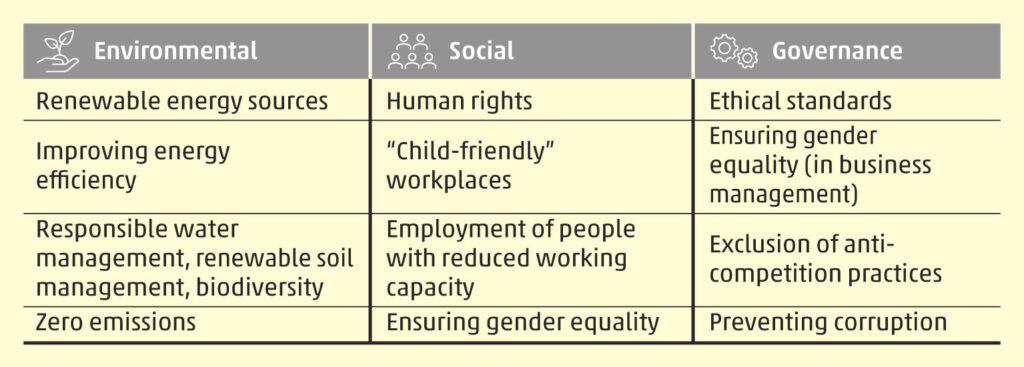

ESG refers to an acronym for environmental, social and governance. These are the three areas, the three pillars, where companies need to make their activities more transparent. They have to disclose the objectives they have set in these areas, the policies they have adopted, the related risks and opportunities, the results they have achieved, and for measurable items, the related indicators. It is important to note that while ESG reports have to be audited, they are far from being just another type of financial report. In fact, instead of a financial focus, answers need to be sought for socially relevant questions and challenges, and solutions found at the level of the company where appropriate.

Three pillars of ESG

The environmental pillar of ESG tackles and responds to complex issues such as sustainability, climate change and the transition to a circular economy.

For the social pillar, the focus should be on human rights, including the challenges posed by child labour or modern-day slavery.

For the corporate governance or governance pillar, there should be a strong focus on shareholder/owner rights, management commitment, as well as the challenges of, and responses to, anti-competitive and corrupt practices, along with any adopted measures.

The ESG pillars can have overlapping themes and mutually reinforcing effects. For example, the right of access to clean air and clean drinking water, as a fundamental social right, is difficult to ensure without the challenges identified in the environmental pillar and appropriate responses to them.

Considerations for compiling an ESG report

Who is affected by the ESG law?

Of course, the ESG law is not a single set of obligations to be fulfilled by all stakeholders in the same way. It is essential that individual businesses tailor their expectations under the ESG law to their own activities, corporate values and cultures. It is easy to see that a company in the mining industry will have to focus on different aspects of the three pillars than, for example, a software development company or an agricultural enterprise.

Preparations are well underway for the first group of companies covered by the ESG law in Hungary, and in some cases they are finished because they are already well into the first year of facing this new reporting obligation.

In practice, the phased rollout looks like this:

- for large businesses considered to be public-interest entities: 2024

- for large business entities: 2025

- and for small and medium-sized enterprises considered to be public-interest entities: 2026

is the year they first have to prepare an ESG report on their activities.

Standards still to come

On the one hand, it is important to note that in addition to preparing and auditing the ESG report, there are many other tasks and reporting obligations that companies need to prepare for. On the other hand, the ESG law is currently seen as a framework rather than a professional standard with clear requirements for compliance and deliverable data. So for the time being, businesses can therefore design their own reporting systems based on the requirements of other existing standards.

Compliance with the law will be monitored by the Supervisory Authority for Regulatory Activities, as the authority with the power to levy sanctions and fines from January 2026 to enforce compliance with the legal obligation.

While a professional consensus is emerging in some areas, in the long term it is probably inevitable that ESG information will be standardised, or that ESG reports will be compiled according to certain standards, ensuring that those reading and using the reports can easily compare data from two or more companies.

In the future, ESG considerations should increasingly become an integral part of overall corporate strategies both as a legal obligation and from an investor/company valuation perspective. Transparency and the comparability of data and results will play an increasingly important role, and this will certainly be no small challenge for companies as it is a very complex and complicated area. This is why it is worth involving an external expert in the preparation phase: feel free to contact us!