In Hungary we are already used to the fact that every year the annual closing creates new tasks for decision-makers and economic experts at businesses. In an optimal scenario, the company management prepares for the annual closing together with accounting and tax colleagues. Why would this be any different this year?

Obligation to top up tax advances now partly optional, and decisions required in other matters too

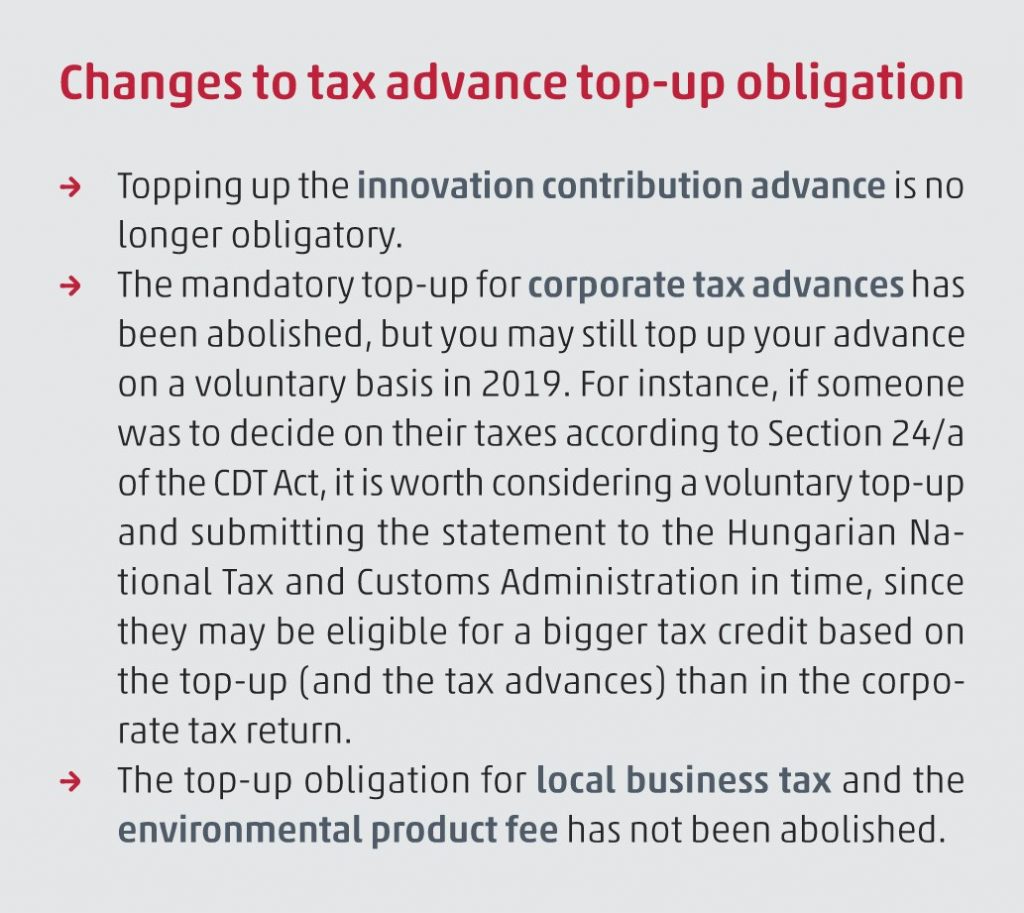

In previous years, the top-up deadline of 20 December forced business entities to reach the most optimal decisions for themselves during the reporting year, as part of their preparations for the annual closing.

This year the compulsory top-up system for tax has partly been abolished, which does not mean, however, that the usual calculations are (partly or fully) obsolete, or that making many business decisions before the annual closing has become unnecessary.

Aspects relating to exchange rate losses and gains worth taking into account before the annual closing

Aspects relating to exchange rate losses and gains worth taking into account before the annual closing

Having followed the exchange rate trends of recent times, what responsible leader would not consider the impact of exchange rate losses on their year-end result, on dividend payments, or even on planned loans, leasing arrangements, tenders, etc.? For example, generating a loss can be an obstacle to requesting a tax refund on excise tax. On the other hand, a significant exchange rate gain (followed by a loss in the following year) may not necessarily be a cause for great joy either.

