Press release

Changes in the Serbian Corporate Income Tax law related to transfer pricing

serbia taxAccording to the latest TP-related changes in the Serbian Corporate Income Tax law, the taxpayer is not obliged to assess the price according to the “arm’s length” principle in the case of the sale of fixed assets to a related party.

Tamás Gyányi among tax experts of International Tax Review

Tamás Gyányi, partner of WTS Klient Hungary, is included as a leading expert on indirect taxes in the special edition of the International Tax Review.

Business valuations based on future incomes: income-based methods

To start our new series we looked at events which can initiate a business valuation and the methods available to value a company. In this article we would like to outline the main points of income-based methods. We will also mention aspects supporting the...

Clarification of the Master and Local File in Austria

On 4 December 2017, the Austrian Finance Ministry published information on the Transfer Pricing Documentation Act, including specifications of the Master and Local File in Austria.

Changes in accounting rules from 2019

The draft bills proposed to the Hungarian National Assembly under No. T/625, primarily on taxation, also include changes to accounting rules. Among these changes in accounting rules we would like to draw your attention to the proposals expected from 2019...

Online data reporting for invoicing

Online data reporting for invoicing was launched in Hungary on 2 July, though we may still see some technical problems in the course of the reporting. WTS Klient Hungary believes it would be useful if the penalty grace period of 1 month, i.e. until 31 July, were...

Changes to the Estonian Income Tax Act

By 1 January 2019 several important changes to the Estonian Income Tax Act are to be expected. Although the exact wording of the new law is not yet agreed, we can provide some insight into the draft law published in April this year. In April 2018, the...

Artificial intelligence in taxation

What is the potential impact of artificial intelligence on taxation, and how can we use it in tax consulting? We seek answers to these in our article.

Introducing master and local file in the TP documentation in Latvia as of 2018

In autumn 2017 Latvian government started working on amendments in the Latvian Taxes and Duties Act with the aim of introducing the recommendations with respect to TP documentation in Latvia stemming from the BEPS project outcomes. Currently the draft law...

Proposals to revise tax regime in Hungary

The Hungarian Government submitted the 2019 state budget to the National Assembly in the middle of June. Obviously, a tax consultant is primarily interested in the changes to the tax regime. Since investors mainly want predictability when it comes to the...

Consignment stock or customs warehouse in Serbia

Serbian legislation does not provide for consignment stock; a suggested replacement for consignment stock would be a customs warehouse. In our article we present two possibilities: goods withdrawn from a customs warehouse by a customer and by a...

Tax amendments in 2019

The Hungarian Government presented its new tax package and a draft law on the social contribution tax on 19 June 2018. According to the general reasoning, one of the major underlying drivers behind the changes is to ensure legal harmonisation and reduce administrative...

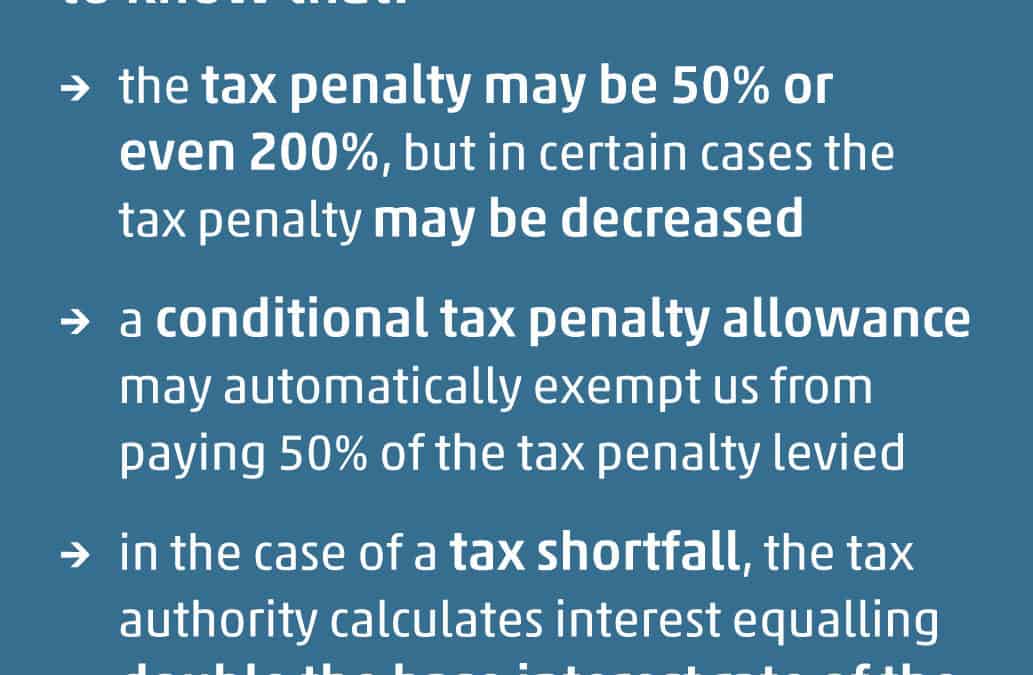

Sanctions of the new Hungarian Act on Rules of Taxation I – Tax penalty and late payment interest

In several of our previous articles (e.g. here and here) we have discussed the provisions of the new Hungarian Act on Rules of Taxation and the Act on Tax Administration Rules, which came into force from 2018. In the first article of our current two-part...

Registration of a legal entity in Russia in 5 steps

Anyone going to do business in Russia or managing to establish a Russian subsidiary in the form of a limited liability company (LLC) is surely interested in the details of registering a legal entity in Russia. In this article we will give you a useful...

Transfer tax exemption in property sales in Hungary

Our phones were rather busy at our Hungarian office prior to Christmas in 2009. Everybody wanted to sell their shares in companies owning real estate, since at that time, if you acquired properties this way, the party acquiring the share was granted...