The recently published measures on taxes and contributions brought in by the government (as part of the economy protection action plan) were not yet known when this article was written. See our later published summary here on the details!

After writing this article, but before its release, the government announced its comprehensive economy protection action plan to mitigate the negative economic impact of the coronavirus pandemic. So I am not in a position to evaluate the measures affecting tax and contribution revenues in this article, but I can try to elaborate a few ideas about the tax and contribution revenues of the 2020 Hungarian budget without taking these government measures into consideration.

Tax and contribution revenues in the 2020 Hungarian budget

Perhaps nobody will be surprised when I say that the bulk of the roughly HUF 21,000 billion (roughly EUR 57.5 billion) revenue of the 2020 Hungarian budget will be comprised of taxes and social security revenues.

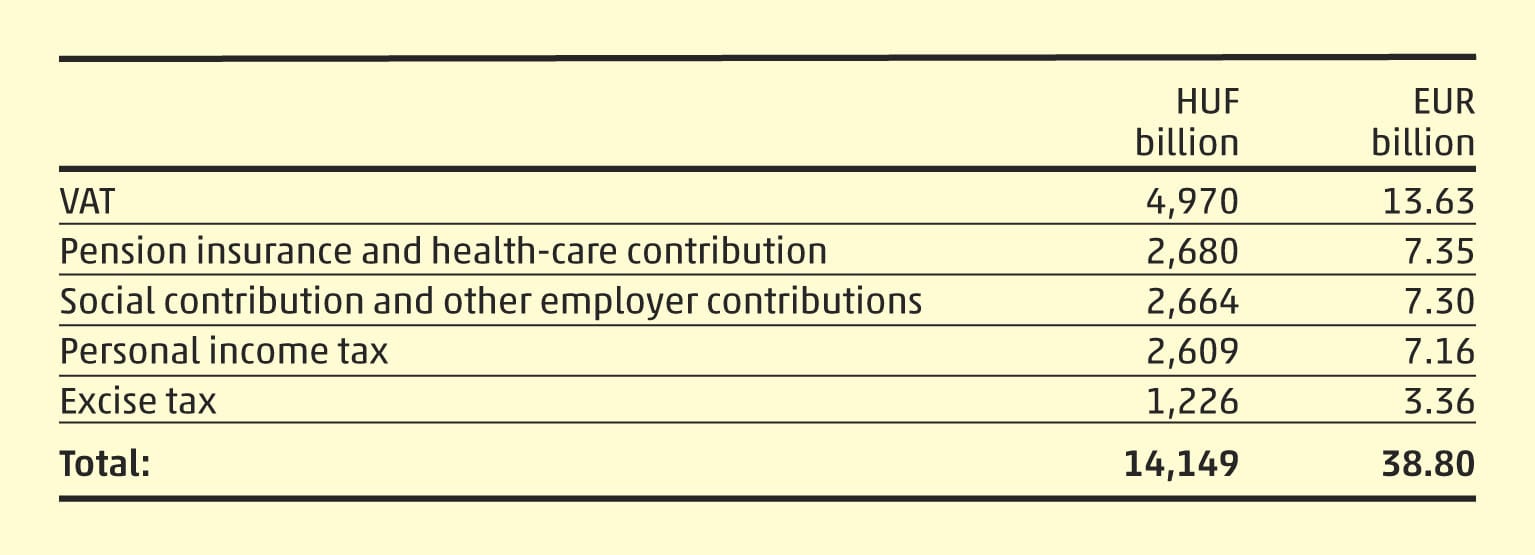

The five major revenue sources from these are the following:

