We are accustomed to the fact that taxes are always present in our lives, and the rates are constantly changing. The percentage changes can have a major impact on us, they can prompt us to make significant changes to our business plans, boost new investments, or even motivate us to rethink the operation of a group of companies active in several countries.

Changes to corporate tax rate

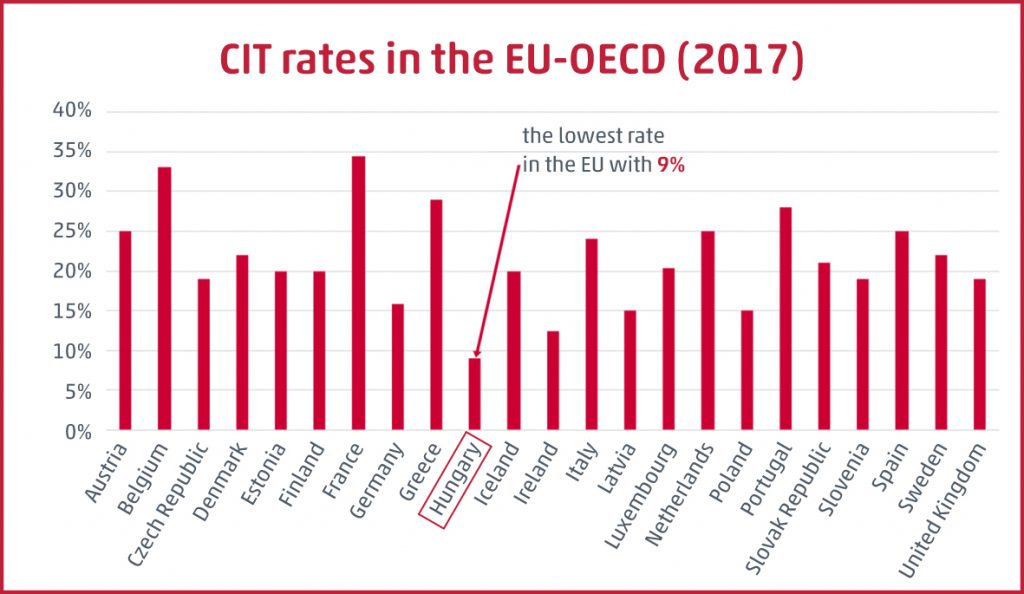

The recent trend clearly emerges if we examine corporate tax rate changes. The corporate tax rate has been steadily reduced, and from 2017 is now a one-digit number, 9% across the board. There used to be two rates, 10% and 19% (the 19% rate was applicable from a tax base of HUF 500 million or more). The trend for the VAT rate is the opposite, where we have seen a continuous increase, currently peaking at 27%.

Revised transactions

The transfer pricing model was created in response to the different corporate tax rates and tax bases. Using the following example, let us imagine how simple it would be to optimise corporate tax expenses within a group if there were no transfer pricing regulations.

Analysts of a group consisting of a Hungarian and a German company continuously monitor the profitability of the two manufacturing units and the amount of corporate tax paid by the companies. Based on the trends over a few years they “realise” that the corporate tax they pay in Germany is considerably higher, despite the fact the two companies have similar revenue and cost levels. In the meantime, the corporate tax payable in Hungary is continuously decreasing as a result of the falling tax rate. At this point, they decide to make better use of the opportunity offered by the steady decrease in the corporate tax rate in Hungary. The only question is how they can move the profit from Germany to Hungary before paying tax, whilst maintaining the profitability of the German manufacturing unit.

The group is currently rethinking its logistic processes, including supplier contracts, and the group managers think that the raw materials should be placed under the authority of the German company, which has a longer history and more extensive relationships (meaning a stronger bargaining position). The German company negotiates the purchase price of the raw materials based on the needs of the whole group, and on this basis they can expect a significant bulk discount. Then the volume required for production in Hungary is resold to the Hungarian company at a discounted price, thereby substantially reducing the material purchase costs of the Hungarian company whilst generating low revenues for the German company. The result is clear: thanks to the cheap raw material, the Hungarian company closes the year with a substantial increase in profit, while the German company generates a low profit owing to the reduced revenues. According to international transfer pricing rules, the tax planning method detailed above does not require a tax base increase in Germany as long as it is proven that by applying this pricing method the German company sold the raw materials to the Hungarian company at arm’s length.

Changing business model

We can move forward using the previous example. The management body of the company convenes and they make a decision: the tax environment Hungary has created is favourable enough to relocate 6 of the 8 main manufacturing units from Germany to Hungary. In this case, they close down the manufacturing units in the German factory and relocate them to Hungary. Tax and transfer pricing rules are very sensitive to such moves, and based on economic realities German legislation is prepared for such changes in business models. It is always worth consulting with an adviser before setting up a structure like this: German legislation has been using the term “Funktionsverlagerung” for a long time, which covers the transformation process described above. Taking into account the business potential of the relocated business units, it endeavours to use various taxation methods to impose taxes on them.