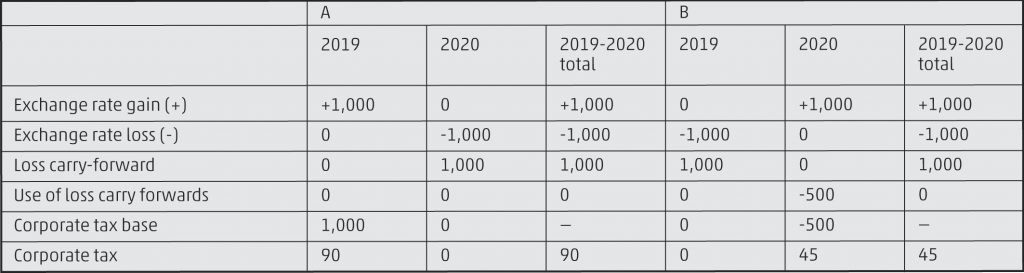

Let us take a simple example, in which we only consider the impact of exchange rate losses and gains. In both A and B in the example below it is true that the pre-tax result in the previous two years was zero, i.e. the exchange rate gain and loss balanced each other out in this two-year period. However, the amount of corporate tax is different. If the exchange rate gain is realised first, the corporate tax liability will be higher since the company cannot use up loss carry forwards before they are actually incurred.

In certain cases of accounting, it is possible to recognise accruals and deferrals with regard to exchange rate losses, and reduce or increase the corporate tax base with regard to exchange rate gains and losses.

For businesses exposed to significant exchange rate fluctuations, it is worth considering changing the accounting currency. These decisions have to be made during the reporting year, before the annual closing. Just consider that the accounting in the next year should be carried out in the new foreign currency, so the new books must be opened in this currency too. This decision obviously entails company law tasks as well.

What other choices should (also) be considered as the annual closing approaches?

A new and compulsory rule from 2020 means sales must be accounted for in line with the percentage of completion, which is an option applicable for 2019 annual reports too. Bear in mind though that accounting sales revenues in proportion to the percentage of completion will increase the local business tax base!

The ceiling for development reserves per tax year has been raised to HUF 10 billion (roughly EUR 30 million). These options can influence equity and tax bases. The Hungarian Act on Accounting and the Corporate Tax Act contain several other options that are worth considering before the annual closing.

If the figures suggest that the company’s equity will not comply with regulations following the annual closing, it might be a good idea to decide on forgiving receivables or making free transfers, and implementing this during the reporting year. Depending on the corporate tax base, these methods might be the most cost-effective solutions for restoring equity.

For companies contemplating terminating their operations this year, or for entities under voluntary liquidation already, it might be a wise decision to postpone the closure (especially if the voluntary termination is being prompted by insolvent clients). This is because the VAT on amounts recognised in the books as irrecoverable debts may be reclaimed from 2020, more precisely, they may be considered retrospectively as items deductible for tax purposes. As is common with favourable tax amendments, there are a number of conditions which should all be met to actually qualify for claiming them. The legal amendment also pertains to receivables where the date of performance for the supply of goods or services underlying the irrecoverable debt falls after 31 December 2015.

As the examples detailed above clearly show, it is indeed justified to consider which accounting and taxation options available for a given company might reduce a reporting-year loss. Furthermore, companies have a number of possibilities with regard to taxation in the following year(s), where the changes need to be reported to the NAV in the reporting year.

The experts of WTS Klient Hungary have been serving clients for more than 20 years, helping them make optimal business decisions for their companies. Feel free to contact us if you are uncertain about what decisions to make or which options to choose based on our article.

Aspects relating to exchange rate losses and gains worth taking into account before the annual closing

Aspects relating to exchange rate losses and gains worth taking into account before the annual closing