In one of our previous articles we presented the theory behind and the significance of one of the most important changes in the Act on Accounting this year, the introduction of deferred tax in Hungary, and what exactly a deferred tax asset or deferred tax liability is.

The amendment is already applicable for the year 2023, so if you want to reflect your company’s future corporate tax position in your books and financial statements, you can already do so. In addition to the article we published a few days ago as a “quick help”, with this detailed guide we want to provide you with a practical guide with examples and useful information.

For such companies, the profit after tax is calculated from the profit before tax, tax payable and the reporting-year change in the deferred tax difference.

What does all this mean in practice?

This article focuses only on the differences between balance sheet figures under the Hungarian Act on Accounting and the carrying amounts (tax values) under the Corporate Tax Act, as well as on the resulting future tax effects. International practice may differ from this. In financial statements prepared under IFRS or some other national reporting framework, the tax effects should be explored based on the differences between Hungarian corporate tax rules and the international/group accounting rules.

It is important to stress that in Hungary, deferred tax is only relevant for corporate tax, since only this tax has a carry-over effect through items adjusting the tax base. The purpose of applying deferred tax is to determine the company’s actual tax expense, i.e. to account for future tax effects in addition to the tax in the reporting period, as this may differ from the tax liability. This is based on distinguishing between the following three key concepts:

- Reporting-year tax: amount of tax payable calculated based on the pre-tax profit for the given period, in accordance with the provisions of the tax legislation

- Deferred tax asset: amount of income tax deductible in the future and reclaimable if certain conditions are met

- Deferred tax liability: amount of income tax payable in the future based on taxable temporary differences

Initial steps

It is important that the decision to present deferred tax should be recorded in writing in the company’s accounting policies. There are 90 days to do this.

The deferred tax system essentially comprises an assessment of the deferred tax effect of the current cumulative tax base adjustment items of assets and liabilities on the balance sheet. If an adjustment has no future tax impact, then the deferred tax effect does not need to be addressed. Only temporary differences reversing in the future have a deferred tax effect, where such may be a deferred tax asset or a deferred tax liability.

The first step in determining the deferred tax for a given financial year is to calculate the opening deferred tax asset / tax liability. This involves looking at previous years and identifying temporary differences – that will reverse in the future – between the carrying amounts of assets and liabilities in the balance sheet and their tax values. The value calculated using the effective tax rate will be the deferred tax asset or liability for the temporary differences.

Most common temporary differences:

- Depreciation difference stemming from differences between accounting and corporate tax law

- Impairment of receivables

- Provisions

- Development reserve

- Loss carry forwards

Differences that do not reverse in the future increase the tax base in the year in which they arise. These are permanent differences (e.g. fines, dividends received), which only appear in the reporting-period tax and have no deferred tax effect.

Tax assets and tax liabilities from previous years, determined based on the practice described below, are presented on a net, consolidated basis. This opening deferred tax must be recognised by the company against Retained earnings. Since the deferred tax asset or liability is deemed non-current, the retained earnings will increase or decrease against the Deferred tax asset recognised under Fixed assets or the Deferred tax liability recognised under Long-term liabilities.

Determining deferred tax asset and tax liability for given year

Once the opening figure has been determined and entered in the accounts, the next step is to determine the deferred tax for the financial year in question. One way of doing this is to explore the differences between the accounting balance sheet and the tax balance sheet. This method involves comparing the carrying amounts and tax values of individual assets and liabilities to calculate the amount of deferred tax.

The cumulative difference between the carrying amounts and tax values identified during the financial year, calculated using the expected income tax rate (effective tax rate) is the deferred tax asset or deferred tax liability, which is also accounted for on a consolidated and net basis. In doing so, the opening values of the previous year must be taken into account, since the deferred tax difference for the given year stems from the change in the opening deferred tax asset or liability. Hence, depending on whether positive or negative, the following accounting entries are possible:

