As part of the raft of measures referred to as the extra-profit tax by the Hungarian government, the rate of the company car tax is also to change from July. Although the tax package promulgated by decree will generally impact on businesses in certain sectors, the company car tax amendment means that potentially all businesses will have to monitor the changing tax burden.

Company car tax in general

Amending the company car tax does not affect the scope of taxpayers, the subject of the tax or the procedural regulations, it is only a change to the tax rate. So in this respect, there should be no big surprises for businesses in Hungary: the general provisions detailed in our earlier article are the only ones to bear in mind.

The company car tax continues to apply for passenger cars, which are

- not owned by private individuals and have a Hungarian licence plate, or

- are privately owned or have a foreign licence plate and costs are accounted on them in accordance with the Act on Accounting or the Act on Personal Income Tax.

Based on the above and further provisions in the legislation, two very important conclusions can be drawn regarding the persons liable for paying the tax. Firstly, not only businesses (economic entities) established in Hungary may be subject to the company car tax, but foreign enterprises too. Secondly, the business using the car does not have to own the car to become liable for the tax (with particular regard to rental and leasing arrangements).

Another important factor is that the obligation to pay the company car tax is also independent of where the vehicle is used. So for instance, when setting up foreign posting arrangements, companies must account for company car tax when determining the expenses incurred in connection with the posting.

What has changed?

The tax continues to be assessed monthly for every passenger car based on the engine power expressed in kilowatts and emissions standards, using the itemised tax rates set out in the legislation and the decree.

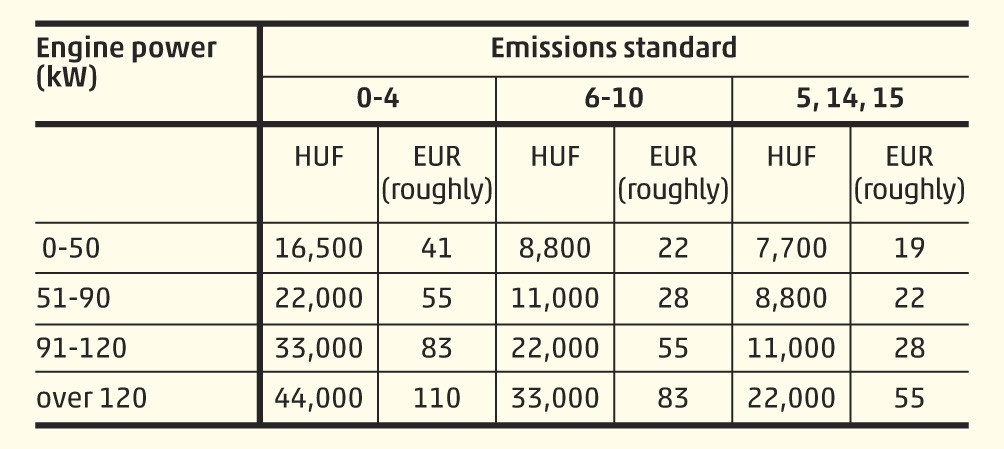

The monthly rate of the company car tax based on emissions standards and engine power until 30 June 2022:

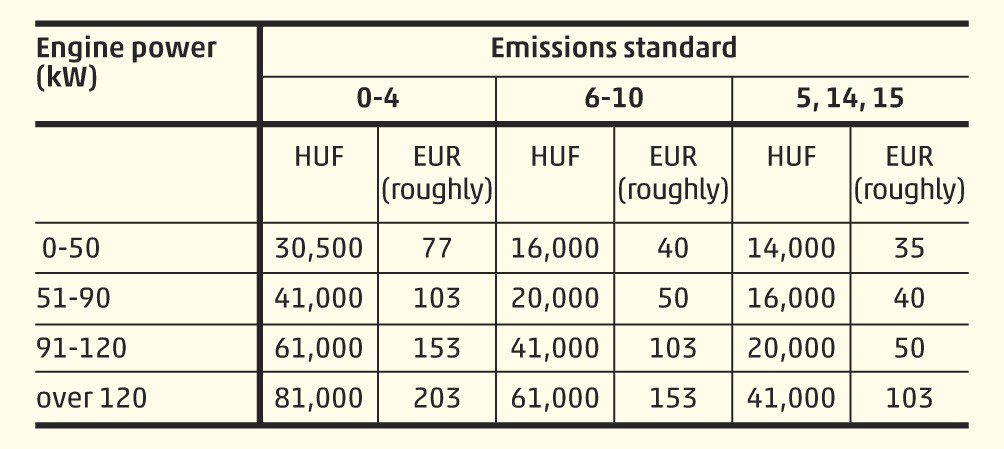

The monthly rate of the company car tax based on emissions standards and engine power from 1 July 2022:

When is the new tax rate applicable?

In line with the decree, the company car tax amendment is temporary, with the increased rates applicable between 1 July 2022 and 31 December 2022. However, it will be worth keeping an eye on law amendments from 1 January 2023, as a provision implemented on a temporary basis can be passed into law by legislation (see, for instance, the special retail tax), and the Hungarian government may also adopt other special measures to ensure the stability of the national economy during the declared state of emergency.

What are the consequences of the company car tax amendment in numbers?

Until 30 June 2022, the monthly tax rate was set within the HUF 7,700 – 44 000 (roughly EUR 20 – 111) range. In the second half of 2022, the tax rate will range from HUF 14,000 up to HUF 81,000 (roughly from EUR 35 up to EUR 204). In terms of the individual passenger car categories, this is equivalent to a tax hike of 82-86%. (In terms of amount, the monthly tax increase will be HUF 6,300 – HUF 37,000; roughly EUR 16 – 93.)

Given that the company car tax must be paid in full every month in which costs are accounted in some way on the car concerned, or the vehicle was owned by the taxpayer (which means using a daily pro rata method is not possible), companies in Hungary may incur an additional cost ranging from HUF 37,800 to HUF 222,000 (roughly from EUR 95 to EUR 559) per passenger car.

With the tax changes and the increase in energy costs, companies must take special care when planning the use of cars.

How can you avoid the increasing burden?

It is perhaps too soon to envision a future in which the participants of a client meeting all roll in on their company bicycles, in spite of the fact that legislation is trying to steer businesses in this direction too by introducing personal income tax exemption for bicycles provided by employers from 1 January 2022. In reality, taxpayers still favour car rental arrangements, which is facilitated by ensuring the right to deduct up to 50% of the value added tax on rental fees.

Not every car is subject to company car tax, however, as the tax is not applicable to environmentally friendly cars, so its amendment will not impact green-minded companies. Tax-exemption and other tax-related reliefs regarding environmentally friendly vehicles may in future act as incentives for the spread of electric cars in the business sector.

From a tax perspective, there are many circumstances that have to be considered in the context of using of passenger cars, both for company cars and for other tax purposes. Since the increasing tax burden means a higher tax risk, feel free to contact us if you have any questions on how your company is impacted by the topic. Our specialists will be happy to help you in assessing the risks.