The amendment to Hungarian Act CXLVII of 2012 on the Fixed-Rate Tax for Low Tax Bracket Entities (Hungarian abbreviation: KATA) and the Small Business Tax, which will enter into force from 1 January 2021, will significantly increase the tax burden of low tax bracket entities.

The essence of the change is that depending on who the contracting parties are and what the value of the transaction is, a 40% tax payment liability may arise. All this may lead to an increase in the price level of transactions , but to calculate the actual price of a transaction it is worth knowing which party (the low tax bracket entity or the client) will pay the tax and when, and contracts should be modified accordingly.

Who shall pay the new tax levied on the transactions of Hungarian low tax bracket entities?

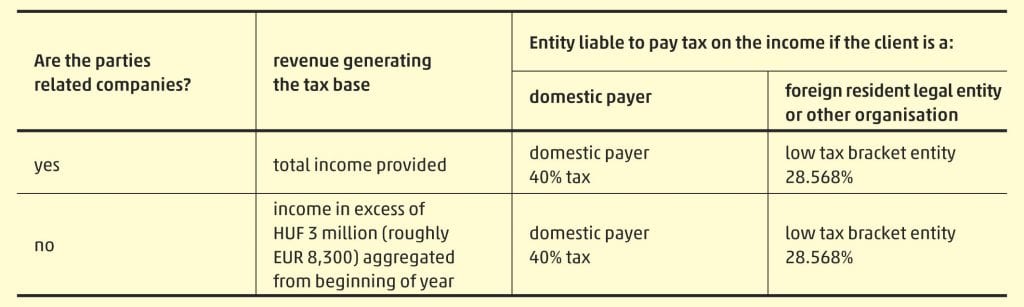

A 40% tax payment liability shall arise on each forint of transactions between low tax bracket entities and their related companies. In the case of transactions between non-related companies, the 40% tax payment liability arises on amounts exceeding income of HUF 3 million (roughly EUR 8,300) aggregated from the beginning of the year.

As to which party is obliged to pay the tax and what is the tax burden, it depends on whether the client is a payer under the Act on Rules of Taxation, or a foreign resident, other organisation. In the first case it is the clients who pay the 40% tax in question, while in the latter case, it is the low tax bracket entities.

The fact that low tax bracket entities must pay 40% tax on amounts in excess of HUF 12 million (roughly EUR 33,300) income realised in the calendar year has not changed. What is changing is that the tax base of the 40% tax payment liability arising on transactions between related companies or on transactions exceeding income of HUF 3 million should be ignored when calculating the threshold of HUF 12 million.

Clarifications in the new tax package

The Hungarian 2021 tax amendments adopted on 17 November 2020 introduce an equaliser for revenues from foreign legal entities which are related companies of a low tax bracket entity and revenues from foreign payers in excess of HUF 3 million, given that in this case the 40% tax rate will not be charged to the payer but to the low tax bracket entity: the basis of the tax is not all of the revenue exceeding HUF 3 million (or, in the case of related companies, not the total revenue), but only 71.42% thereof. It essentially means a 28.568% tax on the revenue generating the tax base.

The reason for the tax rate being exactly 28.568% is because with a 40% price hike a KATA taxpayer pays the same amount of tax as a domestic payer without the price hike. In other words – using an example as an illustration – if a low tax bracket entity invoices HUF 100 next year to a domestic payer, this will cost the domestic payer HUF 140, because the payer is subject to HUF 40 in tax. The low tax bracket entity keeps HUF 100. With a 40% price hike, the low tax bracket entity would invoice HUF 140 to a foreign company, and given the rate of 28.568% it would pay HUF 40 in tax to the NAV. In this case, the low tax bracket entity is still left with HUF 100.

Deadline for paying and filing tax return for the new 40% tax

If the low tax bracket entity is obliged to pay taxes, the new tax shall be paid on the 71.42% of the revenue generating the tax base by the 12th day of the month following the month when the taxable income was received, and the relevant tax return shall be filed by 25 February of the year following the fiscal year.

If the client is obliged to pay the taxes, it shall pay and declare the tax by the 12th day of the month following the month when the taxable income was transferred. By 31 January of the year after the reporting year, it must inform the low tax bracket entity about the amount taken into account for the 40% tax base. Additionally, low tax bracket entities and their clients shall continue to report data.

Obligation of low tax bracket entities to provide information

From 1 January 2021, a private individual can only be registered as one low tax bracket entrepreneur. If they had more than one such status, the NAV will cancel the others.

Upon concluding their contract, low tax bracket entities must inform their client in writing that they qualify as low tax bracket entities. Prior to the change and specifying the start date of such change, low tax bracket entities must also inform the client they are contracted with when the low tax bracket entity’s legal status is terminated or restarted. Low tax bracket entities must fulfil their reporting obligation regarding contracts concluded prior to 2021 by 15 January 2021.

The new 40% tax for low tax bracket entities may affect many large or medium-sized companies because of contracts with their suppliers. In the case of transactions concluded with branches or commercial representatives, it is particularly worthwhile consulting tax experts, lawyers and accounting consultants in advance. The specialists of WTS Klient Hungary are ready to assist you in all areas in reviewing the obligations related to the new 40% tax. Feel free to contact us.