Before booking year-end deferred tax differences in the form of expenses or income, you always have to check the opening figures. If the deferred tax asset or deferred tax liability from the previous year increases, you simply book the increase for the reporting year. However, if a deferred tax liability arises in the given financial year after a previous deferred tax asset, or vice versa, firstly the opening deferred tax asset or liability is reversed against the deferred tax difference, and then the deferred tax for the given year is recognised again. As an example, if a deferred tax liability arises in the given financial year following a deferred tax asset from the previous year, the following accounting treatment is required:

If the carrying amount of the assets is lower than the tax value, then there is a deferred tax asset. If it is higher, a deferred tax liability arises. The reverse is true for liabilities. If the carrying amount of the liabilities is higher than the tax value, then there is a deferred tax asset. If it is lower, a deferred tax liability arises. The figure below illustrates the system well:

Below we use some examples to demonstrate how the deferred tax asset or liability evolves for the five most common temporary differences mentioned above.

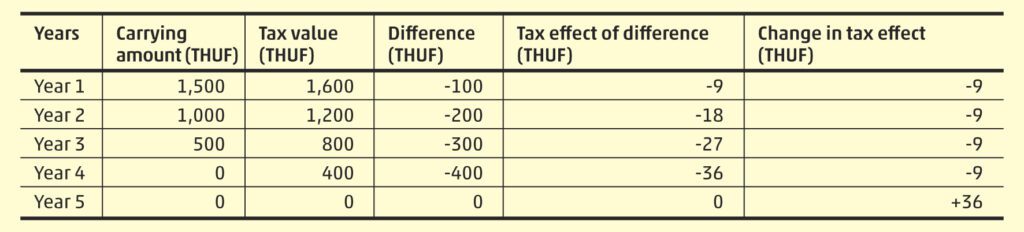

Example 1: Depreciation difference stemming from differences between accounting and corporate tax law

A company acquires a tangible asset with a cost of HUF 2,000,000.

Useful life according to Act on Accounting: 4 years (depreciation HUF 500,000 per year).

Depreciation rate under Act on Corporate Tax: 20% (annual depreciation of HUF 400,000).

Tax rate: 9%

This asset is depreciated on an accelerated basis. In accounting, you book depreciation of HUF 100,000 more per year in years 1-4, but the tax law treats this differently, so the tax base has to be increased. However, the resulting tax surplus is temporary over the useful life of the asset, because the costs recognised in accounting are recognised by the corporate tax law, just not allocated equally between the years. Deferred tax is designed to smooth out this difference.

While the reporting-year tax only reflects the tax effect of the above asset in that year, deferred tax compensates for and offsets changes in the reporting-year tax expense, taking the future effects into account. The deferred tax asset that arises is designed to offset the tax surplus for years 1-4.

In the last year, the difference between the carrying amount and the tax value disappears, as both the carrying amount and the tax value are then zero, so no deferred tax position can be recorded. Consequently, the deferred tax on this asset must be reversed.

The reverse of the above also logically applies with slower depreciation, when in each year (1-4) the accounting depreciation is lower than the depreciation under tax law. In this case, a deferred tax liability arises in years 1-4, which also must be eliminated in year 5.

For assets, however, not only the different depreciation rates but also the residual value can cause differences. This is because while the Hungarian Act on Accounting gives the company the possibility to determine a residual value, the Hungarian Act on Corporate Tax does not, so this also has a deferred tax effect.

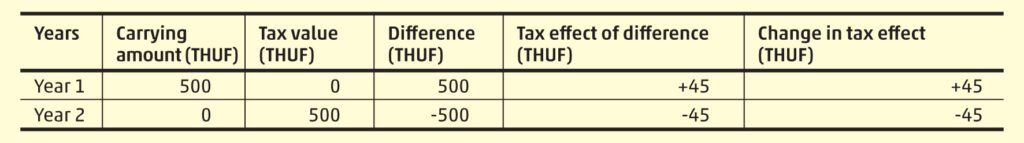

Example 2: Impairment of receivables

A company recognises an impairment loss of HUF 500,000 in respect of its trade receivables in the reporting period. In the following year the receivables are collected, so the impairment is reversed. Tax rate: 9%.

Hungarian corporate tax law does not recognise the impairment of trade receivables that are not considered uncollectible, so the amount recognised in the accounts increases the corporate tax base. Yet this is not a permanent tax liability, since when the impairment is reversed or the trade receivable is written off as uncollectible, this amount becomes deductible from the tax base and the deferred tax asset is eliminated.