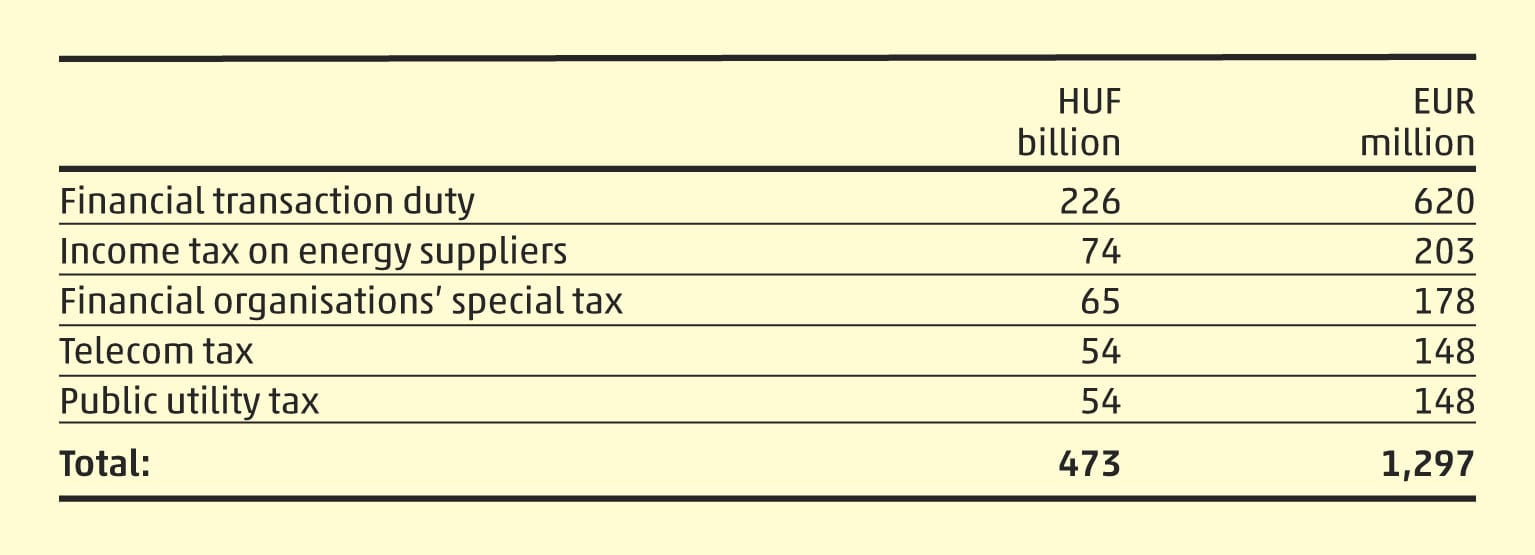

It is clear that these five items cover two-thirds of budgetary expenses. Although not new information, it is important that corporate tax amounting to HUF 501 billion (roughly EUR 1.4 billion) barely contributes to the 2020 Hungarian budget. Another noteworthy fact is that the amount of special taxes still in the system is minor too. The revenue from the five most contested special taxes is as follows:

The overall total here does not even reach that of corporate tax, a tax which is “referred to as insignificant”.

Tax and contribution revenues in the 2020 Hungarian budget under “normal” business circumstances

In several of my earlier articles I have analysed that the taxation policy of the government prioritises the collection of consumption taxes rather than the primary taxation of income. Such consumption taxes include, besides VAT and excise tax, any special sectoral taxes that still remain in the system. These taxes are easy to assess given the simplicity of the tax base and the lack of items modifying the tax base, and with cautious budgetary planning, along with solid but consistent economic growth, they generate surplus revenues for the budget every year, which provide the government with greater scope in its economic policy decisions. Although the significant growth in VAT revenue in Hungary for several years is mainly due to the effect of measures aimed at whitening the economy (online cash registers, the EKAER system and online invoicing), the increase in consumption and investment volumes that goes hand in hand with the growth of GDP figures have for years covered budgetary expenses and ensured a low budget deficit.

If the economy is growing, it is naturally likely that the revenue from income taxes, such as corporate tax and personal income tax, will increase too. The base for these taxes, however, may change significantly as a result of several factors. It is enough to think about the items that markedly reduce the corporate tax base and the generous corporate tax allowances, or the family tax relief that lowers personal income tax. Certain trends are apparent here too, but the annual taxes of a given company or private individual do not necessarily track GDP figures.

Contribution revenue can deviate from growth trends similarly to personal income tax, but mostly due to the extension of family tax relief; on the other hand, in stark contrast to the relative stability of the other tax types, based on the agreement between business entities in 2016 the social contribution tax is on a downward trajectory, so at the level of budgetary revenues it does not follow the trend of economic growth.

Impact of economic downturn on tax and contribution revenues

As an expert on taxation I am not in a place to assess to what extent the coronavirus will impact on GDP figures in 2020. Unfortunately, however, all experts agree that we can expect a significant deceleration of growth, and most likely an economic downturn. Budgetary revenues from consumption taxes will fall by at least the same rate. Naturally, there is no historical data with regard to the coronavirus, but the 2008-2009 recession showed that while consumption fell by almost the same rate as the economic downturn, albeit following a different timeline, private individuals as well as businesses postponed their own investments right at the beginning. In this area we can expect a similarly considerable downturn.

Income taxes and contributions depend on government measures to a much greater extent. While a few pieces of bad news can immediately have a dampening impact on consumption and investment, income taxes and related contributions are more dependent on actual changes of business operations, on the resulting wage reductions and in worse cases, on employee layoffs. Wise government decisions made in these fields, which share the burden across businesses, employees and the state, can greatly alleviate the downturn caused by the recession, and thus also the drop in the revenues of the 2020 Hungarian budget.

Sectoral differences

The government measures brought in so far were aimed at providing significant help for entities in sectors first affected by the coronavirus outbreak (tourism, hospitality, air travel) to be able to retain their workforces. Although the restrictions mean more and more sectors will face serious downturns, we must still try to take proportionate measures, which will include new tax and contribution reduction decisions.

We can only rely on estimates regarding the length and intensity of the crisis, and the same applies when considering the fall of tax and contribution revenues in the 2020 Hungarian budget. In these uncertain times, we will try to be helpful for you with our team who have fully transitioned to working from home. Our experts are still happy to provide assistance, giving specific advice, legal help or contacting relevant authorities as is required. Please feel free to contact us.