Press release

Common errors in Hungarian personal income tax returns of foreign private individuals

The deadline (22 May) for submitting personal income tax returns is fast approaching. For certain types of income it is not always easy to decide whether it should be declared in the return, and if yes, then how. This is particularly difficult for...

Online data reporting: only 2 months to go!

It looks like the live system of online data reporting will finally be introduced in Hungary from 1 July 2018. Any further extension to the deadline seems quite unlikely, especially given that the EU has accepted the system too. Therefore the documentation...

Changes in payment services regulation in Lithuania

On 17 April 2018 the Lithuanian Parliament adopted the package of the draft laws on payment services. We summarise the major changes.

Tax law judgment on chain transactions based on new case ruling by Court of Justice of European Union

In previous articles we reported on important judgments by the Court of Justice of the European Union that may influence Hungarian tax authority practices as well. Such issues included the rulings on leasing VAT or reverse charging. In recent months the...

Poland plans changes to minimum income tax on commercial property

On 1 January 2018, the minimum income tax on commercial property was introduced in Poland. It applies at the rate of 0.035% per month to certain buildings which are worth more than PLN 10 million (roughly EUR 2,400,000) at cost. Now the Polish...

Review of HR activities and processes in Hungary based on GDPR

As previously intimated on several occasions, the General Data Protection Regulation (GDPR) of the EU shall be mandatory and directly applicable in all Member States, including Hungary, from 25 May 2018. The GDPR is to pose new challenges for companies...

Digital VAT in Belarus

Starting from 1 January 2018 foreign companies supplying digital services to individual consumers in the territory of Belarus are obliged to register with Belarusian tax authorities for payment of digital VAT in Belarus. What are digital services? ...

What does electronic communication mean from the perspective of local business tax returns?

In some previous articles we revealed that business entities will need to communicate electronically with the state in Hungary from 1 January 2018. In terms of tax affairs this electronic communication means electronic administration not just at the NAV...

Changes regarding the Romanian corporate income tax and tax on micro-company revenues

Romanian Fiscal Code was amended starting 1 January 2018 for transposing the provisions of Directive 2016/1164/EU of 12 July 2016. The new rules concerning also Romanian corporate income tax are intended to address tax evasion. The most significant...

Hungarian-Turkish social security agreement takes effect

After a long wait, the Hungarian-Turkish social security agreement took effect as of 1 April 2018. The parties agreed upon the terms of the agreement some 3 years ago, but the last notification needed for the agreement to enter into force was only received in 2018....

WTS Klient Hungary is among the nominees of European Tax Awards 2018

WTS Klient Hungary has been shortlisted this year in two categories as one of the best tax firms in the European Tax Awards, the most relevant tax contest in Europe. The winners will be revealed and the awards will be presented on 17th of May in London. WTS Klient...

Special gambling levy in Austria for international lotteries

Organizers of international lotteries and raffles need to be careful. If the Austrian public is allowed to participate, Austrian tax authorities calculate the gambling levy based on the total prize value for all countries involved. On 1 January 2011,...

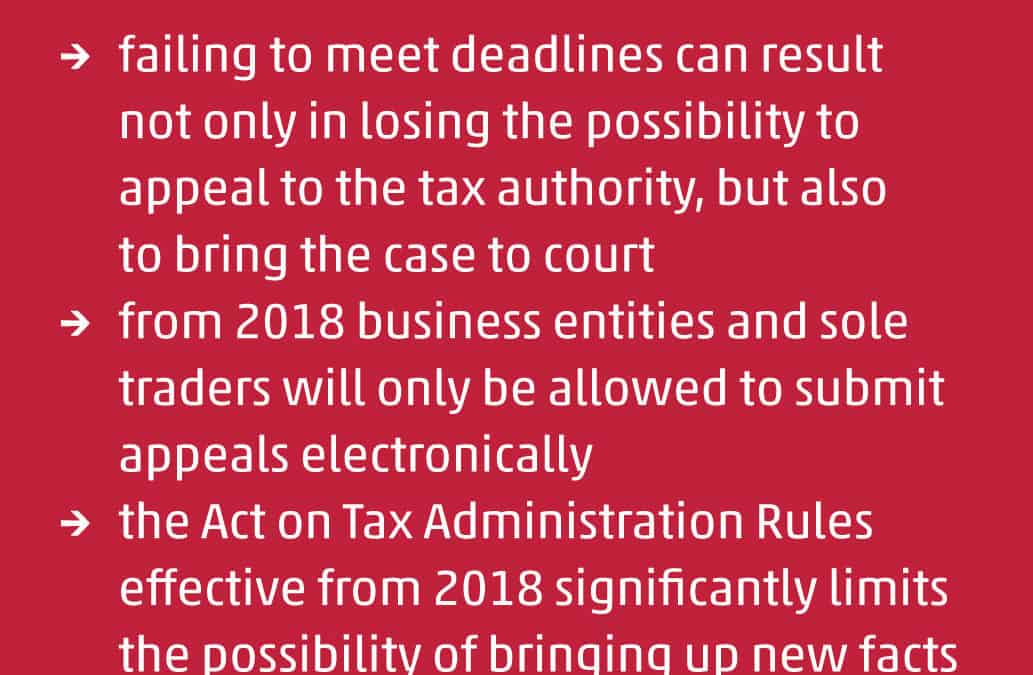

Appeals in tax cases

In an earlier article we reviewed the rules of legal remedies, including appeals in general. The Hungarian Act on Tax Administration Rules effective from 2018 reformulated the rules of appeals to some extent. I will cover this below, as well as the fact...

Specific features of Russian VAT on digital services

A non-Russian company which provides digital services to the Russian individuals is liable to pay VAT from its income as a Russian VAT taxpayer.

Reporting intention to perform a self-revision before tax inspections

As we have already discussed before, there are a number of new features in Act CL of 2017 on Rules of Taxation (hereinafter: Act on Rules of Taxation) for the year 2018. One of them is reporting the intention to perform a self-revision, which is a new...