It’s important to emphasise that, regardless of the fact the tax effect reverses within one year in this case, a long-term deferred tax asset is created when it arises.

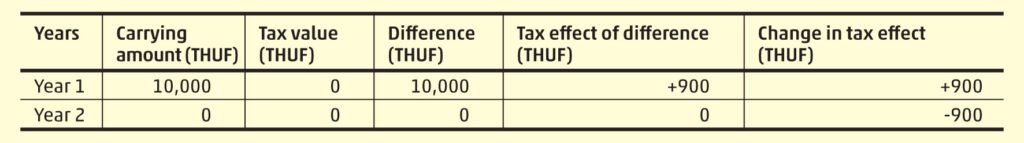

Example 3: Provisions

A company allocates a provision of HUF 10,000,000 in the reporting year for expected future liabilities. In the following year this liability arises and the provision is reversed. Tax rate: 9%.

In this instance we examine the difference between the carrying amount of the provision, as a liability, and its tax value.

The tax law does not recognise the expense from the provisioning, so it increases the tax base, while the income in the year of release will decrease the tax base. These impacts are offset by the deferred tax. A deferred tax asset arises in the year the provision is recorded, and when utilised this deferred tax position is eliminated, in effect releasing the deferred tax asset of the previous year.

Example 4: Development reserve

A company created a development reserve of HUF 12,000,000 in 2023, which was used on 1 January 2024 to acquire a tangible asset. Useful life of asset: 3 years (annual depreciation HUF 4,000,000). Tax rate: 9%.

The company pays less corporate tax in 2023 since the allocated development reserve is a deductible for tax purposes. This tax has to be settled later, but for now you are only deferring the tax liability, as the tax depreciation of the purchased asset will not be deductible from the tax base in later years. The tax depreciation of the asset is considered accounted for, so its tax value from the moment of acquisition is HUF 0.

Example 5: Loss carry forwards

A company turns a profit in two consecutive financial years after making a loss in its first year. The loss incurred in the first year (negative tax base of HUF 15,000,000) is used to adjust or reduce the tax base in the profitable years (by HUF 6,000,000 and then by HUF 9,000,000), according to the conditions laid down by the legislation. Tax rate: 9%.

A társaság tehát a veszteséges működéséből származó halasztott adókövetelését felhasználja a következő években.

Az elhatárolt veszteség esetében a jövőbeli felhasználhatóság egyben feltétele is annak, hogy a beszámolóban halasztott adókövetelés legyen kimutatható. Ez olyan mértékben lehetséges, amennyiben valószínű, hogy elegendő jövőbeli adóköteles nyereség fog rendelkezésre áll a társaságnál.

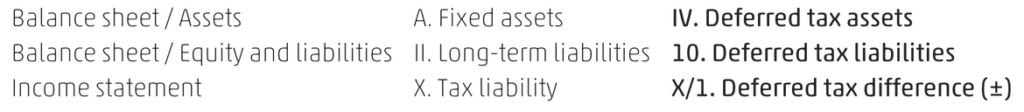

Deferred tax asset and liability in financial statements

Carrying amounts of a deferred tax asset and deferred tax liability: the amount of the calculated deferred tax asset that is expected to be recovered in the subsequent financial year(s). For a deferred tax liability, the carrying amount is the same as the calculated deferred tax liability.

In terms of presentation in the financial statements, it is important to note that both the balance sheet and income statement structures under the Act on Accounting have been expanded with the following rows:

An amendment affecting equity has also been introduced into the Act on Accounting on account of the deferred tax. Accordingly, the carrying amount of the deferred tax asset must be transferred from retained earnings to the allocated reserve, so the deferred tax asset caps the dividend payment.

Furthermore, any changes in deferred tax assets and liabilities must be broken down by title in the supplementary notes.

Should you have any questions on this topic, or need expert help in understanding how deferred tax can be applied, calculated and managed at your company, please do not hesitate to contact the accounting advisers at WTS Klient Hungary.