by WTS CEE | Nov 24, 2022 | CEE, WTS hírek

At the end of August 2022, an amendment to the VAT Act of...

by Anita Marinov | Jul 26, 2022 | eng news, WTS hírek

Reducing the corporate tax base by allocating a...

by WTS Klient | Jun 26, 2018 | eng news, WTS hírek

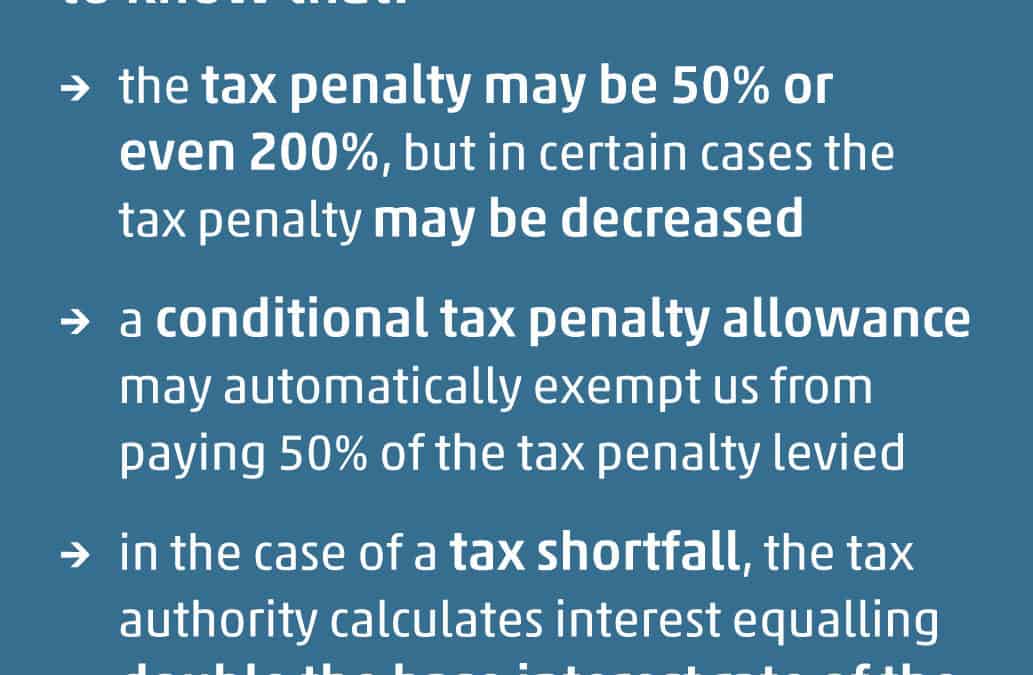

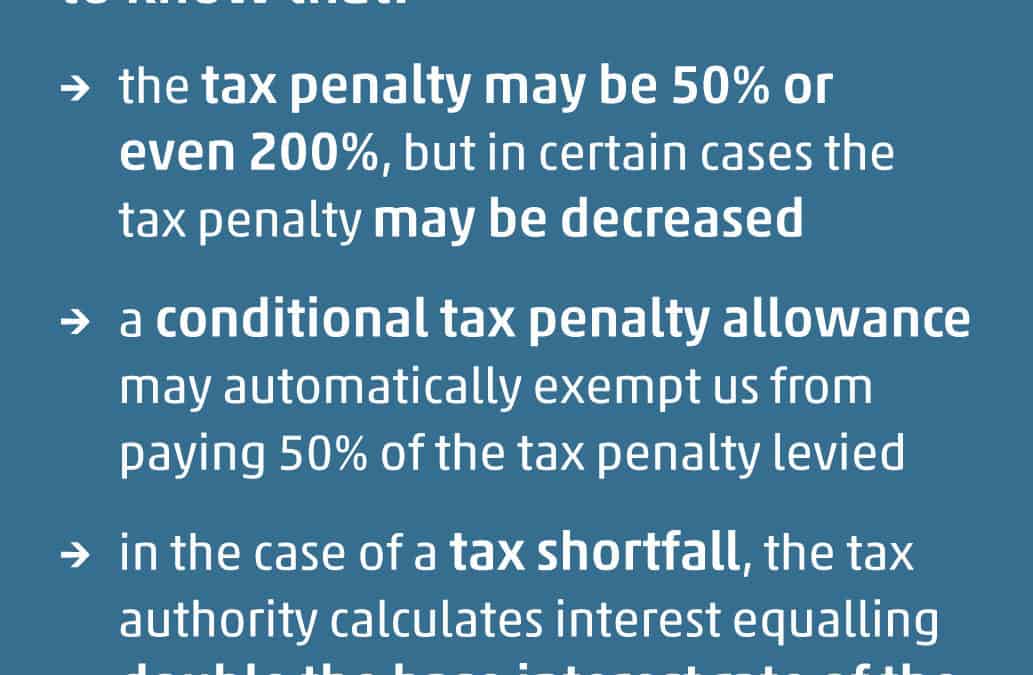

In several of our previous articles (e.g. here and here)...

by Tamás Gyányi | Aug 10, 2017 | eng news, főoldal angol, német hírek, WTS hírek

The Ministry for National Economy published the draft of...