When setting up a business in Hungary, there are a number of issues that need to be clarified and then decided upon. In an earlier article we explored the obligations of start-ups, and now we take a closer look at the issue of selecting a currency.

Choosing exchange rates

If businesses have their assets and liabilities in a currency other than their bookkeeping currency, these must be translated into the currency of their choice at a fixed exchange rate, which then enables them to be recognised in the books. To this end they can choose the average of the buying and selling rates of a credit institution chosen by the company, or apply the official foreign exchange rate published by the National Bank of Hungary or the European Central Bank.

Eligible currencies

When setting up a business in Hungary, it is easy to think automatically of the Hungarian forint to keep your books in and fulfil your reporting obligations. But it is worthwhile considering whether this really is the best option for your company. Of course, you can choose to use the Hungarian forint. However, if it is deemed a more optimal solution, there is nothing stopping you choosing the euro or US dollar. This can happen, for example, if the parent company’s accounts or most of the invoices received from partners are in a particular currency. In any case, selecting a currency requires careful consideration, as the next time it can be changed is for the third financial year following the decision, and the accounting policies and articles of association must be amended accordingly too. Although this change used to be only possible for the fifth financial year at the earliest, and has now been reduced to three years, it still means a lengthy period.

You can also decide to choose a different currency from the euro or the US dollar, but this is subject to conditions. This is possible if the currency of the company’s primary business environment is not one of the above-mentioned currencies, and more than 25% of its income, costs and expenses, financial assets and liabilities are denominated in that currency.

In terms of selecting a currency it is also important to note that, as of 2019, the Hungarian Act on Accounting requires that the currency used for reporting and accounting must be the same as the currency recorded in the articles of association. Among other things, this means that the registered capital cannot be recorded in a currency other than the currency you later want to keep your books in.

Importance of selecting a currency

Essentially, choosing the right currency is not significant because of how you can review your accounting records, although this may be taken into account in the case of reporting in a different currency. What is much more important is the effect of realised and unrealised exchange rate differences arising from transactions in other currencies. The incessant and unpredictable movement of exchange rates constantly affects the results of a company. So if you know that the large and significant transactions of the company will mainly be in a particular currency, when selecting a currency you should aim to avoid any problems with this.

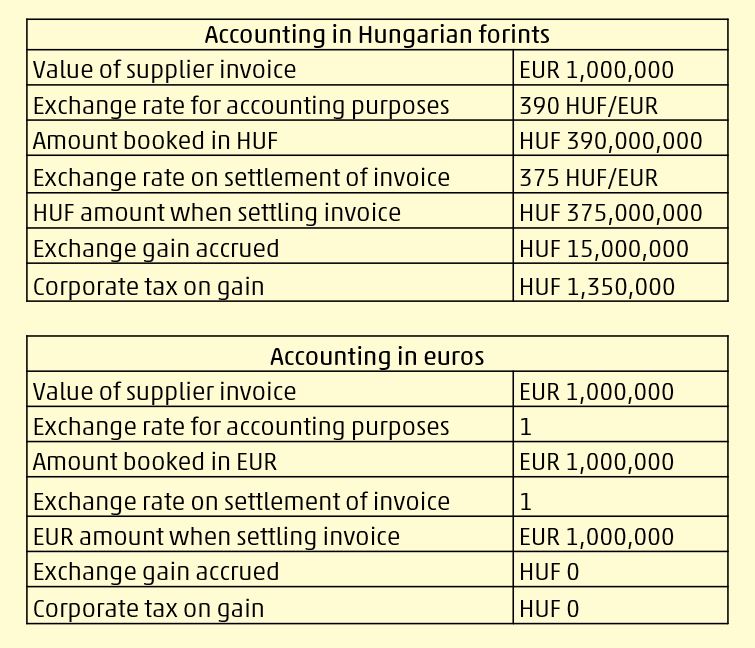

Let’s look at what this might mean in concrete terms:

In the case of accounting in Hungarian forints, income is booked based on the difference between the exchange rate when the invoice is recorded and the exchange rate when it is settled, which is included in the corporate tax base at the end of the year, thus increasing your tax liability. By contrast, in the case of euro accounting, no exchange rate difference had to be accounted for, so this has no impact on your result.

Of course, it is also possible for an exchange loss to arise upon settlement of the invoice, which reduces profit and hence the tax liability as an expense on financial transactions.

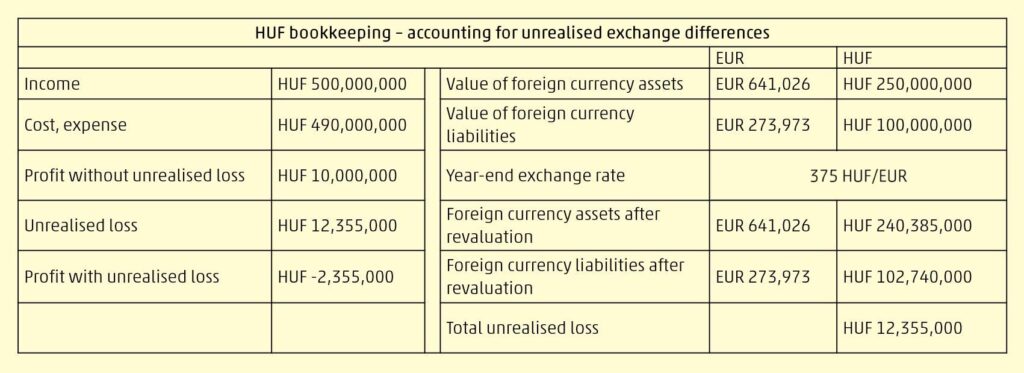

It is also worth noting the impact of the mandatory year-end revaluations, where all foreign currency items must be recorded in forints using the chosen exchange rate as of the reporting date of the financial year.

Our example shows how much of an impact gains from exchange rate differences can have on your company, as they can significantly increase your tax liability, but also, exchange differences can even turn your profit into a loss. This impact can be reduced by making the best choice for your company when selecting a currency.

Changing currency

If there is a change in the company’s operations, or if it becomes clear in the meantime that the chosen currency is not the most optimal, it is possible to switch currency. We covered this in detail in an earlier publication.

Since selecting a currency and switching currencies are complex processes comprising accounting, tax, legal and IT challenges, it is advisable to do your research and ask for help as to what really is the best solution for your company. Do not hesitate to contact our financial and accounting advisers, they will be happy to help.