Beside optimising taxation and accounting processes, an important condition of efficient operation and profitability at every company is evading and exposing infringements, occupational fraud and unintentional errors. As already elaborated in a previous article, business enterprises lose almost 5% of their annual revenue due to various kinds of fraudulent act committed in the course of employment. This is not insignificant, and it can also be easily reduced via fraud investigations and its various tools. In this article I will explain a rule of mathematics applied in fraud investigations concerning the frequency of the use of numbers, and it is extremely efficient in mapping accounting and other business tricks. This is Benford’s Law.

Discovering Benford’s Law

The first discoverer of Benford’s Law was the Canadian-American astrophysicist Simon Newcomb. In 1881, while thumbing through logarithm tables in the library, he found that there are more signs of wear and tear on the initial pages than near the end, which means numbers starting with a lower-value digit were definitely looked up more often than numbers starting with a higher-value digit. After some research he created a formula according to which a logarithmic distribution was evident in the occurrence of the first digits of numbers. Accordingly, numbers starting with 1 occur six times more frequently than those starting with 9. The discovery fell into obscurity until 1938, when American Frank Benford picked it up again and published the topic, but presenting it on a set of nearly 20,000 figures taken from real life. The physicist/engineer confirmed the connection with samples taken from numerous real-life fields, datasets related to population, economics, geography, chemistry etc., which then became known as Benford’s Law.

Applications of Benford’s Law

Benford’s Law works excellently on business datasets, but cannot be used, for instance, on random numbers (lottery numbers, etc.) or data with limited values (body height). One key area of application in business is fraud investigations. The US tax authority has been using this method to identify suspect cases since the 1980s. The figures of business entities based on real activities are likely to display Benford’s distribution, but randomly made-up, artificially generated data does not. If a business dataset does not comply with Benford’s distribution, it does not automatically mean that there is a fraud or error, but it is a great indicator of what is worth investigating in more detail.

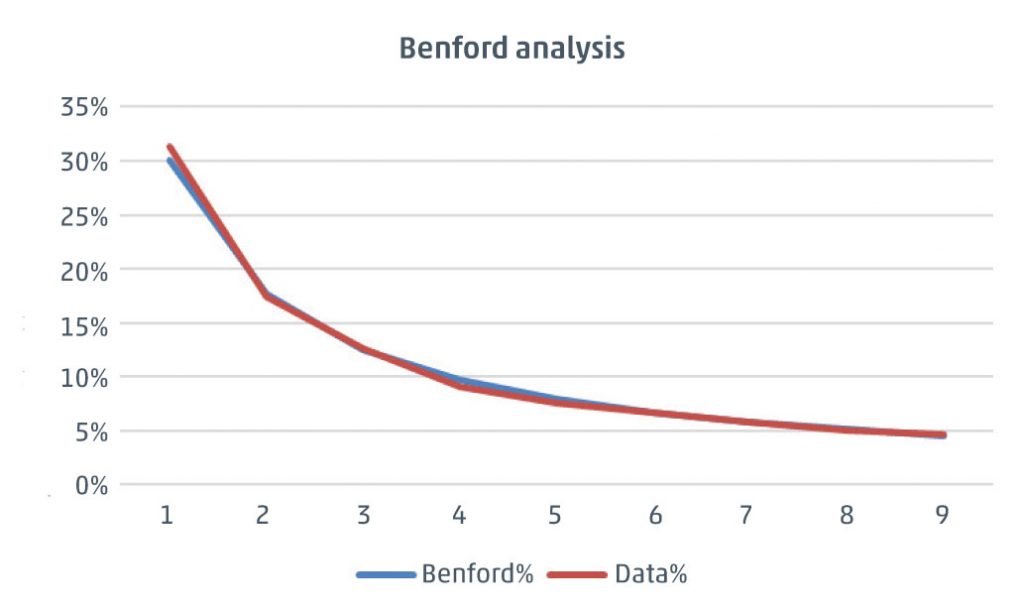

At first, Benford’s Law may seem contrary to our feelings, so I suggest you try it on your own datasets, if possible. For example, if you have at least a thousand invoices with total amounts, the analysis can be carried out in an Excel spreadsheet within seconds. To help you, you can download a sample spreadsheet from here, which contains the real dataset of a company account including 33,000 items (the table can be used freely, only the first column needs to be populated with your own dataset). By visualising the results in a graph, you can see that the examined data almost completely corresponds to the values forecast by Benford’s Law.

If you are curious how much your dataset “approximates” Benford’s distribution, you have to move beyond graphic visualisation to statistical methodologies. There are several tests which examine correspondence with Benford’s Law, the most frequently used of which are the z-test, the Chi-squared test, the mean absolute deviation (MAD) test and the summary test. These tests enable you to decide precisely how much a dataset matches expectations, yet a detailed description of them is beyond the scope of this article.

Benford’s Law can be applied in diverse ways and in various places. You can read, for instance, about the analysis of election results or the testing of the data related to the coronavirus pandemic. It is a method that can be used in numerous areas where datasets with great numbers of data are available, to examine if the data has been manipulated or was indeed generated by real-life events.

Discovering and preventing business fraud is a key interest of all business entities. The WTS Klient Business Automation division is here to help should your accounting or any other areas of your business operation need review.