Today, EU and government grants have become a driving force of the economy in Hungary. Their availability is one of the crucial conditions for numerous market players and Hungarian and foreign investors when deciding about an investment or choosing a permanent establishment. Countries and regions compete for investors, who cannot avoid considering grants when calculating the return on their investment.

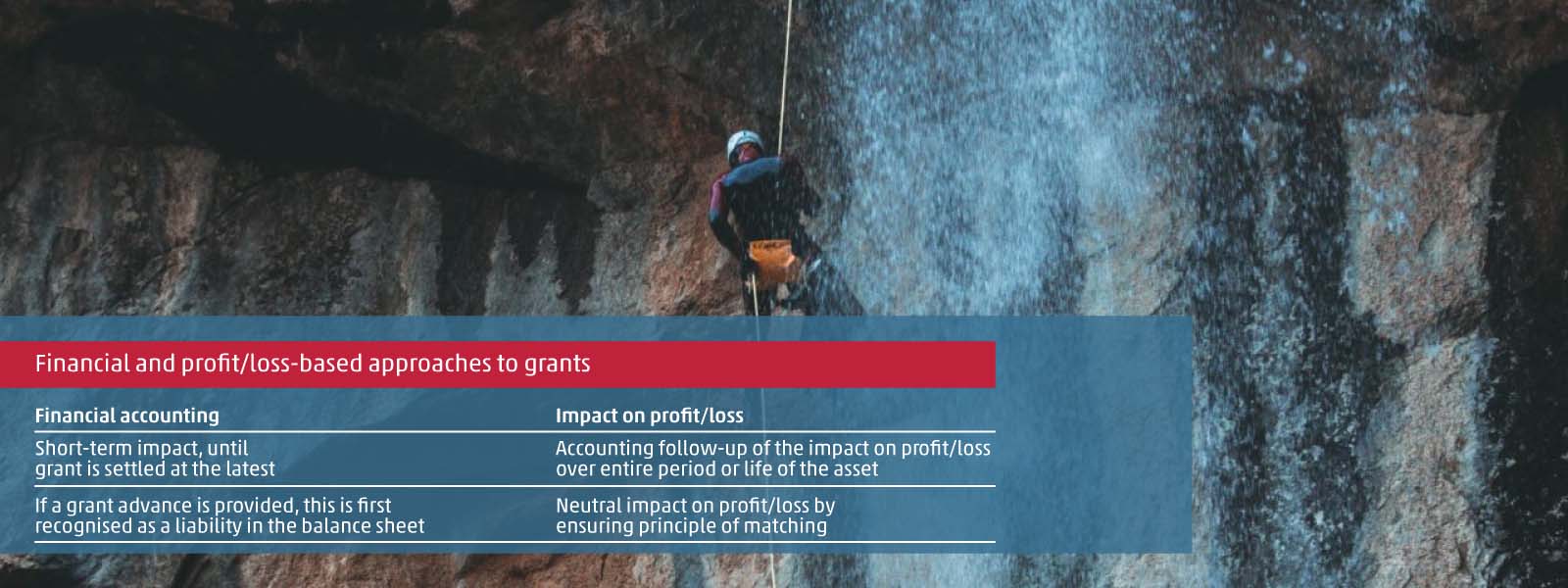

A production hall or machinery funded from grants as well as wage support are all factors contributing to future success, but at the same time, they mitigate the required financial funding for investments or costs in the present. In our article we would like to explore this duality, in other words, the difference between the financial accounting of grants and their impact on profit/loss. Moreover, thanks to a recent change in the law, from this year the two processes will be separated even more markedly in Hungary.

What motivates a company to claim grants?

The question sounds trivial, and the answer too simple. It’s nothing other than money. Any grants, whether provided for developmental goals or to cover costs, contribute to the company’s financing resources in the short term. Interestingly, the impact of grants on profit/loss typically differs, or may differ significantly, from its positive impact on the company’s cash flow.

Increase in financial resources and their impact on the balance sheet

Grants are often connected to pre-financing. In a crisis, a 100% advance on grants is common practice as a form of quick assistance. With investment subsidies, subsidies for experimental developments or support to cover wage costs, the company often receives a certain percentage of the grant in advance. Grant advances must be recognised in the company’s financial statements under liabilities until the financial report on the received funding is approved by the funding organisation. It is not unusual in Hungary to break down a funding period into milestones. In such cases, the funding is approved at every milestone, and the milestone after which the advance is deemed settled must be determined, i.e. after which milestone does the related liability cease. This means, that the pre-financing of a grant is recognised as debt in the balance sheet of the company’s annual financial statements until the final approval regarding the implemented funded investment or the settled costs is received.

What role do grants have in terms of profit and loss?

According to the accounting logic for the profit and loss accounting of grants, the funded costs must equal the grants received in a given year, so the impact on profit/loss is zero. This approach is called the matching principle in the Hungarian Act on Accounting, the point of which is that incomes and costs should relate to the period in which they are incurred for economic purposes. In reality this means that the grant income only neutralises the impact of costs that would otherwise be incurred. The prorated income released from deferred income is matched against the depreciation of the completed investment, just as the grant income is matched with the funded wage costs in the given year.

Rules for accounting grant income unified

Ensuring the principle of matching prompted changes in grant accounting in recent years. These changes are the following:

- From 2016, in the case of grants awarded to cover costs, financial settlement by the balance sheet preparation date is no longer a condition for income recognition, it is enough just to complete the settlement with the funding organisation by that date.

- From 2019, a new element also for grants awarded to cover costs is that the grant income can be accounted against accrued income if the entity can prove it will comply with the conditions set forth for receiving the funding, and it is likely that it will receive the funding.

- One change in 2022, but already effective from 2021, allows for development grants to be accounted against accrued income, provided the entity can prove that it complies with the conditions and it will likely be awarded the funding.

This essentially unifies the accounting of the two types of funding and, overall, the principle of matching can be applied in both cases.

This welcome amendment to the law will result in a complete separation of financial and profit and loss accounting. Any grant advances potentially recognised in the form of pre-financing are treated separately from any income through accruals not yet recognised.

It is important to add that the legislator sees the principle of matching only as an option, not as an obligation. In the accountant’s mind, the question immediately arises as to whether the principle of prudence is more important than the principle of matching because of the uncertainty in the realisation of income, i.e. whether the grant received should be shown together with the cost it was awarded to cover. Of course, this should always be considered in the light of the circumstances.

International comparison

The International Financial Reporting Standards (IFRS) also offer a solution to the thinking outlined above. IAS 20 — Accounting for Government Grants and Disclosure of Government Assistance provides for the possibility of reducing the cost in addition to accruing the income. This means that the funded asset does not appear in the books at its invoiced value, but at the amount less the funding. This method also results in lower depreciation costs due to the lower cost. In other words, neither the funded cost nor the related income is recognised in the income statement, so this method also ensures that the transaction is neutral on profit/loss. The impact on profit or loss is therefore the same as when the rules of the Act on Accounting are applied.

Grants are not only beneficial for a company’s profitability, but they naturally also exert a positive impact on the operation of the company in terms of its cash flow. However, while financing tends to be short term, the impact on profit/loss is felt throughout the life of the asset or the entire period during which the costs incurred. Whatever the form of funding, the financial accounting requires in-depth expertise. If you need help with this, please contact our experts.