Companies that adopt the calendar year for their financial year – i.e. most companies – have until 31 May 2022 to publish their financial statements for the previous year. The same date is also the deadline for submitting corporate tax returns for the 2021 financial year.

Corporate tax allocations are an important part of corporate tax returns

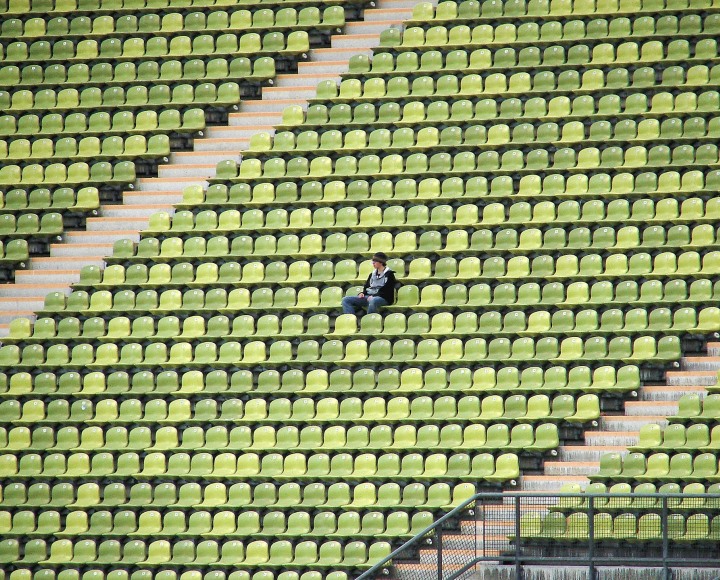

As we have reported several times already (most recently in this article), when filing corporate tax returns and calculating the final tax liability for the previous year, companies have the option to support some form of spectator team sport with up to 80% of their corporate tax. Spectator team sports include football, handball, basketball, water polo, ice hockey and volleyball.

Many companies use their tax advances during the year for their corporate tax allocation. In such case, the sum of the actual tax to be paid simultaneously with the filing of the corporate income tax return and tax advances already paid cannot exceed 80% of the final corporate income tax liability.

Corporate tax returns to be submitted by 31 May also include information on the frequency and amount of corporate tax advances that companies will be liable to pay from July 2022 to June 2023. With knowledge of these advance payments, companies can subsequently decide on a separate form whom to allocate up to 80% of the monthly or quarterly corporate tax advance to.

Tax credit: 7.5% or 2.5%?

In addition to supporting a noble cause and promoting the next generation of sportsmen and women for example, businesses also receive a tax credit for their tax allocations. This amount is credited to your tax current account once a year, in July, and can be used against future tax liabilities. The amount of the credit is 7.5% of the donated amount if the allocation was made from a tax advance, and 2.5% if the allocation was made from the tax payable at the end of the year.

If you have not yet made use of the option to allocate part of your tax advance in 2021, you should definitely donate up to 80% of your 2021 corporate tax now, before the 31 May deadline for filing corporate tax returns, as this is the only way to benefit from the 2.5% tax advantage for 2021. However, for monthly or quarterly corporate tax advances payable in 2022, it is worth starting with the allocations now as the tax credit available this way will be exactly three times the size of the tax advantage of the amount pledged after the year-end.

If you are thinking about making a tax allocation before the filing deadline for corporate tax returns, or at any time during the year, we are happy to help you calculate the tax advantage, complete the form, or even find an appropriate spectator team sport to support. Please do not hesitate to contact the tax advisers at WTS Klient Hungary.